What the fund that beat the crash is buying now: The INVESTING SHOW speaks to the manager of Argonaut Absolute Return, which has made a 23% profit this year

As investment funds dived in the first three months of 2020, FP Argonaut Absolute Return managed to deliver a 23 per cent return to investors.

Absolute return funds are meant to do what they say on the tin and make money for investors in the bad times as well as the good, but many have been left disappointed over the years.

This time round, the Argonaut fund pulled the trick off and then some in the first quarter of the year when it became the top-performing fund.

On this episode of the Investing Show, we speak to manager Barry Norris to ask him how the fund not only weathered the storm but turned a big profit – and what he is investing in now.

As an absolute return fund manager, he is free to invest in almost anything he likes and can go both long and short of companies - backing those he things will do well and selling those he thinks will suffer.

This is definitely a 'don't try this at home' school of investing and it is often the case that absolute return funds carry high fees and relatively low returns.

Argonaut Absolute Return certainly has a high ongoing charges figure, compared to a standard investment fund, of 2.26 per cent.

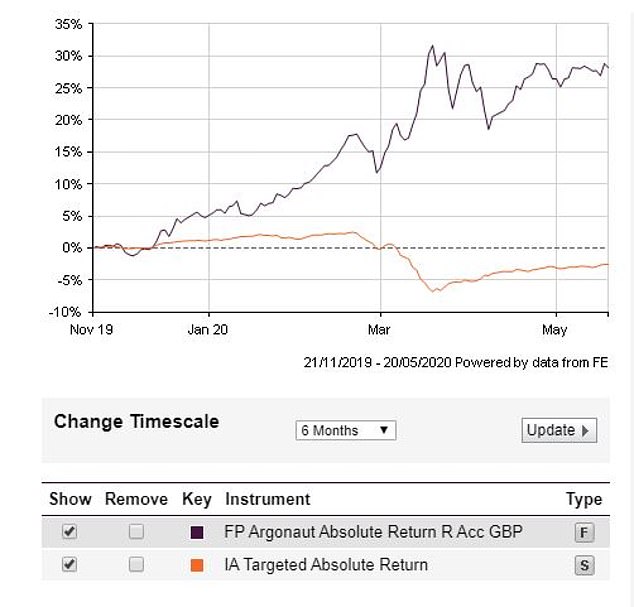

It is up 21 per cent year-to-date and has returned 30 per cent over one year, 46 per cent over three years, but just 15.1 per cent over five years.

Those figures compare to sector averages of - 3.9 per cent year-to-date and -1.2 per cent, -0.6 per cent and 2.7 per cent over one, three and five years, respectively.

Barry explains how he thinks the recovery will unfold, what shape it will be and why he decided to buy shares in Zoom last November. He also discusses why an investor would consider buying into an absolute return fund after the market has crashed and its protective cloak may no longer feel necessary.

The performance of the Argonaut Absolute Return fund (purple) compared to the average in the sector (orange) over the past six months

THE INVESTING SHOW

-

What you need to know about investing in a VCT and the 30% tax break

What you need to know about investing in a VCT and the 30% tax break -

ChatGPT's threat to Google, Meta going wrong and a growth energy stock

ChatGPT's threat to Google, Meta going wrong and a growth energy stock -

Is commercial property now a great value opportunity?

Is commercial property now a great value opportunity? -

Impax Environmental Markets invests in companies that help the planet

Impax Environmental Markets invests in companies that help the planet -

Will investors get a boost if inflation drops?

Will investors get a boost if inflation drops? -

Temple Bar: The UK stock market is as interesting as in 2008

Temple Bar: The UK stock market is as interesting as in 2008 -

International Biotech's Ailsa Craig says shares are cheap

International Biotech's Ailsa Craig says shares are cheap -

What will Liz Truss mean for the stock market and investors?

What will Liz Truss mean for the stock market and investors? -

Will the rest of 2022 be better and can the UK outperform?

Will the rest of 2022 be better and can the UK outperform? -

Blue Whale's Stephen Yiu on ditching Facebook

Blue Whale's Stephen Yiu on ditching Facebook -

Has the shift from growth to value kicked in already?

Has the shift from growth to value kicked in already? -

BP and Shell shares pay big dividends but will they be held back?

BP and Shell shares pay big dividends but will they be held back? -

Gresham House's Ken Wotton on UK smaller companies

Gresham House's Ken Wotton on UK smaller companies -

The next wave of disruptive firms: BG US Growth's manager

The next wave of disruptive firms: BG US Growth's manager -

Where investors can profit in the dividend recovery

Where investors can profit in the dividend recovery -

Investing in the best of British smaller companies can pay off

Investing in the best of British smaller companies can pay off -

Are cheap bank shares a way to bag recovery profits?

