Open a Stocks & Shares ISA.

A popular and tax-efficient way to invest with Chip.

No tax on any returns you make.

Annual £20,000 allowance.

No tax reporting, no hassle.

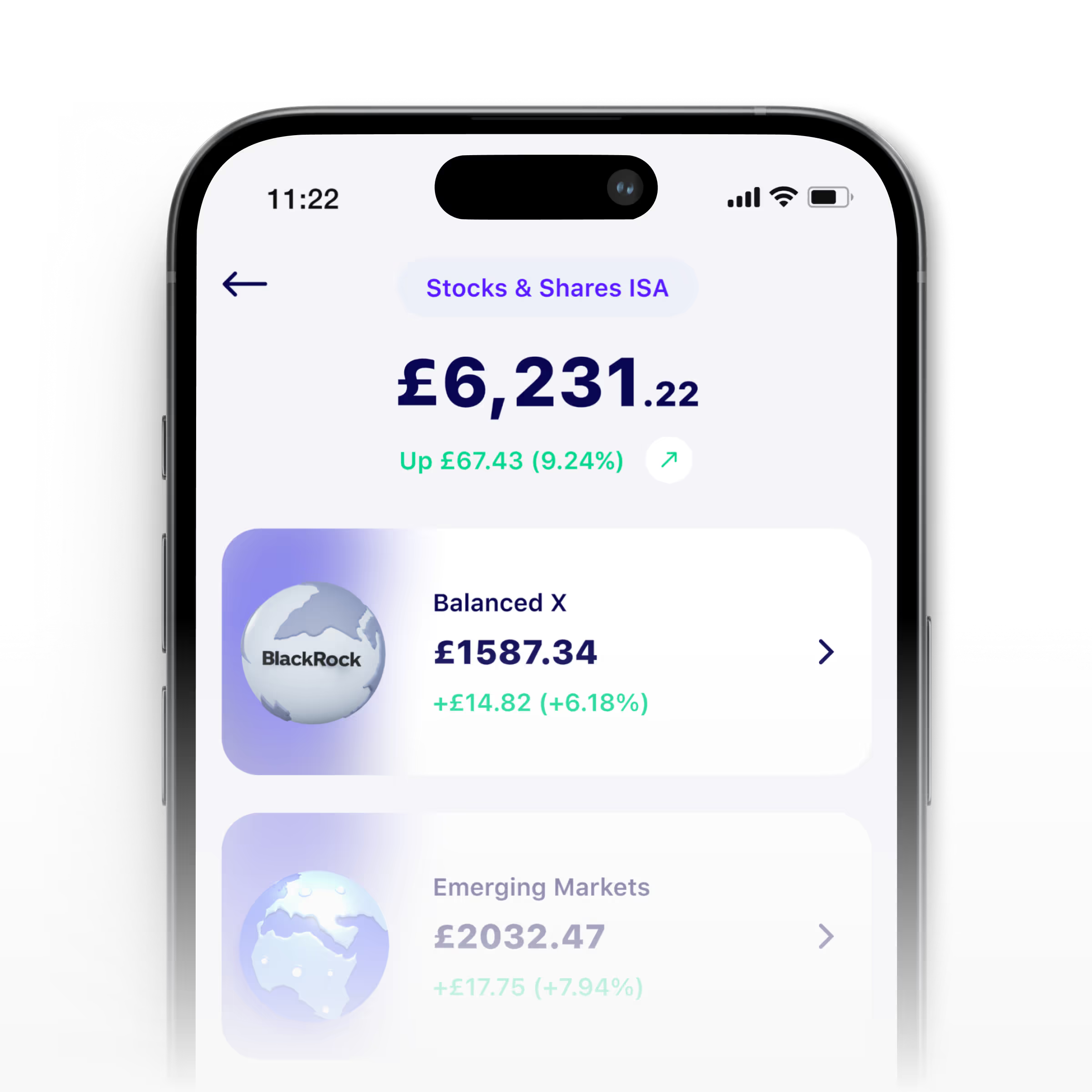

Build a diverse portfolio with our range of investment funds.

