Five best cash Isas 2024: Top fixed-rate and easy-access deals

Products featured in this article are independently selected by This is Money's specialist journalists. If you open an account using links which have an asterisk, This is Money will earn an affiliate commission. We do not allow this to affect our editorial independence.

In this regularly updated round-up, This is Money picks our five favourite cash Isas for savers in 2024.

It is essential reading to help you choose a top savings account for your money that can also protect you from tax - and we detail the top easy access and fixed rate deals.

This top Isa round-up has keeping our readers updated on the best savings deals since 2014 - and is kept up-to-date weekly - bookmark it for the very latest developments.

Piggy five: We round-up the best tax-free deals - and it is slim pickings at the moment

How an Isa works and why you should have one

Each year in April, savers are given a fresh Isa allowance that qualifies for tax-free interest.

For the 2024/25 financial year, starting 6 April 2024 and ending 5 April 2025, the limit is £20,000.

You can transfer Isa money whichever way you wish between an investment account to savings account, whereas previously you could only shift it from saving to investments.

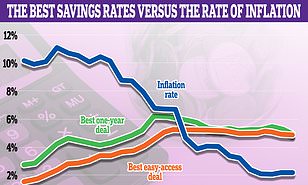

Cash Isa rates have been rising, along with non-tax free rates. It is worth opening one to shield money away from the taxman, especially with rates moving upwards.

Isa rules state you can only contribute to one Isa per tax year.

You can also transfer an old Isa for better returns. Here's a quick guide to Isa saving.

It is possible to switch your current year's cash Isa if you move the entire amount, but it is far simpler to get your choice right in the first place.

Get an Isa to beat savings tax

The cash Isa savings market has seen considerable improvement off the back of Bank of England rate rises. The best buy easy-access rates on a tax-free account pay more than 5 per cent.

Many may ask themselves why bother? Especially given that rates on non tax-free accounts can be higher.

Yet with inflation above target, it becomes even more important to make sure you are getting as much as you can from your savings.

And higher rates have dragged more people into the savings tax net, meaning a cash Isa's shelter is even more valuable.

An Isa is worth having, despite the tax-free savings interest allowance of £1,000 a year for basic rate taxpayers and £500 for higher rate taxpayers.

If you're a basic-rate taxpayer earning 5 per cent interest, having more than £20,000 in savings will tip you into tax, for a higher-rate taxpayer that figure is £10,000 and if you are in the 45p tax bracket, you get no savings allowance at all.

You may also want to look into stocks and shares version of an Isa - how to choose the best (and cheapest) DIY investing Isa.

Our five favourite Isas:

Trading 212*, easy-access, 5.17% [full details]

- Facts: £1 to open

- Transfers in: Yes

- Flexible: Yes

- This is Money says: This account is the best overall rate for an easy-access cash Isa paying a market-leading 5.17 per cent. It has bucked the trend of cutting rates as the Bank of England base rate was held at 5 per cent.

On 31 October it raised its rate from 5.1 per cent to 5.15 per cent and again to 5.17 per cent on 6 November.

This account can only be opened by downloading Trading 212's app. There are no limits to how many times you can withdraw your money and Trading 212 will not reduce your interest rate for accessing your money.

Trading 212's Isa is a flexible Isa which is a big benefit to savers with the financial fire power to max out their Isa limit each year.

Flexible Isas allow you to dip into your pot and, as long as you put the money back in during the same tax year, it doesn't lose its tax-free wrapper or use up any of that year's Isa allowance.

Other top flexible easy access cash Isas come from Paragon at 4.87 per cent (below), Chip* offering 4.58 per cent and Zopa at 4.55 per cent - both Chip and Zopa are app-based accounts.

Any cash deposited is fully FSCS protected, as are all of the accounts in this list. Funds in the Trading 212 Isa are held in partner bank accounts with Barclays, NatWest and JPMorgan.

Customers are able to see the percentage of their cash held at each bank is in the interest on the cash tab in the Trading 212 app.

It means if you already have money in Barclays, NatWest or JPMorgan, you'll need to be careful not to breach the £85,000 limit if you put money away with Trading 212.

The interest is paid daily.

Paragon Bank, easy-access 4.87% [full details]

- Facts: £1,000 to open

- Transfers in: Yes

- Flexible: Yes

- This is Money says: Paragon's easy-access Isa can be opened online. For those who don't want to download an app to get an Isa, which many of the top easy-access Isas require such Plum (above), Zopa and Chip, this is the best option.

It is also a flexible Isa, meaning savers wont lose their Isa allowance if they want to withdraw money from their pot.

Termed 'double access', Paragon's Isa only lets you withdraw money twice before being penalised. On a third withdrawal, the rate drops to just 1.5 per cent.

The lower interest rate will apply from the third withdrawal to the day before the anniversary of your account opening. From your anniversary the interest rate and withdrawals reset.

Cynergy Bank, one-year fix, 4.48% [full details]

- Facts: £1,000 to open

- Transfers in: Yes

- Flexible: No

- This is Money says: Cynergy Bank now offers the best one-year Isa on the market. You can open and manage this Isa online on Cynergy Bank's website with a minimum of £1,000.

If you withdraw money or close the account before the one-year term ends, you will be subject to a penalty equivalent to 180 days loss of interest.

Cynergy Bank, two-year fix, 4.36% [full details]

- Facts: £1,000 to open

- Transfers in: Yes

- Flexible: No

- This is Money says: Cynergy Bank now also offers the best overall two-year fixed rate Isa as well as the best one year fix. This Isa can be opened and managed online on Cynergy Bank's website with a minmum of £1,000.

If you withdraw money or close the account before the one-year term ends, you will be subject to a penalty equivalent to 180 days loss of interest.

The best lifetime Isa

Moneybox, Cash lifetime Isa, 5% [full details]

- Facts: £1 to open

- Transfers in: Yes

- Flexible: No

- This is Money says: For those aged between 18-39 who are either saving up to buy their first home or towards retirement, this is the best paying cash Lisa deal on the market.

Save up to £4,000 each tax year and get a 25 per cent government bonus. The deal is only available via its app.

The rate includes a 1 per cent fixed bonus for the first year, the underlying rate is 4 per cent

SAVE MONEY, MAKE MONEY

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence. *Chase: Cashback available for first year. Exceptions apply. 18+, UK residents.