EXCLUSIVEStarling Bank to launch its first easy-access savings account - here's how the rate compares to rivals

Starling Bank will launch an easy-access account at the end of November, This is Money can reveal.

Starling's easy-access account will pay 4 per cent and have no withdrawal restrictions - customers will be able to withdraw money as often as they like without being penalised by the rate being cut.

In recent years, many best buy 'instant' access accounts come with hoops to jump through, including bonuses and withdrawal restrictions.

It is the first time the digital bank has launched an easy-access account. Up until now Starling has only offered a one-year fixed-rate account paying 4.05 per cent.

Starling will launch its first easy-access account at the end of November paying 4%

It comes as rivals Chase and Monzo revealed they will cut easy-access rates.

Chase will cut its easy-access rate to 3.5 per cent from 3.75 per cent today.

Meanwhile Monzo has revealed it's cutting its easy-access rate to 3.6 per cent from 3.85 per cent later in the month.

Starling's 4 per cent interest rate is a variable rate, meaning it could go up or down with changes to the savings market.

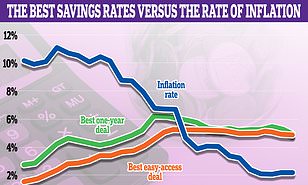

This is Money analysis revealed 27 easy-access deals have had rate cuts or been pulled from the market since the Bank of England cut the base rate last week.

Savers can get better rates than 4 per cent if they look around. This is Money's best buy tables show there are easy-access rates paying as much 4.9 per cent.

While offering flashy rates, some of the top easy-access deals come with withdrawal restrictions, bonus rates which fall away if you withdraw money or a high minimum deposit of £25,000.

Starling's 4 per cent rate is competitive compared to other big name providers.

Barclay's everyday saver pays 1.66 per cent while NatWest's flexible saver pays 1.6 per cent. Santander's easy-access account pays 1.4 per cent while Lloyds easy-access account pays just 1.3 per cent.

HSBC offers the highest rate of the big banks on easy-access savings at 2 per cent, but this will be cut to 1.7 per cent on 18 November.

There is a bonus version of the account which pays 4 per cent if customers don't make withdrawals.

Starling's easy-access account will appeal to savers looking for a high interest savings account that can be opened and managed with ease from their current account.

The easy-access account will only be available to Starling's sole current account customers at launch, not joint account holders.

The easy-access account will be accessible through the 'Spaces' section of its current account.

It is open to new and existing customers, but new customers will need to open a current account with Starling as the easy-access account is linked to current accounts, much like Monzo's savings pots.

There is no minimum deposit needed to start saving, and savers can deposit up to £1million in the account - £85,000 of that is protected under the Financial Services Compensation Scheme.

Interest on cash held in Starling's easy-access account will be earned daily and paid out monthly.

Maria Vidler, of Starling, said: 'Easy Saver helps our customers with a competitive interest rate, penalty-free access and full integration into their Starling app so they can see everything in one place.'

SAVE MONEY, MAKE MONEY

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence. *Chase: Cashback available for first year. Exceptions apply. 18+, UK residents.