We’ve curated a selection of investment funds from the experts (like BlackRock) designed to give you a diverse portfolio - without overwhelming you.

Ethical X fund

This fund aims to make investments that meet Environmental, Social and Governance (ESG) guidelines.

Crypto Companies fund

This fund invests in over 50 companies involved in the Blockchain and Crypto industry.

Healthcare Innovations fund

This fund invests in over 200 companies around the worldinvolved in medical research and technology.

Global Companies fund

Invest in a wide range of international powerhouses spanning 23 developed countries.

What is a Stocks & Shares ISA?

A Stocks and Shares ISA is a type of investment account that allows you to invest up to £20,000 and pay no income tax or capital gains tax on any returns.

Look at the ISA like a box that allows you to put investments of your choice into it. The box is ‘wrapped up’ meaning any investment gains are protected from tax.

A Stocks and Shares ISA offers the possibility of better returns in the long run compared to saving in cash. For those who aren’t looking for instant access to their money and are prepared to keep money invested for a number of years, it could be the right fit.

When it comes to investing your capital is at risk and your investments can go down as well as up in value. Chip does not give financial advice and you should not construe this as a personal recommendation. Always do your own research.

Investing in an ISA can suit your long-term goals (5 years or more) such as buying a house or retirement with the flexibility of being able to access your funds whenever.

You can have multiple Stocks and Shares ISAs open with different providers but note you can only deposit a maximum of £20,000 across all your ISAs in a given tax year.

We partner with the world’s biggest fund managers.

At Chip we offer investment funds from the experts at some of the biggest names in investing, who already help millions of investors build their wealth across the globe.

These investment funds are created based on what you want to invest in, such as investing in clean energy or emerging markets.

Vanguard

Established in 1975 and trusted by over 30 million investors.

Blackrock

The world's largest money manager with over $9 trillion in assets.

Invesco

One of the world's largest independent investment management firms.

iShares

A world leader in exchange traded-funds (part of BlackRock).

Why choose a Chip Stocks & Shares ISA?

Stocks and Shares ISAs offer tax advantages, allowing you to potentially grow your investments without paying capital gains tax or income tax on the returns. Here’s what’s included with a Chip Stocks and Shares ISA:

Invest up to £20,000 per tax year

Pay no income tax or capital gains tax on any returns.

Diversify your portfolio.

Invest using our full range of funds from the biggest asset managers in the world.

A curated range of investment funds

Say goodbye to endless scrolling. We've curated a range of popular investment funds to build a diverse portfolio with ease.

Auto-investing features.

Get unlimited use of our award-winning auto-investing features.

.png)

Invest with 0% platform

fees.

A ChipX membership allows you to invest as much as you like with no percentage platform fees. Zero. This means you don’t have to pay more to invest more and your monthly fee stays fixed as your wealth grows.

See how much you could earn with a Stocks and Shares ISA.

Calculate your potential returns with an initial lump sum deposit, regular monthly payments or a combination of the two (up to your annual ISA allowance of £20,000)

The calculation assumes no platform charges as part of a ChipX membership, but includes an annual fund charge of 0.40% (charges may vary depending on the fund). A ChipX membership is required to open and hold a Stocks & Shares ISA with Chip.

Got a question?

Please note fund management charges also apply, charged by the asset manager responsible for your fund e.g. BlackRock.

A minimum charge of £1 applies if you have a balance above £1 in any investment fund. You can find information about your platform fees, and how these are charged in your Investment statements’, on your Profile. We reserve the right to amend these fees with two months’ notice.

Still have questions?

Opening a Chip account takes just a few minutes. No forms, no fuss.

1. Download Chip

Head to the App Store or Google Play Store.

2. Create an account

Enter a few details and pass a quick check.

3. You're good to go!

Choose from our range of finance products.

.avif)