'Why we invest in Amazon, Tesla... and Ferrari': Scottish Mortgage's Tom Slater on hunting for the best growth shares on the INVESTING SHOW

Scottish Mortgage has delivered big returns to investors by backing some of technology and the modern consumer world's biggest names.

But are the best days already past of the star firms, such as Amazon, Google and Tesla, that have helped deliver a 474 per cent return over ten years?

And is China's burgeoning technology scene good enough to warrant major backing?

On this episode of the Investing Show, Scottish Mortgage's co-manager Tom Slater, joins us to explain how the trust invests and why he believes 'the world's most exciting, interesting growth companies' have many more years of good times ahead.

And Slater says that investing for growth around the world is not just a case of backing US tech stars, with China also increasingly offering outstanding opportunities.

He says: 'Today some of the ideas, the technology and the strength of the businesses that are coming out of Beijing and the east coast of China are on a par if not better than their Silicon Valley counterparts.'

Slater explains that Scottish Mortgage's philosophy is to achieve 'long-term capital appreciation for shareholders' and to do that by investing in outstanding firms.

But the fund manager adds that there is another very important part to seeking out companies that fit the bill and also to the trust's own approach to investment.

He says that companies must have 'the most attractive long-term prospects' while Scottish Mortgage aims to be a 'very long term and patient shareholder'. This can mean volatility over the short term but the managers believe that is necessary for those long-term returns.

Slater adds: 'We don't think that we can predict the future, we don't have answer to what the world will look like, but can we find companies and entrepreneurs we think are shaping that future.'

Scottish Mortgage invests in some of the world's largest and most easily recognisable tech companies, counting Amazon, Google-parent Alphabet, Facebook and Netflix among its holdings, along with China's tech giants Tencent, Alibaba and Baidu.

One of the questions investors raise about these established tech stars is whether investors have already had the best returns they will offer.

Certainly Scottish Mortgage's recent record of outstanding growth has slowed, with an 8.6 per cent return in 2019 so far, compared to a 16 per cent global investment trust average.

But Slater points out that in business terms the current crop of tech giants are still relatively young companies.

Amazon's reputation for innovation has delivered new products such as Alexa

He says that Scottish Mortgage believes the best will have opportunities for a long time to come, adding, 'we don't think there's any reason why if a business model is underpinned by technology it should mean its longevity is any less than more traditional companies.'

As an example of this he cites the continuing opportunities for even a company as big as Amazon, ranging from online groceries and same and next day delivery in the US, to improving its digital shopfront and areas such as digital search and its web services division.

The key to this argues the fund manager is Amazon's commitment to experimentation and innovation at scale.

Among the other famous names in Scottish Mortgage's top ten holdings are two very different car companies: Tesla and Ferrari.

The attraction of electric and self-driving car pioneer Tesla to a trust like Scottish Mortgage is obvious, but why also hold an old-school sports and racing car company like Ferrari?

A name like Tesla is expected in the Scottish Mortgage portfolio but why does the trust hold Ferrari, a name more synonymous with the old school motoring world?

Slater says that firstly Ferrari makes some of the best cars in the world and secondly it is one of the most desirable brands. The Italian car maker, which listed on the stock market in 2015, intends to profit on both its cars and the iconic brand but knows it must tread carefully in doing so.

The fund manager says that Scottish Mortgage believes those in charge at Ferrari can successfully walk that tightrope and deliver growth for years to come.

A sizeable chunk of Scottish Mortgage's £7.5billion worth of investments is now in companies that are not listed on the stock market. This could worry some investors, as investing in unquoted companies at scale has sparked some controversy over the past year, with the high profile downfall of star fund manager Neil Woodford.

However, as an investment trust Scottish Mortgage cannot be forced to sell to meet withdrawals in the same way that an open-ended investment fund manager can. Meanwhile, Slater explains that the trust's private company holdings tend to be in very sizeable firms.

Investing in unquoted companies is important for Scottish Mortgage, argues Slater, as companies are choosing to stay private longer and firms are choosing to list much later in their life cycle.

He says it is not about buying very small companies or becoming venture capitalists but about investing in substantial companies that in other eras would be publicly listed, such as Tik Tok owner Bytedance.

