INVESTING SHOW: Is Japan a golden opportunity for investors in the coronavirus storm?

As coronavirus shut down economies around the world, Japan stood out as one of the countries that managed to avoid a hard lockdown.

There were fears that Japan with its elderly population would suffer heavily in the coronavirus pandemic, but deaths have been low and its cash-rich companies have proved robust.

Japan’s economy has taken a hit but Nicholas Weindling, manager of the JP Morgan Japanese Investment Trust, says that the country has not been affected as badly as many people thought it would be.

Does that mean that the land of the rising sun – thought of by many investors as the land of the false dawn – presents an opportunity for investors in the coronavirus storm?

Nicholas, who is based in Tokyo, joins Simon Lambert and Richard Hunter on this episode of the Investing Show to discuss how Japan has weathered Covid-19 and where he sees long-term prospects for growth in its stock market.

The fund manager argues that while many investors will think of global big name Japanese companies when they consider the country, this is not where the chances to profit lie.

Instead, he says that the companies further down the scale tapping into Japan’s consumer economy and helping fellow businesses adapt to the digital world can provide returns.

He says: ‘We’re investing in great companies that happen to be in Japan, not in the Japanese market itself.’

The JP Morgan Japanese trust is up 19.3 per cent since the start of 2020, compared to a 4.75 per cent gain for the AIC sector average trust.

It has ongoing charges of 0.69 per cent and shares currently trade at a 10 per cent discount to net asset value.

Rival trusts include Baillie Gifford's highly rated pair Baillie Gifford Japan and Shin Nippon, which invests in smaller companies, along with Fidelity Japan and Schroder Japan growth.

Nicholas says that while people often think of Japan as a very high-tech country – and in some places, such as Tokyo it is – much of the rest of the nation has some catching up to do with the rest of the world

He says: ‘In many ways Japan is lagging behind the rest of the world and that is the key opportunity. In Japan e-commerce is only about 8 per cent of total sales. It’s still very low and that is an opportunity.’

He also cites Japan’s low level of card payments, with 80 per Nicholas Weindling cent of transactions still done in cash – something which he says is going to change.

Nicholas argues that this means that for investors this means that the country’s companies have further to run in terms of growth that other major markets, such as the US, where much of the digital world’s gains have already been made.

There were fears that Japan with its elderly population would suffer heavily in the coronavirus pandemic, but deaths have been low and it has avoided a strict lockdown

THE INVESTING SHOW

-

What you need to know about investing in a VCT and the 30% tax break

What you need to know about investing in a VCT and the 30% tax break -

ChatGPT's threat to Google, Meta going wrong and a growth energy stock

ChatGPT's threat to Google, Meta going wrong and a growth energy stock -

Is commercial property now a great value opportunity?

Is commercial property now a great value opportunity? -

Impax Environmental Markets invests in companies that help the planet

Impax Environmental Markets invests in companies that help the planet -

Will investors get a boost if inflation drops?

Will investors get a boost if inflation drops? -

Temple Bar: The UK stock market is as interesting as in 2008

Temple Bar: The UK stock market is as interesting as in 2008 -

International Biotech's Ailsa Craig says shares are cheap

International Biotech's Ailsa Craig says shares are cheap -

What will Liz Truss mean for the stock market and investors?

What will Liz Truss mean for the stock market and investors? -

Will the rest of 2022 be better and can the UK outperform?

Will the rest of 2022 be better and can the UK outperform? -

Blue Whale's Stephen Yiu on ditching Facebook

Blue Whale's Stephen Yiu on ditching Facebook -

Has the shift from growth to value kicked in already?

Has the shift from growth to value kicked in already? -

BP and Shell shares pay big dividends but will they be held back?

BP and Shell shares pay big dividends but will they be held back? -

Gresham House's Ken Wotton on UK smaller companies

Gresham House's Ken Wotton on UK smaller companies -

The next wave of disruptive firms: BG US Growth's manager

The next wave of disruptive firms: BG US Growth's manager -

Where investors can profit in the dividend recovery

Where investors can profit in the dividend recovery -

Investing in the best of British smaller companies can pay off

Investing in the best of British smaller companies can pay off -

Are cheap bank shares a way to bag recovery profits?

Are cheap bank shares a way to bag recovery profits? -

'Crypto is the poster child of empty calorie speculation'

'Crypto is the poster child of empty calorie speculation' -

Will investors profit from a Roaring Twenties?

