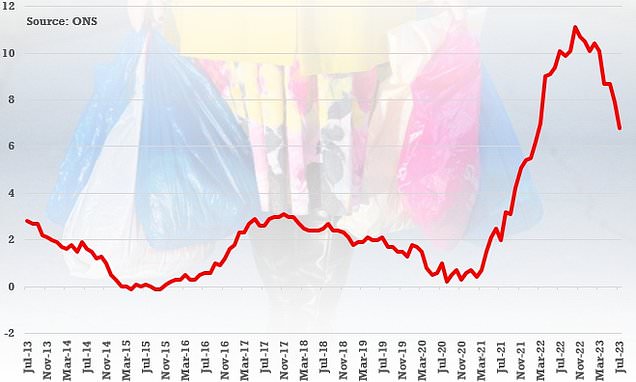

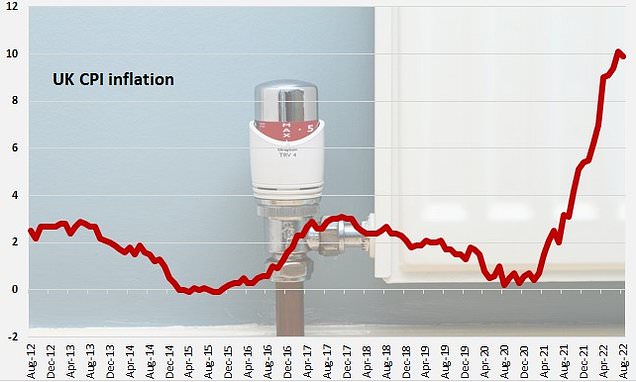

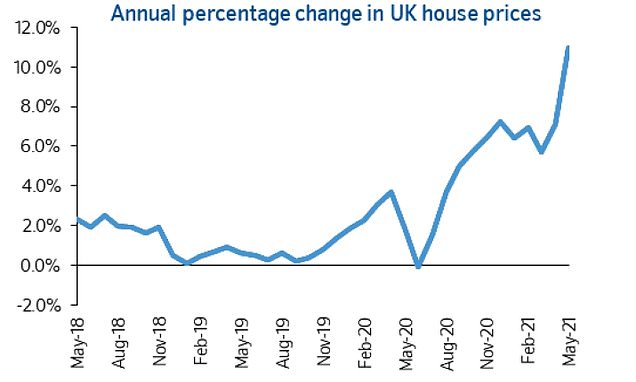

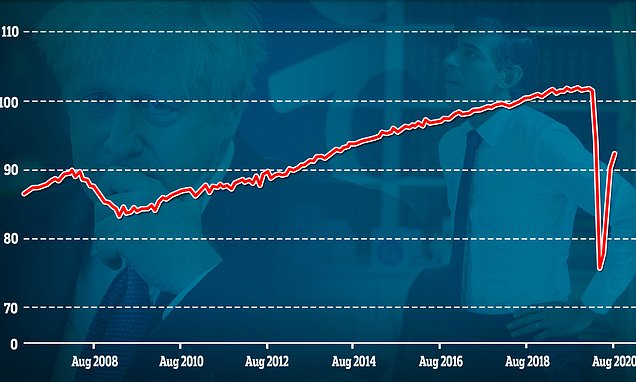

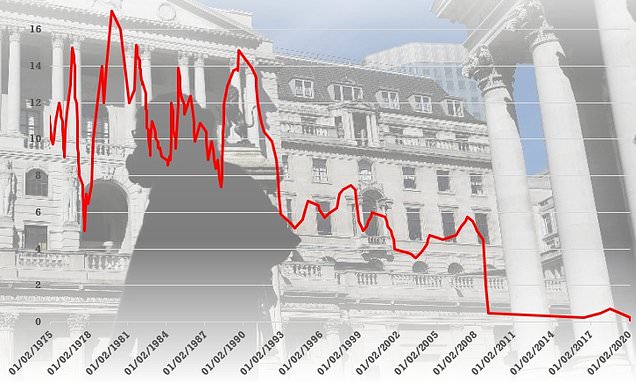

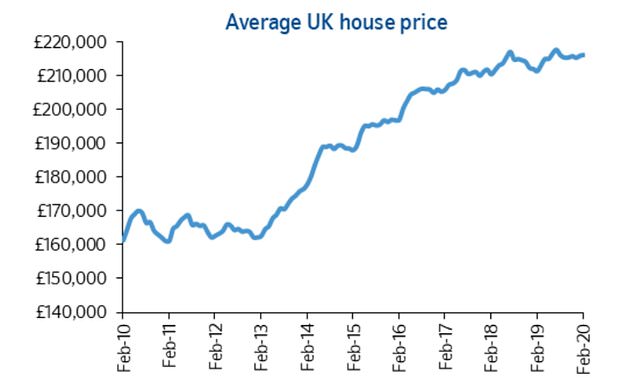

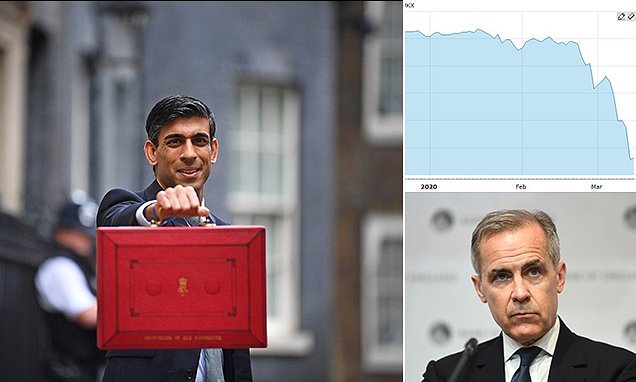

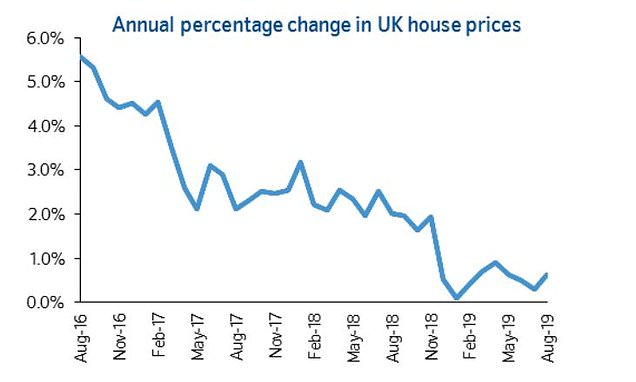

Bank of England boss Andrew Bailey has joined the Office of Budget Responsibility in stating that the recent Autumn Budget is likely to lift inflation, as employers face higher costs from national insurance and the rising minimum wage. On this podcast, Georgie Frost, Helen Crane and Simon Lambert, talk inflation, rates, mortgages and savings, plus farmers and inheritance and the question of the week.