In the apparel industry, most companies are known for their clothes.

Suitmaker Jos. A Bank, however, is best known for its outrageous promotions.

But these popular promotions may be losing their effectiveness.

Shares of Jos. A Bank are getting punished today after the company announced a shocking warning regarding its recent financial performance. In their own words:

However, many of the promotional items and a large part of our holiday assortment were items that sell best in cold weather and the weather was unseasonably warm. Historically, we have had strength with these types of items, but our customers (specifically at our stores) didn't respond as well to our promotional offers as they had in the past. Our customers responded well to our suit promotions during this period, but our non-suit customers responded poorly to our holiday season offerings, even at very low prices on products such as sweaters, outerwear, hats, gloves, scarves, and jackets made of heavier fabrics such as camel's hair and cashmere.

Promotional pricing usually works if the customer believes it will soon go away. However, Jos. A Bank offers similar promotions on a rolling basis.

Perhaps, the customer is finally realizing that they'll never miss out on a Jos. A Bank deal.

The Business Model

You may have heard of one of their recent promotions: Buy 1, Get 7 Free. You buy 1 suit at regular price, and they give you 2 more free suits, 2 dress shirts, 2 silk ties, and an Android smartphone.

More common promotions include 70% off all suits and buy one suit, get two free.

How can a company like this make money?

Three words: higher initial markups.

You'll see those three words all over their regulatory filings.

The markup is the difference between the cost of a good and the price it's sold at. The higher the markup, the more you can discount and still make a profit.

For example, a typical store might sell you a $400 suit and offer 25% off. In Jos A Banks' world, they'd rather price a suit at $1,000 and offer it at 70% off.

Either place you shop, you pay $300 for a suit that might be of identical quality to the one sold at the other place.

But the $1,000 initial price tag gives the perception of higher quality. And the 70% discount gives the illusion of a great deal. Combine those two things and it's no surprise why the bargain-hunting American male would be seduced by Jos A Bank's offering.

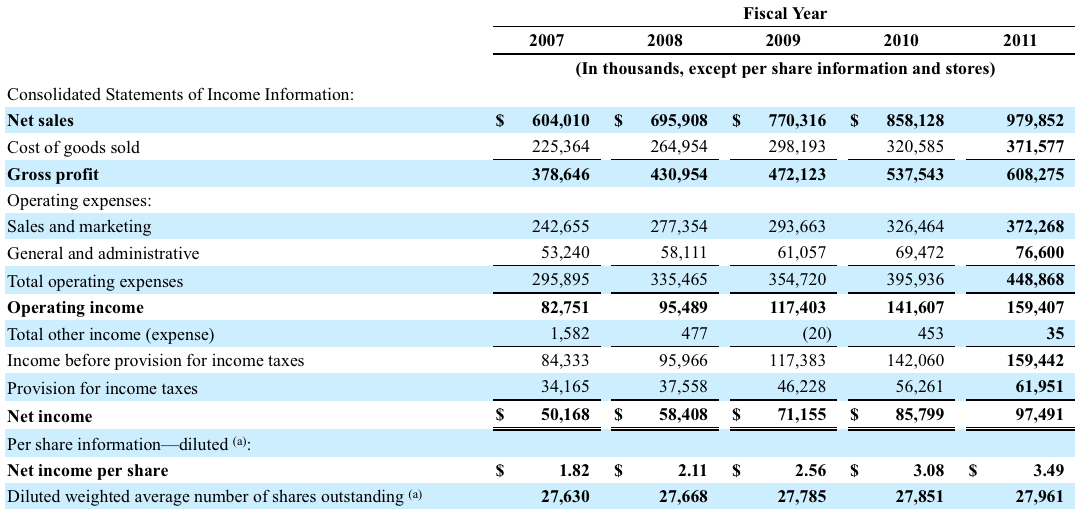

This business model had been working for quite a while. Sales and profits have been climbing for years.

And more importantly, the gross profit margin has trended up from 58% to 62%.over the last five full fiscal years.

However, any profit margin is no good without sales.

And if the secret of Jos. A Bank's success is out, then they may have lost their ability to differentiate themselves from the competition.