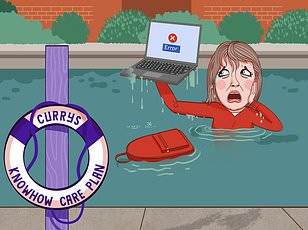

Santander won't send our credit card to Spain - now we can't feed 40 cats: SALLY SORTS IT

My wife and I and I are in our early 80s and have lived in Spain for 21 years. My wife has banked with Santander (formerly Abbey National) for 45 years, but we have suddenly found ourselves unable to get her a new debit card since her old one expired.

Apparently, my wife’s credentials aren’t correct and the bank needed proof such as a utility bill. I sent our electricity bill but it was only in my name. I also sent two other official documents showing her name and our address but have had no response. We are not able to pay for food for ourselves or for our 40 rescue cats.

B.N., Spain.

Sally Hamilton replies: They say curiosity killed the cat, but I simply had to find out how you came to have 40 feline mouths to feed – as well as get to the bottom of your challenges in accessing vital cash.

Your wife explained it all began three years ago when she spotted a mother cat frantically carrying four kittens, one by one, by the scruff of their necks and dropping them onto your porch.

Your wife was in such awe at the efforts the mum made to bring her offspring to safety that she took in the whole family. Sometime later two more pregnant strays turned up and stayed. Your wife’s soft spot for rescuing animals means you now house 40 cats, plus a dog and occasional other canine visitors. The bill for feeding them all is about €100 (£83) a week.

Meeting your bills wasn’t a problem until recently as you regularly transferred your British state and personal pensions totalling about £1,000 a month from a deposit account you hold jointly into your wife’s personal current account. Both are UK Santander accounts.

She then used the debit card for spending. Each new card was previously sent to a trusted friend’s address in the UK. They then forwarded it to your post office box in a nearby Spanish town, as there is no residential delivery service in the remote mountain area where you live.

The arrangement worked until your friend moved and the most recent plastic was returned to sender. This alerted Santander, which requested the updated security details.

You tried to resolve matters and even purchased an iPhone so that you could communicate with Santander by email instead of by phone, as well as set up online banking. In June, you stopped chasing because of a hospital stay.

But, when the card expired in September, you were forced to act. Making no progress on your own, and having to borrow cash from friends to feed yourself and your furry friends, you asked me to intervene.

Following investigations, Santander said it could not send out the card as address verification for your wife was still required. You sent other documents.

A few days ago Santander confirmed these had been received and that a new card was on its way to your post box service, which the bank has accepted as your address. Your wife can collect the card upon presenting her ID. Your arrangements for banking had become a cat’s cradle over the years, but now you are online, with your address updated, you should not lose access to your cash again.

As it happens, you are lucky to bank with Santander, as many other High Street banks have recently closed the shutters to British expat customers.

A Santander spokesman says: ‘It is vital that we hold correct contact information, including addresses, for all of our customers.

‘As Mr and Mrs N had not updated the address we hold for them for around 20 years, we were unable to quickly assist with providing a new card and online banking credentials. We’re sorry that we missed an opportunity in June to enact a change of address sooner and have offered £300 in recognition of this.’ Purrfect.

In March my friend's dementia and Parkinson's deteriorated badly and he was taken into residential care. He no longer has the capacity to use his mobile phone. As I have a financial lasting power of attorney (LPA) for him, I went to a Tesco Mobile shop to ask how to cancel his account. Despite doing everything asked, the process has turned into a nightmare over the past few months with debt collectors chasing me for non-payment of his mobile bills. Please can you help.

M.L., Greater London.

Sally Hamilton replies: Your friend is lucky to have you acting in his interests. Having a financial LPA takes the burden off people when they lose capacity so that their bills can be managed (hopefully) smoothly by someone they trust. While acting as someone's attorney when they are too frail to manage decisions on their own is a blessing for them, it can be a challenge for the person in charge if things go wrong.

I would have thought cancelling a £7 a month phone contract would be simple, but you hit one hurdle after another. On visiting the mobile store to ask for help, Tesco told you to use your friend's phone to call customer services as it would immediately recognise his account. You did this in April and were able to explain the situation. A call handler said she would make a note of the cancellation and send you a confirmation email.

Nothing came to you, although a customer satisfaction email arrived in your friend's inbox. Meanwhile, you asked the bank to cancel the monthly direct debit. After several weeks, a letter arrived warning of arrears, so you phoned customer services again. Tesco asked you to email a copy of the LPA which they said was not legible and requested you scan each page separately. This you did. You heard nothing further so assumed all was well.

A few weeks later, a debt collector's letter landed on the doormat. You made contact and they also requested sight of the LPA. As they also couldn't read the emailed version, you posted hard copies, along with printouts of your correspondence with Tesco Mobile.

Despite this, you are still being chased by letter and daily texts for the debt and when you called the collection agency, it said there was no record of the documents.

At the end of your tether, you came to me. On my request, Tesco Mobile delved into the case. It did not explain what had gone wrong but it finally put things right and called off the debt collectors. A Tesco Mobile spokesman says: 'We're really sorry this has happened. We've written off the remaining balance on this account and have reached out to the customer to apologise.'

- Write to Sally Hamilton at Sally Sorts It, Money Mail, 9 Derry Street, London, W8 5HY or email [email protected] — include phone number, address and a note addressed to the offending organisation giving them permission to talk to Sally Hamilton. Please do not send original documents as we cannot take responsibility for them. No legal responsibility can be accepted by the Daily Mail for answers given.