Will investors profit from a Roaring Twenties? -

How we invest in companies helping the planet: Jupiter Green

How we invest in companies helping the planet: Jupiter Green -

What's behind Baillie Gifford Managed Fund's winning mix?

What's behind Baillie Gifford Managed Fund's winning mix? -

Nick Train: 'There's plenty to be optimistic about'

Nick Train: 'There's plenty to be optimistic about' -

Can Scottish Mortgage keep climbing? Tom Slater interview

Can Scottish Mortgage keep climbing? Tom Slater interview -

'UK equities could be the perfect way to play a global reopening'

'UK equities could be the perfect way to play a global reopening' -

We've had the vaccine rally and US election, so what happens next?

We've had the vaccine rally and US election, so what happens next? -

Is Japan a golden opportunity in the coronavirus storm?

Is Japan a golden opportunity in the coronavirus storm? -

What next for shares after the post-crash bounce?

What next for shares after the post-crash bounce? -

What the fund that beat the crash is buying now

What the fund that beat the crash is buying now -

Where to look for shares that will benefit from a recovery?

Where to look for shares that will benefit from a recovery? -

What kind of rescue could trigger a bounce back?

What kind of rescue could trigger a bounce back? -

How to invest through a crisis like coronavirus

How to invest through a crisis like coronavirus -

How to invest for high income and avoid dividend traps

How to invest for high income and avoid dividend traps -

How to find shares with dividends that can grow: Troy Income & Growth...

How to find shares with dividends that can grow: Troy Income & Growth... -

Blue Whale: 'We want companies that grow whatever happens'

Blue Whale: 'We want companies that grow whatever happens' -

How biotech investors can profit from an ageing population

How biotech investors can profit from an ageing population -

Will the UK election result boost or sink the stock market?

Will the UK election result boost or sink the stock market? -

Scottish Mortgage's Tom Slater on how and why it invests

Scottish Mortgage's Tom Slater on how and why it invests -

'It's a vast area of change': We meet a food fund manager

'It's a vast area of change': We meet a food fund manager -

Are 'cheap' bank shares an opportunity to profit or a value trap?

Are 'cheap' bank shares an opportunity to profit or a value trap? -

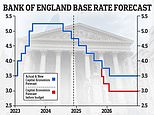

How to invest in the new era of falling interest rates

How to invest in the new era of falling interest rates -

How to profit from green energy, reducing waste and boosting recycling

How to profit from green energy, reducing waste and boosting recycling -

How to get a near 6% yield by tapping into Asia's dividends

How to get a near 6% yield by tapping into Asia's dividends -

The UK is cheap and shares could bounce back: Fund managers' tips

The UK is cheap and shares could bounce back: Fund managers' tips -

How to find the best British companies and not worry about Brexit

How to find the best British companies and not worry about Brexit -

What next for Neil Woodford and his investors?

What next for Neil Woodford and his investors? -

Can US smaller companies can still offer rich pickings?

Can US smaller companies can still offer rich pickings? -

Can UK shares shake off the Brexit hangover?

Can UK shares shake off the Brexit hangover? -

Is commercial property an unloved investment ripe for returns?

Is commercial property an unloved investment ripe for returns? -

Buffettology manager's tips on picking shares to beat the market

Buffettology manager's tips on picking shares to beat the market -

Invest in the UK's best companies and beat Brexit: Free Spirit manager

Invest in the UK's best companies and beat Brexit: Free Spirit manager -

Are house prices due a fall or could there be a Brexit deal bounce?

Are house prices due a fall or could there be a Brexit deal bounce? -

Profit from smaller company shares but take less risk - Gresham House...

Profit from smaller company shares but take less risk - Gresham House... -

How to find the world's best dividend shares: Evenlode Global Income...

How to find the world's best dividend shares: Evenlode Global Income... -

The US is expensive and the UK is unloved, so it's time to be picky:...

The US is expensive and the UK is unloved, so it's time to be picky:... -

Ruffer made 23% when shares crashed in 2008, so where is it investing...

Ruffer made 23% when shares crashed in 2008, so where is it investing... -

The shares hit the hardest in the stock market slump (and those that...

The shares hit the hardest in the stock market slump (and those that... -

How to invest in improving our world: From a reverse vending machine...

