We invested in Cauta Capital bonds but the interest payments stopped: TONY HETHERINGTON

Tony Hetherington is Financial Mail on Sunday's ace investigator, fighting readers corners, revealing the truth that lies behind closed doors and winning victories for those who have been left out-of-pocket. Find out how to contact him below.

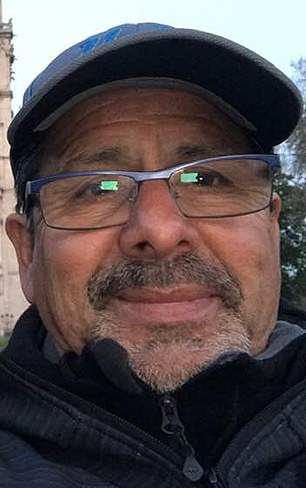

Broken promises: Cauta Capital's owner William Abundes

Ms Y.G. writes: We invested savings into Cauta Capital loan bonds.

We have been in regular contact with the company's owner, William Abundes, for a couple of years, since interest payments stopped.

He promised dates for repayment of the bonds but these have passed without the return of our money.

Tony Hetherington replies: Cauta Capital made lots of promises. It would invest your money in property projects only where the developers had pledged their own assets as a safeguard.

It would put your money into a property scheme only if the scheme's assets were far greater than the amount injected by Cauta.

And it would give an independent accountant a legal charge over more than £28 million of its own assets as a safety net. Yet every one of these promises was broken.

When complaints started to arrive from investors, who told me that Cauta had failed to pay interest that was due and then failed to repay loan bonds when they matured, I contacted the company's boss, William Abundes.

He is a 70-year-old American who lives in Luxembourg, and he is a major figure in campaigning for Donald Trump among US voters who live in Europe.

I reported last April that he told me his company had made unsuccessful investments in property, so had used the remaining money to buy uncut emeralds – something never mentioned when he was offering his loan bonds with the sales pitch that funds would be invested in safe property developments.

He described this as 'a strategic decision made in response to unexpected losses the company incurred'. And when I pressed him to explain what allowed him to make such a dramatic shift in how your money was used, he pointed me towards a vague section of the investment terms allowing for 'secured joint ventures'.

You and every other investor may have taken this to refer to property deals secured against land and buildings. Clearly though, Abundes saw this as permitting investment in virtually anything he liked.

Cauta Capital has twice come close to being compulsorily struck off for failing to file accounts with Companies House.

Its 2023 accounts – filed late, in May this year – were nothing more than an absurd cut-and-paste copy of its 2022 figures.

They valued the company's assets at £19.4 million, but failed to include interest owed to investors.

Worse has followed. In July, Cauta Capital fell into administration. The administrators have moved with impressive speed to investigate what went wrong.

They found that Cauta first invested in an apartment development on the site of Copenhagen's historic Tuborg Brewery.

The developer went bankrupt in 2019. Abundes then backed a second Danish development, but this also collapsed.

In 2020 Cauta put your money into uncut emeralds. The accountant who was appointed to safeguard investors' interests has told me that he was not even informed of this.

And late last year – again without any announcement – Cauta swapped its emeralds for an investment in a Luxembourg fund that will not mature until at least next August.

There is major uncertainty around this, but the administrators say the investment had a 'nominal value' of around $3 million (about £2.3 million).

This contrasts sharply with Cauta's most recent accounts showing it to be worth £19 million. The uncertainty is not helped by difficulties the administrators have faced in obtaining company records.

Apparently Cauta did not even operate its own bank account.

The bottom line is that bondholders are owed more than £11 million plus interest of around £1.5 million.

It is impossible to predict the Luxembourg fund's value when it matures, but administrators say the likely outcome is that Cauta Capital will have to be put into liquidation, with a possible return to unsecured creditors of just over 12p in the £1.

This whole affair has reinforced the lack of investor protection that surrounds loan bonds. They are just IOUs, but they are often marketed like shares with shaky claims that they are guaranteed or secured.

The last government did nothing to change this, and I do not hold out hope for the current bunch.

All too often in this country, investors are on their own. Investor protection is the abandoned child of successive ministers and regulators.

If you believe you are the victim of financial wrongdoing, write to Tony Hetherington at Financial Mail, 9 Derry Street, London W8 5HY or email [email protected]. Because of the high volume of enquiries, personal replies cannot be given. Please send only copies of original documents, which we regret cannot be returned.