Zombie life insurer could buy rival for £1bn

Consolidation in the insurance sector is hotting up ahead of new capital rules

A "deal frenzy sweeping the UK insurance sector" is set to continue, Sky News reports, as so-called 'zombie fund' manager Phoenix Group lines up a "£1bn-plus" takeover bid for rival Guardian Financial Services.

Phoenix, which is listed and has a market value of £1.9bn, manages around £52bn worth of assets on behalf of five million policy holders, spread across group personal pension and life assurance funds acquired from other providers. All are closed to new business, which is why they are called zombie funds.

The company makes money by taking fees from policyholders and selling follow-on products, such as income-for-life annuities to those whose pension funds have matured.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Consolidation is sweeping the sector in the wake of new pension freedoms, which give savers unlimited access to savings, cutting dramatically the number of annuities sold. New European laws increasing the amount of capital reserves insurers must hold have also contributed to the trend.

Elsewhere, Zurich is on the verge of buying British rival RSA in a £5.6bn deal, while Aviva acquired Friends Life earlier this year in a £5.2bn transaction.

Guardian is owned by private equity firm Cinven and controls around £18bn in assets on behalf of 695,000 customers in the UK and Ireland. If Phoenix were to buy the company it would be "reunited" with around £1.7bn worth of funds it previously sold to its potential takeover target. That sale was intended to reduce a debt pile that stood at £3.5bn, and which is now closer to £1.7bn.

Sky News adds that Phoenix is "not the only party in discussions with Cinven, according to people close to the situation". Other potential bidders could include Admin Re and fellow private equity form CVC Capital Partners.

Broader interest could be helpful in Cinven securing an acceptable return from any sale, the Financial Times suggests. "Insiders have previously said that the business had an 'embedded value' of more than £1bn" and, "although listed companies in the sector tend to trade at a discount to this metric", a buyout at half this could prompt "questions from prospective investors".

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Can AI tools be used to Hollywood's advantage?

Can AI tools be used to Hollywood's advantage?Talking Points It makes some aspects of the industry faster and cheaper. It will also put many people in the entertainment world out of work

By Anya Jaremko-Greenwold, The Week US Published

-

'Paraguay has found itself in a key position'

'Paraguay has found itself in a key position'Instant Opinion Opinion, comment and editorials of the day

By Justin Klawans, The Week US Published

-

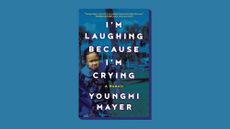

Meet Youngmi Mayer, the renegade comedian whose frank new memoir is a blitzkrieg to the genre

Meet Youngmi Mayer, the renegade comedian whose frank new memoir is a blitzkrieg to the genreThe Week Recommends 'I'm Laughing Because I'm Crying' details a biracial life on the margins, with humor as salving grace

By Scott Hocker, The Week US Published

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

By The Week Staff Published

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

By The Week Staff Published

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

By The Week Staff Last updated

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

By The Week Staff Published

-

Ryanair: readying for departure from London

Ryanair: readying for departure from LondonSpeed Read Plans to delist Ryanair from the London Stock Exchange could spell ‘another blow’ to the ‘dwindling’ London market

By The Week Staff Published

-

Out of fashion: Asos ‘curse’ has struck again

Out of fashion: Asos ‘curse’ has struck againSpeed Read Share price tumbles following the departure of CEO Nick Beighton

By The Week Staff Published

-

Universal Music’s blockbuster listing: don’t stop me now…

Universal Music’s blockbuster listing: don’t stop me now…Speed Read Investors are betting heavily that the ‘boom in music streaming’, which has transformed Universal’s fortunes, ‘still has a long way to go’

By The Week Staff Published

-

EasyJet/Wizz: battle for air supremacy

EasyJet/Wizz: battle for air supremacySpeed Read ‘Wizz’s cheeky takeover bid will have come as a blow to the corporate ego’

By The Week Staff Published