How to invest in improving our world: From a reverse vending machine... -

Mark Mobius: 'Emerging and frontier markets are cheap'

Mark Mobius: 'Emerging and frontier markets are cheap' -

How to invest around the world the easy way - and try to dodge crashes

How to invest around the world the easy way - and try to dodge crashes -

How impact investing can profit from the companies that will shape our...

How impact investing can profit from the companies that will shape our... -

Did England's World Cup run boost the economy?

Did England's World Cup run boost the economy? -

How to find the best companies - and make sure their shares are worth...

How to find the best companies - and make sure their shares are worth... -

What is happening to house prices and the property market?

What is happening to house prices and the property market? -

Three opportunities to profit for investors - from gold and oil shares...

Three opportunities to profit for investors - from gold and oil shares... -

What you need to know about global funds - and finding the world's...

What you need to know about global funds - and finding the world's... -

When is a good time to start investing - and how can you cut the...

When is a good time to start investing - and how can you cut the... -

What you need to know about crowdfunding, peer to peer, and Innovative...

What you need to know about crowdfunding, peer to peer, and Innovative... -

How to invest in retirement: The Investing Show Live

How to invest in retirement: The Investing Show Live -

Tips to invest your Isa - and what to think about if you're worried...

Tips to invest your Isa - and what to think about if you're worried... -

Why now is the time to invest in Vietnam

Why now is the time to invest in Vietnam -

Get a 4% dividend from the future of medicine: International...

Get a 4% dividend from the future of medicine: International... -

Asia's best companies can deliver for the next 20 years - we speak to...

Asia's best companies can deliver for the next 20 years - we speak to...

Most watched Money videos

- Tesla UK unveils look of sleek CyberCab in London's Westfield

- Jaguar targets new customers by ditching logo and going electric

- How Trump changes things for investors and ways to back AI

- Inside the Polestar 4, the UK's first car without a rear window

- French family car Renault launch new electric era Renault 4 E-Tech

- Actor Theo James appears in advert for the Range Rover Sport

- Rare 1992 Ford Escort RS Cosworth sets new world record auction price

- Hyundai Inster: Is it the cheap EV we've been waiting for?

- Ford Capri EV driven: We test 2024's most controversial car

- Couple turns Disney World cabin into perfect tiny home

- Check out the new £1million Brabus Big Boy 1200 motorhome

- Custom Land Rover Defender built for Guy Ritchie goes on sale

-

Are interest rate cuts about to stall and what does that...

Are interest rate cuts about to stall and what does that...

-

JEFF PRESTRIDGE: If World War Three really does break...

JEFF PRESTRIDGE: If World War Three really does break...

-

Bosses demand urgent business rates shake-up

Bosses demand urgent business rates shake-up

-

Nationwide bags £2bn on Virgin Money deal

Nationwide bags £2bn on Virgin Money deal

-

TONY HETHERINGTON: The truth comes out about Tui's...

TONY HETHERINGTON: The truth comes out about Tui's...

-

HAMISH MCRAE: Roaring Twenties may fizzle out for investors

HAMISH MCRAE: Roaring Twenties may fizzle out for investors

-

Car finance scandal plunging Close Brothers into turmoil

Car finance scandal plunging Close Brothers into turmoil

-

City grandee Victor Blank gave Rachel Reeves £175k donations

City grandee Victor Blank gave Rachel Reeves £175k donations

-

Cannon and Ball started as singers but switched to comedy...

Cannon and Ball started as singers but switched to comedy...

-

Sara Weller is Britain's bravest businesswoman

Sara Weller is Britain's bravest businesswoman

-

Ease the pain of 'farmer harmer' Starmer's brutal...

Ease the pain of 'farmer harmer' Starmer's brutal...

-

EDINBURGH INVESTMENT TRUST Impressive returns and a...

EDINBURGH INVESTMENT TRUST Impressive returns and a...

-

Asda hires former boss to revive its fortunes

Asda hires former boss to revive its fortunes

-

MIDAS SHARE TIPS: Fintel, the investor who really knows...

MIDAS SHARE TIPS: Fintel, the investor who really knows...

-

Women retire on £695 less a month than men

Women retire on £695 less a month than men

-

MIDAS SHARE TIPS UPDATE: Shares in our tip BP Marsh have...

MIDAS SHARE TIPS UPDATE: Shares in our tip BP Marsh have...

-

Killing Kittens founder seeks £500k for growth

Killing Kittens founder seeks £500k for growth

-

Treasury cuts stake in NatWest to less than 11%

Treasury cuts stake in NatWest to less than 11%