I'm a fund manager: Greg Eckel of Canadian General Investments on where he would invest

- Our series quizzes expert fund managers on their investing tips and tricks

Each month, This is Money puts a senior fund or investment manager to task with tough questions for our I'm a fund manager series to find out how they manage their own money.

We want to know where they'd invest for the next year - or even next 10 years - and what pitfalls to avoid.

This week, we spoke to Greg Eckel, portfolio manager of Canadian General Investments (CGI).

In the hot seat: We quiz Greg Eckel on the companies he backs, whether Bitcoin and Tesla are worth it and the age-old question of growth versus value

Canadian General Investments is a closed-ended equity fund that was established in 1930.

Close to half its investments are in the information technology sector and the industrials sector. Its largest individual holding is Nvidia.

1. If you could invest in only one company for the next 10 years, what would it be?

In our fast-paced digital world, patience seems to be a lost virtue. Yet, for savvy investors, a long-term perspective remains a cornerstone of wealth creation.

Franco-Nevada Corporation, which has been one of our largest investments since its 2007 IPO, epitomises this long-term strategy.

As a global leader in gold royalties and streaming, Franco-Nevada offers investors a unique blend of yield and commodity exposure – making it a 'go-to' gold stock for the generalist.

We would expect it to continue to provide decent returns over the next decade and beyond.

A 'go-to' gold stock for the generalist? Franco-Nevada Corporation has been one of Canadian General Investments largest investments since its 2007 IPO

2. What about for the next 12 months?

When considering investments, we're more interested in steady, reliable returns than short-term market fluctuations or event-driven bets.

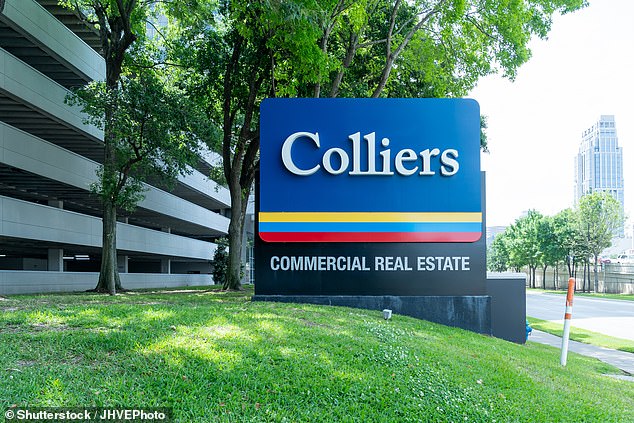

That said, the market environment has drawn our attention to the real estate sector, and Colliers International Group, a leading global commercial real estate services firm, is well positioned to benefit from the sector's revival.

Colliers has delivered impressive returns historically, but a rising interest rate cycle and lingering effects of the pandemic have temporarily dampened its stock price.

As economic conditions stabilise and the real estate market rebounds over the next 12 months, we anticipate its stock price will experience significant growth.

Real estate winner: Eckel thinks Colliers International Group, a global commercial real estate services firm, is well positioned to benefit from the sector’s revival

3. Which sector should people be most excited by?

Innovation is a constant force that enhances results across industries.

Modernisation and the drive for improvement are relentless, and companies leading this charge are often concentrated in the engineering and technology sectors, making these areas particularly exciting.

4. What sector would you be avoiding and why?

We have been reducing our exposure to the communications sector.

In Canada, it is a mature industry that remains highly competitive with limited growth opportunities.

Greg Eckel, portfolio manager of Canadian General Investments

5. Do you think the US market is expensive and why?

As always, what counts is the individual companies we are invested in rather than our broad market view.

With around 24 per cent of our portfolio allocated to the US market, we remain optimistic about our US holdings.

6. Which country offers the best value for investors?

Right now, Canada's market stands out as one of the most undervalued, with the S&P/TSX Composite Index trading at a historically wide discount compared to the U.S. S&P 500.

While often overlooked, Canada is poised to be the fastest-growing G7 economy in 2025, offering stability in uncertain times.

As a commodity-rich nation, the country is well-positioned to benefit from a potential bull run in raw materials, further fuelled by the global nuclear renaissance.

Coupled with its deep economic ties to the US, Canada presents a compelling investment opportunity for UK investors.

7. Should investors focus on growth or value stocks?

We don't usually get hung up on labels like growth or value to determine where we should be looking.

Good investments can be found in almost any category and sentiment towards one or the other changes over time.

8. What about active or passive investing?

There will always be different investment styles. Investors should build a portfolio that aligns with their risk appetite and financial goals.

Both active and passive strategies have their place, much like the diversification across asset classes.

Eckel thinks Canada's market stands out as one of the most undervalued

Maintain an open mind and prioritise performance over singular factors like costs.

While passive strategies have enjoyed the limelight in recent years, history demonstrates the success of active management.

9. Tesla - will it ultimately boom or bust?

Tesla has certainly benefitted from its early start and adoption in the electric vehicle space but, over time, its leadership will be challenged by others and its place will become more normalized.

It will likely remain a key specialist with others adopting some of its technology but, eventually, the playing field will level out and success or failure will depend on its competitive offerings in the general auto industry.

10. Nvidia - would you buy, hold, or sell?

Nvidia has once again surpassed Apple to become the world's most valuable company.

We first bought Nvidia in 2016 and it has been a great investment for us.

We have been taking profits every year since then, apart from one, to keep our holding within our risk tolerances for single stocks.

It is currently our largest holding, at 7.6 per cent of the portfolio.

Greg Eckel says the company has been investing in Nvidia since 2016 and it is now its largest individual holding

11. Should gold form part of everyone's portfolio?

Again, this depends on an investor's financial goals. Gold has proved itself to be a useful hedge during market corrections however, as long-term investors, we see greater value in building a diversified portfolio of high-quality cash-generative companies.

12. What about bitcoin?

To me, Bitcoin is a mystery. If you can define it, trust the security of something intangible, ignore the lack of structured regulation, and grasp its unique investment dynamics, have fun.

Maybe one day I'll be proved wrong. But for now, I'm sticking with what I know and trust to deliver long-term returns.