Which car brands have electric car sales on target and which are falling behind as end of year ZEV fines loom?

- Is your favourite brand in the green or in the red with months to go? We reveal all

By the end of 2024, car manufacturers have strict deadlines to sell a certain number of electric cars to hit government-set targets.

The Zero Emission Vehicle (ZEV) mandate requires car makers to sell 22 per cent EVs this year to escape punishing fines of £15,000 per model.

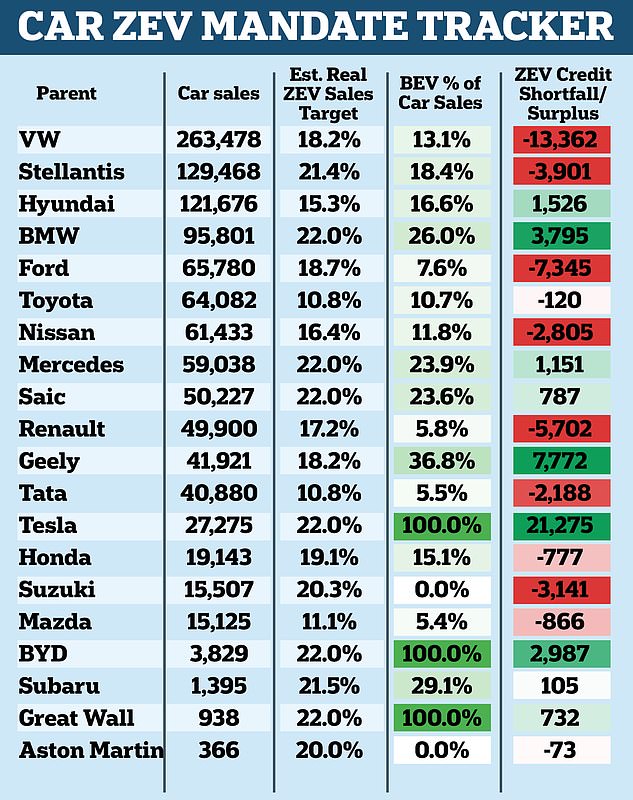

After crossing the halfway mark of the year, research from EV think tank New Automotive shows there are some brands storming ahead, and some that could be slapped with financial penalties instead.

We reveal which are in the green and which are in the red with the clock counting down to the end of the year...

*Scroll further down to see how each manufacturer is performing against the ZEV mandate in 2024

The Zero Emission Vehicle (ZEV) mandate requires car makers to sell 22 per cent EVs this year to escape punishing fines of £15,000 per model. With under four months to go until the end of the year, which brands are on track to hit 22% and which are likely to be fined?

New Automotive's ZEV mandate tracker shows how each car brand is performing with BEV sales against the ZEV target of 22%. Scroll to the bottom for the full table

The latest sales data from the Society of Motor Manufacturers and Traders (SMMT) puts electric car registrations over the threshold needed to exceed the binding Government targets for the first time this year.

Some 23 per cent of all new models in August were fully-electric - the first time in a single month that the share of EV registrations are above the ZEV target market-wide.

And New Automotive’s Market Insights shows that July and August saw manufacturers make big strides towards hitting ZEV mandate requirements.

'August's sales were so strong that there need not be any additional overall growth in BEV [battery electric vehicle] share of sales in the remaining months of the year for the market to comply with ZEV mandate targets,' it said.

Of the manufacturers (by parent company) that sell both fuel and electric cars, BMW, Mercedes-Benz, and China's SAIC are all on course to hit 22 per cent – the ZEV mandate target.

As of August 2024, New Automotive figures put BMW current calendar year EV percentage of car sales at 26 per cent, while Mercedes’ EV sales are at 23.9 per cent.

The SAIC group is just behind Mercedes with all-electric sales of 23.6 per cent.

MG - which is owned by Chinese parent company SAIC Motors - has achieved huge success in recent years with its cheap new EVs, including the best-selling MG4.

As of August 2024, New Automotive figures put BMW current calendar year battery electric vehicle percentage of car sales (BEV) at 26 per cent, while Mercedes’ BEV sales are at 23.9 per cent. The SAIC group - which owns MG - is just behind Mercedes with all-electric sales of 23.6 per cent

In 2023, the BMW i4 was the biggest seller in BMW’s all-electric range (up 33 per cent), with 8,940 registrations

The data collected by the independent group also shows BMW having a strong 2023 and 2024 so far: every fourth BMW sold in the UK was all-electric, with 28,723 EVs registered in 2023.

With 8,940 registrations, the i4 saloon was the biggest seller in BMW’s all-electric range (up 33 per cent).

