As the 100th banking hub opens its doors - is YOUR town be next in line to get one?

- Darwen in Lancashire has become the 100th town to receive a banking hub

There are now 100 banking hubs across the country in a milestone for Cash Access UK.

Today Darwen in Lancashire and Morriston in Wales became the latest towns to receive a banking hub, marking number 99 and 100.

Darwen was recommended a hub by ATM-network Link following a community request after bank branch closures in the town.

This week, Cash Access UK – the non-profit organisation which runs the banking hubs - opened five new hubs in Harpenden, Yeadon, Huntly and - today - Darwen, and Morriston.

Labour has pledged 350 banking hubs by the end of Parliament. With 100 of the hubs now open, Post Office boss Neil Brocklehurst said ‘we are on our way to meeting the Government's target.’

It can take up to a year to set up a banking hub, with most of this time being taken up by finding a location for a new hub.

There are now 100 banking hubs up and down the country as Darwen Lancashire become the newest town to receive one

Link conducts community assessments following the announcement of the closure of any high street bank, a significant change in the hours or services provided, or when a member of a community requests it.

Link then recommends new banking hubs or deposit services and they are delivered by Cash Access UK, which is owned by the banks.

To date, 176 banking hubs have been recommended as well as 126 deposit services. Cash Access UK today confirmed 100 deposit services will be live by the end of the year.

A number of other towns around the country could be set to receive a banking hub on their high street. In September, Link recommended banking hubs open in 15 towns.

Previously, towns where a Nationwide branch was the last remaining branch were not eligible to receive a banking hub. But the rules changed in September and towns where the last branch in town is a Nationwide can also receive a banking hub.

This is Money analysis can now reveal there are 19 other towns which would meet the criteria to be recommended a banking hub, given they only have one bank left in town.

It means that towns such as Windsor in Royal Barkshire, where the only remaining branch in town is a Nationwide Building Society, could be in line to receive a banking hub.

Other towns that could be set to benefit from hubs include Glastonbury in Somerset, Lampater in Wales and Alloa in Scotland.

Towns where there are just one bank branch

- Alloa

- Campbeltown

- Ilkley

- Glastonbury

- Windsor

- Leatherhead

- Leigh-on-Sea

- Lampeter

- Pocklington

- Dagenham

- Largs

- Cardigan

- Guisborough

- March

- Melksham

- Pontypool

- Whitstable

- Glossop

- Chepstow

Dorking had previously been on this list but it was recommended a banking hub by Link just yesterday.

Banking hubs have a traditional counter service operated by the Post Office, and community bankers from nine major high street banks operate on a rotating basis to provide support to customers with their banking needs.

While deposit services allow small businesses to deposit and access cash either through deposit ATMs or Post Offices, where there is a separate counter for banking customers.

And they are proving popular with residents of bankless towns.

In Brixham in Devon and Rochford in Essex, towns where some of the first hubs opened - three in 10 people said they visit and spend more on the local high street because of the hubs, research from Cash Access UK found.

Gareth Oakley, chief executive of Cash Access UK said: 'Our hubs are proving extremely popular which shows that access to cash and banking services remains vital for millions of individuals across the UK, despite more people choosing to bank and make payments digitally.'

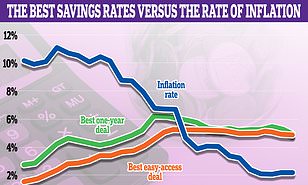

SAVE MONEY, MAKE MONEY

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence. *Chase: Cashback available for first year. Exceptions apply. 18+, UK residents.