Labour's attack on pensions isn't over - why I believe they will be hit AGAIN: JEFF PRESTRIDGE

The reverberations from Wednesday's Budget continue – and they are not good ones.

As much as I hate to say this, it looks like the country is heading for the buffers – plagued by anaemic economic growth, weighed down by a bloated and inefficient public sector, and undermined by a creaking business community now under siege from a tsunami of new Labour taxes and costly regulations.

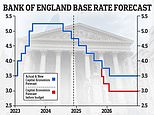

Maybe I'm being too gloomy, and I will be proved wrong (it won't be the first time). But even the country's leading economic think-tanks are now questioning the merits of Rachel Reeves's spending and borrowing splurge, paid for in part by a £40 billion tax hit on businesses and households.

Rachel Reeves leaves 11 Downing Street with the red box ahead of revealing her Budget on Wednesday

Post Budget, the Institute for Fiscal Studies (IFS) warned that the country faced a 'decade of higher taxes', adding that 'the state has grown, and it seems unlikely to shrink again any time soon'.

Chillingly, it said that the Chancellor would probably have to come back again to households and businesses for yet more tax revenues.

For businesses already reeling from the £25 billion National Insurance tax hit, that would mean lower profits, higher prices, and a reduction in their workforces. For working households, it would result in subdued pay rises (that's if their jobs still exist) and yet more taxes on their savings and investments. A step closer to financial dystopia.

Wearing my personal finance hat, my big concern post Wednesday's sobering Budget is that Ms Reeves is in serious danger of killing the country's savings culture.

Last Wednesday's anti-savings measures – a frightening inheritance tax (IHT) hit on pensions and a hike in capital gains tax on profits from investments – were awful enough in their own right. But given the IFS's view that the Chancellor's thirst for tax revenues is far from quenched, it is obvious that our pensions (private, not public) will come under assault again in the near future.

Edward Hughes, a 71-year-old retired shoe maker from Ware in Hertfordshire, speaks for many. He has been a saver all his life, but fears that the propensity of Chancellors (past and present) to repeatedly dip into our pensions is hugely damaging.

On Friday he told me: 'As pension savers, we put money into a long-term savings vehicle which we can't access until our mid-50s. The least we deserve in return for such long-term commitment is an assurance from government that the tax treatment of our pension will not be changed, especially to plug holes in the public finances.'

Edward believes that the IHT raid on inherited pensions – on top of all the other assaults going back to Gordon Brown's £5 billion a year tax raid on company pensions in 1997 – has now made private pensions 'unattractive for current and future savers'.

The result of this growing antipathy, he fears, will be more people turning to the State in old age, 'building a massive social problem for the future'.

Edward's vision is more financially dystopian than my own, but he makes a great point which the Chancellor should heed. Tinkering with pensions is not in the best interests of anyone – including the public purse.

Above-inflation rail fare increases were buried away in documents published alongside the budget

Fares up, but rail's still a fail

Wednesday's announcement of above-inflation rail fare increases – buried away in documents published alongside the Budget – will depress many commuters.

The 4.6 per cent increase in the price of many tickets, effective from March, would be tolerable if there was evidence of a step up in the reliability and quality of train services. But I see none, despite the generous pay awards recently given to railway employees.

SWR and GWR, the providers of the services I rely upon for my daily work commute, frustrate me constantly.

Late trains and cancelled trains (especially on a Monday morning) are the norm. Yet the pain they cause – including the ear damage from constant onboard reminders that anyone travelling ticketless could face a fine and criminal prosecution – pales into insignificance compared to that regularly inflicted on me at the weekend by Arriva's CrossCountry.

I use its Bournemouth-to-Manchester service to travel to see my football team, WBA, play. Yet it's like playing the lottery – a win (an on-time service) is a rarity.

My last journey was a nightmare. Despite being warned when booking tickets that the train would be busy with Bournemouth supporters going to their team's game against Aston Villa, CrossCountry ran a four rather than an eight-coach service. Why? It meant that when it rocked up at Reading it was packed to the rafters, with people standing in the aisles. My partner refused to get on and went home.

Somehow, I managed to sit in my reserved seat, but only after turfing someone out of it. It was a truly awful and claustrophobic journey.

To compound the misery, the return train arrived more than 30 minutes late. Third World travel at premium prices. My compensation claim has been acknowledged, but not yet paid.

PayPal is 2nd class on scams

Online scammers don't give a fig about controversial Budgets. Their sole aim is to rip us off.

Doug Brodie, founder of London-based Chancery Lane Retirement Income Planning, receives his fair share of scams – and always tips me off about them. Most are bogus corporate bonds offering ludicrously high interest rates.

But the latest was in response to his ordering of postage online from Royal Mail so he could send an envelope to the US.

Everything, he says, went tickety-boo – he paid online and arranged for the letter's collection. But later that day, he received an email, purportedly from Royal Mail, saying delivery was 'pending' and that a £23 fee was payable. A link took him to a PayPal page where he was requested to make the payment. Doug is too long in the scam tooth to be fooled by such a ruse (the fact that the PayPal payment request was for $23 – not £23 as in the email – was a giveaway).

Like a good citizen and fearing others could fall for the ruse, he tried to report the fraud to PayPal. But it wouldn't let him without providing the username of the PayPal account he had been directed to. Understandably, the fraudster hadn't given that detail.

'It's so frustrating,' said Doug. 'PayPal should be stamping down hard on scammers – and listening to those who have received scam payment requests.'

On Friday, PayPal said it took payment security 'very seriously'. Any recipient of a spoof email, it said, should send it to: [email protected]. Royal Mail said it would never send an email to a customer requesting payment. So if you receive such a demand, it's a scam.