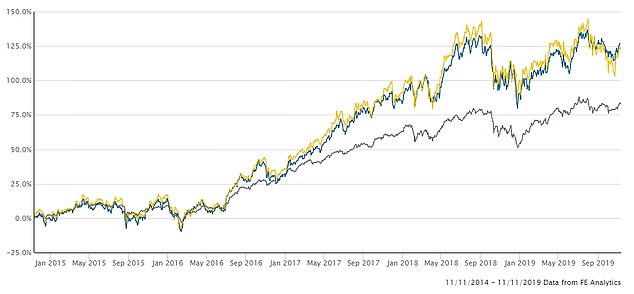

Scottish Mortgage's net asset value (blue) and share price (yellow) has beaten the average global investment trust over the past five years (black)

THE INVESTING SHOW

-

What you need to know about investing in a VCT and the 30% tax break

What you need to know about investing in a VCT and the 30% tax break -

ChatGPT's threat to Google, Meta going wrong and a growth energy stock

ChatGPT's threat to Google, Meta going wrong and a growth energy stock -

Is commercial property now a great value opportunity?

Is commercial property now a great value opportunity? -

Impax Environmental Markets invests in companies that help the planet

Impax Environmental Markets invests in companies that help the planet -

Will investors get a boost if inflation drops?

Will investors get a boost if inflation drops? -

Temple Bar: The UK stock market is as interesting as in 2008

Temple Bar: The UK stock market is as interesting as in 2008 -

International Biotech's Ailsa Craig says shares are cheap

International Biotech's Ailsa Craig says shares are cheap -

What will Liz Truss mean for the stock market and investors?

What will Liz Truss mean for the stock market and investors? -

Will the rest of 2022 be better and can the UK outperform?

Will the rest of 2022 be better and can the UK outperform? -

Blue Whale's Stephen Yiu on ditching Facebook

Blue Whale's Stephen Yiu on ditching Facebook -

Has the shift from growth to value kicked in already?

Has the shift from growth to value kicked in already? -

BP and Shell shares pay big dividends but will they be held back?

BP and Shell shares pay big dividends but will they be held back? -

Gresham House's Ken Wotton on UK smaller companies

Gresham House's Ken Wotton on UK smaller companies -

The next wave of disruptive firms: BG US Growth's manager

The next wave of disruptive firms: BG US Growth's manager -

Where investors can profit in the dividend recovery

Where investors can profit in the dividend recovery -

Investing in the best of British smaller companies can pay off

Investing in the best of British smaller companies can pay off -

Are cheap bank shares a way to bag recovery profits?

Are cheap bank shares a way to bag recovery profits? -

'Crypto is the poster child of empty calorie speculation'

'Crypto is the poster child of empty calorie speculation' -

Will investors profit from a Roaring Twenties?

Will investors profit from a Roaring Twenties? -

How we invest in companies helping the planet: Jupiter Green

How we invest in companies helping the planet: Jupiter Green -

What's behind Baillie Gifford Managed Fund's winning mix?

What's behind Baillie Gifford Managed Fund's winning mix? -

Nick Train: 'There's plenty to be optimistic about'

Nick Train: 'There's plenty to be optimistic about' -

Can Scottish Mortgage keep climbing? Tom Slater interview

Can Scottish Mortgage keep climbing? Tom Slater interview -

'UK equities could be the perfect way to play a global reopening'

'UK equities could be the perfect way to play a global reopening' -

We've had the vaccine rally and US election, so what happens next?

We've had the vaccine rally and US election, so what happens next? -

Is Japan a golden opportunity in the coronavirus storm?

Is Japan a golden opportunity in the coronavirus storm? -

What next for shares after the post-crash bounce?

What next for shares after the post-crash bounce? -

What the fund that beat the crash is buying now

What the fund that beat the crash is buying now -

Where to look for shares that will benefit from a recovery?

Where to look for shares that will benefit from a recovery? -

What kind of rescue could trigger a bounce back?

What kind of rescue could trigger a bounce back? -

How to invest through a crisis like coronavirus

How to invest through a crisis like coronavirus -

How to invest for high income and avoid dividend traps

How to invest for high income and avoid dividend traps -

How to find shares with dividends that can grow: Troy Income & Growth...

How to find shares with dividends that can grow: Troy Income & Growth... -

Blue Whale: 'We want companies that grow whatever happens'

Blue Whale: 'We want companies that grow whatever happens' -

How biotech investors can profit from an ageing population

How biotech investors can profit from an ageing population -

Will the UK election result boost or sink the stock market?

Will the UK election result boost or sink the stock market? -

Scottish Mortgage's Tom Slater on how and why it invests

Scottish Mortgage's Tom Slater on how and why it invests -

'It's a vast area of change': We meet a food fund manager

'It's a vast area of change': We meet a food fund manager -

Are 'cheap' bank shares an opportunity to profit or a value trap?