Are cheap bank shares a way to bag recovery profits? -

'Crypto is the poster child of empty calorie speculation'

'Crypto is the poster child of empty calorie speculation' -

Will investors profit from a Roaring Twenties?

Will investors profit from a Roaring Twenties? -

How we invest in companies helping the planet: Jupiter Green

How we invest in companies helping the planet: Jupiter Green -

What's behind Baillie Gifford Managed Fund's winning mix?

What's behind Baillie Gifford Managed Fund's winning mix? -

Nick Train: 'There's plenty to be optimistic about'

Nick Train: 'There's plenty to be optimistic about' -

Can Scottish Mortgage keep climbing? Tom Slater interview

Can Scottish Mortgage keep climbing? Tom Slater interview -

'UK equities could be the perfect way to play a global reopening'

'UK equities could be the perfect way to play a global reopening' -

We've had the vaccine rally and US election, so what happens next?

We've had the vaccine rally and US election, so what happens next? -

Is Japan a golden opportunity in the coronavirus storm?

Is Japan a golden opportunity in the coronavirus storm? -

What next for shares after the post-crash bounce?

What next for shares after the post-crash bounce? -

What the fund that beat the crash is buying now

What the fund that beat the crash is buying now -

Where to look for shares that will benefit from a recovery?

Where to look for shares that will benefit from a recovery? -

What kind of rescue could trigger a bounce back?

What kind of rescue could trigger a bounce back? -

How to invest through a crisis like coronavirus

How to invest through a crisis like coronavirus -

How to invest for high income and avoid dividend traps

How to invest for high income and avoid dividend traps -

How to find shares with dividends that can grow: Troy Income & Growth...

How to find shares with dividends that can grow: Troy Income & Growth... -

Blue Whale: 'We want companies that grow whatever happens'

Blue Whale: 'We want companies that grow whatever happens' -

How biotech investors can profit from an ageing population

How biotech investors can profit from an ageing population -

Will the UK election result boost or sink the stock market?

Will the UK election result boost or sink the stock market? -

Scottish Mortgage's Tom Slater on how and why it invests

Scottish Mortgage's Tom Slater on how and why it invests -

'It's a vast area of change': We meet a food fund manager

'It's a vast area of change': We meet a food fund manager -

Are 'cheap' bank shares an opportunity to profit or a value trap?

Are 'cheap' bank shares an opportunity to profit or a value trap? -

How to invest in the new era of falling interest rates

How to invest in the new era of falling interest rates -

How to profit from green energy, reducing waste and boosting recycling

How to profit from green energy, reducing waste and boosting recycling -

How to get a near 6% yield by tapping into Asia's dividends

How to get a near 6% yield by tapping into Asia's dividends -

The UK is cheap and shares could bounce back: Fund managers' tips

The UK is cheap and shares could bounce back: Fund managers' tips -

How to find the best British companies and not worry about Brexit

How to find the best British companies and not worry about Brexit -

What next for Neil Woodford and his investors?

What next for Neil Woodford and his investors? -

Can US smaller companies can still offer rich pickings?

Can US smaller companies can still offer rich pickings? -

Can UK shares shake off the Brexit hangover?

Can UK shares shake off the Brexit hangover? -

Is commercial property an unloved investment ripe for returns?

Is commercial property an unloved investment ripe for returns? -

Buffettology manager's tips on picking shares to beat the market

Buffettology manager's tips on picking shares to beat the market -

Invest in the UK's best companies and beat Brexit: Free Spirit manager

Invest in the UK's best companies and beat Brexit: Free Spirit manager -

Are house prices due a fall or could there be a Brexit deal bounce?

Are house prices due a fall or could there be a Brexit deal bounce? -

Profit from smaller company shares but take less risk - Gresham House...

Profit from smaller company shares but take less risk - Gresham House... -

How to find the world's best dividend shares: Evenlode Global Income...

How to find the world's best dividend shares: Evenlode Global Income... -

The US is expensive and the UK is unloved, so it's time to be picky:...

The US is expensive and the UK is unloved, so it's time to be picky:... -

Ruffer made 23% when shares crashed in 2008, so where is it investing...

Ruffer made 23% when shares crashed in 2008, so where is it investing... -

The shares hit the hardest in the stock market slump (and those that...

The shares hit the hardest in the stock market slump (and those that... -

How to invest in improving our world: From a reverse vending machine...

