MARKET REPORT: Sofa, so good as DFS defies downturn in retail sector

The High Street may have suffered an uncomfortable start to the Christmas quarter but DFS revealed it was sitting pretty.

The furniture retailer bucked the trend by signalling that recent better trading has continued into its latest financial year.

In a brief update, the sofa firm said improved trading in the final quarter of its last fiscal year has continued into the first 20 weeks of the current period.

Orders have kept growing, in line with its expectations, while further progress has also been made on cutting costs.

DFS accompanied the update with the surprise appointment of Marie Wall, formerly of Imperial Brands, as its interim chief financial officer. Wall joins on December 2, ensuring a smooth handover from John Fallon, who leaves on January 17.

Analysts at Jefferies raised their price target for DFS to 170p from 140p and repeated a buy rating. DFS shares rose 1.7 per cent, or 2.2p, to 135p.

Sitting pretty: DFS signalled that recent better trading has continued into its latest financial year

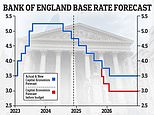

It came despite official figures yesterday showing retail sales slumped in October. The weak UK data added to expectations that the Bank of England could further reduce interest rates this year, which gave a boost to the London benchmarks.

The FTSE 100 closed 1.4 per cent, or 112.81 points, higher at 8262.08, while the FTSE 250 added 1.1 per cent, or 231.77 points, at 20,581.69.

Rate-sensitive housebuilders were in demand, with Vistry gaining 3 per cent, or 18.5p, at 643p, Berkeley Group ahead 1.6 per cent, or 46p, at 4322p, and Taylor Wimpey up 2 per cent, or 2.5p, at 129.65p.

But banks were weaker amid worries over a downturn, with Barclays falling 2.1 per cent, or 5.45p, to 257.2p and Lloyds off 1.1 per cent, or 0.6p, at 54.42p.

Elsewhere, JD Sports shed 2.1 per cent, or 1.98p, to 93.46p, having tumbled on Thursday after a profit warning, as analysts at JP Morgan cut their rating for the stock to 'neutral'.

Unilever gained 3.3 per cent, or 150p, to 4692p as the consumer products giant confirmed it remains on track to separate out its ice cream business and deliver its productivity boost programme by the end of 2025.

On the AIM market, Tavistock Investments rose 11.3 per cent, or 0.4p, to 3.95p as the financial advice and investment management provider said it has a substantial level of funding to refocus its activities after two disposals.

Learning Technologies rose 2.3 per cent, or 2.1p, at 92.3p as the digital learning and talent management firm extended a deadline to December 6 for US private equity outfit General Atlantic Service to announce an intention to make an offer or withdraw its bid.

Ferro-Alloy Resources gained 3.1 per cent, or 0.2p, to 6.7p after revealing a promising development for its carbon black substitute product which it thinks has significant revenue potential in the sustainable materials market.

But Webis Holdings sank 68.8 per cent, or 0.28p, to 0.13p as the gaming and technology firm announced proposals to cancel its listing on AIM, which the company's board believes will reduce costs and protect shareholder value.

DIY INVESTING PLATFORMS

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you