Could YOUR pension fund a 35-year retirement? More are living to 100, here's how to go the distance

- We look at how big a pension needs to be - and how to boost your pot

The prospect of a '100-year life' is becoming increasingly likely, thanks to medical advancements and improvements in our standard of living.

With people living longer, the number of years they are retired will be on the rise too.

For today's workers, a 35-year retirement is a growing possibility. But can they afford it?

According to figures from the ONS, the number of those aged over 65 is expected to grow by 40 per cent between 2023 and 2050, with the number of those over 80 increasing by 90 per cent.

The state pension age is set to rise to 67 between 2026 and 2028, and will reach 68 by 2042 to 2044.

But that would still leave 32 years of retirement to pay for, compared to the current average retirement length of just over 20 years for women and just over 18 years for men.

100-year life: An increasing number of people are reaching a century, but this also means they need to fund a longer retirement

That is without accounting for those who live beyond 100, with the number of centenarians projected to increase by 200 per cent over the next 30 or so years.

Worryingly, however, data from pension firm Canada Life indicates that three quarters of people would be worried about their quality of life if they lived to 100 - and just 49 per cent have discussed their intentions regarding care or inheritance.

More than a third said they are worried about running out of money in retirement.

Annabelle Williams, a spokesperson for pension consolidation service Pensionbee, says: 'In previous generations only a small minority could expect to live to 100, so planning financially for such a long life was rarely a consideration.

'However, someone in their twenties, thirties or forties today has a far higher likelihood of living to 100, and although longer lives are a blessing, this trend will pose a significant challenge for retirement planning.

'Someone aged 30 today who plans to retire at 60 may have 40 more years ahead of them, which means they will need a far bigger pension pot to last them throughout retirement.'

How big does my pension need to be?

The amount you need to save for such a long retirement largely depends on your expected costs during this time.

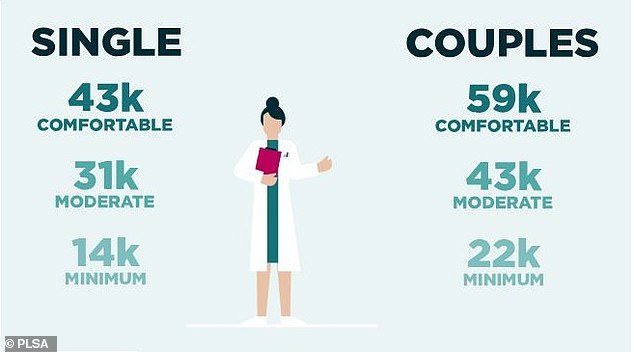

The Pensions and Lifetime Savings Association sets out three benchmark figures for what it calls a 'minimum' retirement - enough to live on, but not much left over for luxuries - at £14,400 for a single person.

That rises to £31,300 per year for a 'moderate' retirement, and £43,100 per year for a 'comfortable' retirement.

For couples, these figures are lower than the equivalent of two single people, with a minimum standard of living requiring £22,400, a moderate retirement requiring £43,100 and £59,000 to fund a comfortable retirement.

With a state pension giving £11,500 per year, this means that a retiree would need a further £20,000 or so each year to fund a moderate retirement.

According to investment platform Nucleus Financial, a £20,000 annuity purchased at 65 and rising by three per cent each year would cost around £380,0000.

Meanwhile, a pension pot large enough to take £20,000 per year for 35 years would have to be £700,000. To meet the £43,100 for a comfortable retirement for a 35-year period, a pension pot of £1.1million would be required.

Building such a pot is no mean feat. The average pension pot of someone in their sixties is £228,200 for men and £152,600 for women – far short of what is needed to fund a 100-year life according to the PLSA's figures.

It is also worth noting that these figures don't account for income tax, which is currently charged on 75 per cent of your pot, with the first quarter available tax-free.

Beyond this, pensions are taxed the same way as normal income, with 20 per cent paid between £12,571 and £50,270.

Above £50,270, the higher 40 per cent rate kicks in, while 45 per cent is charged above £125,140.

Pension pot: The PLSA says single people need at least £31,000 per year in order to fund a moderate retirement

How can I boost my pension pot?

As a general rule of thumb, pension savers have been advised to have saved a year's salary by age 30, then three times their salary by 40, six times by 50 and eight times by sixty. The goal of this is to reach ten times your salary by retirement age.

Alternatively, savers can aim to contribute half a percent of their income for each year of their life. At twenty, this would be 10 per cent, rising to 15 per cent at age thirty.

Pensionbee's Williams, however, says: 'The traditional wisdom is being challenged by rising longevity and the many competing demands on income that younger people, in particular, face.

'For example, buying a home is much harder, making outright home ownership by retirement less likely. Rents are more expensive, childcare is more expensive and many under-30s will be making student loan repayments too.

'This means that younger generations are likely to be in a worse financial position by retirement age than their parents and grandparents.'

As a result of this, it is all the more important to begin pension saving early in order to benefit from employer contributions, and the growth of your pension investments and the compounding effect of reinvestment.

This also means that there is considerably less benefit to saving up for a lump sum contribution later in life. You'll lose the benefits of employer contributions if you cut your own contribution, as well as losing out on the compound growth of your pot over a long period.

Making monthly contributions, therefore, is the best way to do this.

According to Nucleus, this could look something like this for a £380,000 pot, not accounting for tax relief and employer contributions, or increases in personal contributions:

- If starting contributions at age 25 and paying for 40 years - approximately £240 per month

- If starting at age 30, approximately £320 a month

- If starting at age 35, approximately £430 a month

- If starting at age 40, approximately £600 a month