How to invest in improving our world: From a reverse vending machine... -

Mark Mobius: 'Emerging and frontier markets are cheap'

Mark Mobius: 'Emerging and frontier markets are cheap' -

How to invest around the world the easy way - and try to dodge crashes

How to invest around the world the easy way - and try to dodge crashes -

How impact investing can profit from the companies that will shape our...

How impact investing can profit from the companies that will shape our... -

Did England's World Cup run boost the economy?

Did England's World Cup run boost the economy? -

How to find the best companies - and make sure their shares are worth...

How to find the best companies - and make sure their shares are worth... -

What is happening to house prices and the property market?

What is happening to house prices and the property market? -

Three opportunities to profit for investors - from gold and oil shares...

Three opportunities to profit for investors - from gold and oil shares... -

What you need to know about global funds - and finding the world's...

What you need to know about global funds - and finding the world's... -

When is a good time to start investing - and how can you cut the...

When is a good time to start investing - and how can you cut the... -

What you need to know about crowdfunding, peer to peer, and Innovative...

What you need to know about crowdfunding, peer to peer, and Innovative... -

How to invest in retirement: The Investing Show Live

How to invest in retirement: The Investing Show Live -

Tips to invest your Isa - and what to think about if you're worried...

Tips to invest your Isa - and what to think about if you're worried... -

Why now is the time to invest in Vietnam

Why now is the time to invest in Vietnam -

Get a 4% dividend from the future of medicine: International...

Get a 4% dividend from the future of medicine: International... -

Asia's best companies can deliver for the next 20 years - we speak to...

Asia's best companies can deliver for the next 20 years - we speak to...

Most watched Money videos

- Watch Christmas celebrations in charming small town

- Boreham Motorworks unveils the limited-edition Mk1 Ford Escort

- Amazon's latest $49,000 double-story TINY home comes with glass sunroom

- Jaguar targets new customers by ditching logo and going electric

- Rare 1992 Ford Escort RS Cosworth sets new world record auction price

- How to buy the best UK shares at a cheaper price

- Hyundai Inster: Is it the cheap EV we've been waiting for?

- Ford Capri EV driven: We test 2024's most controversial car

- Tesla UK unveils look of sleek CyberCab in London's Westfield

- Toyota relaunches Urban Cruiser as an electric tech-rich crossover

- Snoop Dogg in film announcing Publicis as largest advertising agency

- Range Rover Electric undergoes last extreme-weather tests

-

Is a pavement parking ban in Britain inbound? Just one in...

Is a pavement parking ban in Britain inbound? Just one in...

-

British Gas sent a widow a £6,500 bill addressed to her...

British Gas sent a widow a £6,500 bill addressed to her...

-

It's time to cash in your NS&I savings and move your...

It's time to cash in your NS&I savings and move your...

-

Waspi women will receive NO compensation, says Labour, as...

Waspi women will receive NO compensation, says Labour, as...

-

I got back home from Christmas shopping to find a car...

I got back home from Christmas shopping to find a car...

-

BUSINESS LIVE: Wage growth accelerates; Britvic takeover...

BUSINESS LIVE: Wage growth accelerates; Britvic takeover...

-

I'm a 57-year-old hairdresser from Birmingham who's made...

I'm a 57-year-old hairdresser from Birmingham who's made...

-

A first-class farce: With stamps now costing £1.65 each,...

A first-class farce: With stamps now costing £1.65 each,...

-

A nail bar conman has stolen £380 from me: SALLY SORTS IT

A nail bar conman has stolen £380 from me: SALLY SORTS IT

-

Capita plans to slash costs by £250m with the help of AI...

Capita plans to slash costs by £250m with the help of AI...

-

Audi takes 'painful' decision to close Brussels EV...

Audi takes 'painful' decision to close Brussels EV...

-

Terrifying truth about Temu toys: From toxic chemicals,...

Terrifying truth about Temu toys: From toxic chemicals,...

-

Barclays loses attempt to overturn Ombudsman's ruling on...

Barclays loses attempt to overturn Ombudsman's ruling on...

-

Are YOU living in one of Britain's 18 most cash deprived...

Are YOU living in one of Britain's 18 most cash deprived...

-

Tullow Oil shares sink as US rival Kosmos Energy abandons...

Tullow Oil shares sink as US rival Kosmos Energy abandons...

-

Carlsberg's £3.3bn takeover of Britvic given the green light

Carlsberg's £3.3bn takeover of Britvic given the green light

-

Chemring order book exceeds record £1bn on defence...

Chemring order book exceeds record £1bn on defence...

-

High Street sheds 225,000 jobs in just five years: Reeves...

High Street sheds 225,000 jobs in just five years: Reeves...