In the middle of the field are a few parent companies tracking just shy of the ZEV sales target, including Stellantis (parent group of Citroen, Fiat, Peugeot and Vauxhall) at 21.4 per cent, Suzuki (20.3 per cent) and Subaru (21.5 per cent).

Overall New Automotive reports: ‘August and July have seen manufacturers make significant progress towards their ZEV mandate obligations. Our estimates are that the market as a whole stands with a rough balance of supply and demand for ZEV mandate credits.’

Stellantis - which is one of the world's largest car conglomerates - is predicted to hit 21.4 per cent of the 22% ZEV mandate target

New Automotive predicts that ‘those manufacturers who are still behind on their targets, and who have new BEV models coming to market in future years, are likely to make use of the borrowing facility, betting on the success of their new products’

Some car companies including VW, Ford and Honda aren’t estimated to hit the 22 per cent ZEV target but are likely to use the credit system available to make up for a EV shortfall.

The VW Group records 13.1 per cent of sales as EV, while Ford, which is predicted to hit 18.7 per cent of the ZEV sales target, with 7.6 per cent EV sales.

Honda is on course for 19.1 per cent of the 22 per cent ZEV mandate, tracking 15.1 BEV percentage of sales.

There are of course several brands that are easily hitting the 22 per cent ZEV mandate target because they manufacture only electric cars and plug-in hybrids: Tesla, BYD and Great Wall Motor Company all have 100 per cent EV sales.

Polestar is another brand which is all-electric.

However, because it comes under its majority shareholder brand Geely - which also owns Volvo - is currently tracking 18.2 per cent towards target overall, with an EV sales percentage of 36.8 per cent as of August.

On the flip side, brands that aren’t tracking close to the 22 per cent include Hyundai, Toyota, Nissan, Tata (JLR's parent group) and Mazda.

Toyota, which has been openly reluctant to ditch hybrid technology in the pursuit of full electrification, is predicted to end the year on just 10.8 per cent of the 22 ZEV sales target needed, with August recording 10.7 per cent of sales as EVs.

Toyota currently offers just one EV model in its range - the bZ4X - while its sister brand Lexus has the RZ and UX powered entirely by batteries.

Jaguar Land Rover's parent group Tata is also not doing well against the ZEV mandate targets, with an estimate real ZEV sales target of 10.8 per cent.

This is perhaps not surprising as Land Rover has been slow to adopt electric.

While the Coventry-based brand is undergoing a major overhaul, with Jaguar plotting a move to becoming an all-electric brand from next year and Land Rover promising six fully-electric models due to launch in the next five years, there is currently not much of an all-electric offering while the world awaits the new electric Range Rover.

Mazda is only slightly ahead of Tata and Toyota, at 11.1 per cent of the target, with BEVs at 5.4 per cent of car sales.

Hyundai and Nissan are faring better with 15.3 per cent and 16.4 per cent ZEV sales target respectively.

New Automotive predicts that ‘those manufacturers who are still behind on their targets, and who have new BEV models coming to market in future years, are likely to make use of the borrowing facility, betting on the success of their new products’.

How does the ZEV mandate work?

The ZEV mandate has a headline target of 22 per cent BEV sales for each car maker. This will rise incrementally to 100 per cent in 2035.

Manufacturers face hefty fines of £15,000 for each car sold outside the target.

With the new Labour government bringing forward the ban on new petrol and diesel cars to 2030, the ZEV mandate may shift even closer.

However, the mandate works on a credit-based system where manufacturers are awarded or stripped of credits if they overperform or underperform on these targets.

The ZEV mandate requires mainstream car makers to increase their share of EV sales each year until the ban on new petrol and diesel models. The minimum requirement to avoid fines in 2024 is 22%, rising to 28% next year and 33% in 2026

Brands can choose to bank these credits for future years if they’re needed or can be sold to underperforming brands who need them to avoid fines.

Conglomerates like Volkswagen can use credits from one brand under its umbrella to help another worse performing other brand it owns.

But manufacturers also earn emission credits for sales of low emission cars, such as plug-in hybrids.

If a car maker beats their CO2 target (which is set individually for each brand) by reducing their CO2 emissions, then they can, for the first three years, convert this breathing room into ZEV credits at an exchange rate.

Overall New Automotive says that ‘carmakers are overwhelmingly earning credits from ZEV sales’ and that those lagging can earn credits with focus on ‘fuel efficiency improvements or hybrid technologies.’

ZEV Mandate tracking explained

New Automotive calculated the implied ZEV target by estimating the number of credits each manufacturer is expected to generate based on the CO2 ratings of newly registered ICE cars in 2024.

It bases the ZEV bulletin on DVLA data which is released monthly.

The research organisation also said that you can see ‘CO2 flexibility in action’ with a ‘significant amount of credits are likely to be earned from the improvement in the average CO2 ratings of newly registered vehicles’.