Are 'cheap' bank shares an opportunity to profit or a value trap? -

How to invest in the new era of falling interest rates

How to invest in the new era of falling interest rates -

How to profit from green energy, reducing waste and boosting recycling

How to profit from green energy, reducing waste and boosting recycling -

How to get a near 6% yield by tapping into Asia's dividends

How to get a near 6% yield by tapping into Asia's dividends -

The UK is cheap and shares could bounce back: Fund managers' tips

The UK is cheap and shares could bounce back: Fund managers' tips -

How to find the best British companies and not worry about Brexit

How to find the best British companies and not worry about Brexit -

What next for Neil Woodford and his investors?

What next for Neil Woodford and his investors? -

Can US smaller companies can still offer rich pickings?

Can US smaller companies can still offer rich pickings? -

Can UK shares shake off the Brexit hangover?

Can UK shares shake off the Brexit hangover? -

Is commercial property an unloved investment ripe for returns?

Is commercial property an unloved investment ripe for returns? -

Buffettology manager's tips on picking shares to beat the market

Buffettology manager's tips on picking shares to beat the market -

Invest in the UK's best companies and beat Brexit: Free Spirit manager

Invest in the UK's best companies and beat Brexit: Free Spirit manager -

Are house prices due a fall or could there be a Brexit deal bounce?

Are house prices due a fall or could there be a Brexit deal bounce? -

Profit from smaller company shares but take less risk - Gresham House...

Profit from smaller company shares but take less risk - Gresham House... -

How to find the world's best dividend shares: Evenlode Global Income...

How to find the world's best dividend shares: Evenlode Global Income... -

The US is expensive and the UK is unloved, so it's time to be picky:...

The US is expensive and the UK is unloved, so it's time to be picky:... -

Ruffer made 23% when shares crashed in 2008, so where is it investing...

Ruffer made 23% when shares crashed in 2008, so where is it investing... -

The shares hit the hardest in the stock market slump (and those that...

The shares hit the hardest in the stock market slump (and those that... -

How to invest in improving our world: From a reverse vending machine...

How to invest in improving our world: From a reverse vending machine... -

Mark Mobius: 'Emerging and frontier markets are cheap'

Mark Mobius: 'Emerging and frontier markets are cheap' -

How to invest around the world the easy way - and try to dodge crashes

How to invest around the world the easy way - and try to dodge crashes -

How impact investing can profit from the companies that will shape our...

How impact investing can profit from the companies that will shape our... -

Did England's World Cup run boost the economy?

Did England's World Cup run boost the economy? -

How to find the best companies - and make sure their shares are worth...

How to find the best companies - and make sure their shares are worth... -

What is happening to house prices and the property market?

What is happening to house prices and the property market? -

Three opportunities to profit for investors - from gold and oil shares...

Three opportunities to profit for investors - from gold and oil shares... -

What you need to know about global funds - and finding the world's...

What you need to know about global funds - and finding the world's... -

When is a good time to start investing - and how can you cut the...

When is a good time to start investing - and how can you cut the... -

What you need to know about crowdfunding, peer to peer, and Innovative...

What you need to know about crowdfunding, peer to peer, and Innovative... -

How to invest in retirement: The Investing Show Live

How to invest in retirement: The Investing Show Live -

Tips to invest your Isa - and what to think about if you're worried...

Tips to invest your Isa - and what to think about if you're worried... -

Why now is the time to invest in Vietnam

Why now is the time to invest in Vietnam -

Get a 4% dividend from the future of medicine: International...

Get a 4% dividend from the future of medicine: International... -

Asia's best companies can deliver for the next 20 years - we speak to...

Asia's best companies can deliver for the next 20 years - we speak to...

Most watched Money videos

- Jaguar targets new customers by ditching logo and going electric

- Tesla UK unveils look of sleek CyberCab in London's Westfield

- French family car Renault launch new electric era Renault 4 E-Tech

- Rare 1992 Ford Escort RS Cosworth sets new world record auction price

- How Trump changes things for investors and ways to back AI

- Couple turns Disney World cabin into perfect tiny home

- Inside the Polestar 4, the UK's first car without a rear window

- Actor Theo James appears in advert for the Range Rover Sport

- Ford Capri EV driven: We test 2024's most controversial car

- Hyundai Inster: Is it the cheap EV we've been waiting for?

- Custom Land Rover Defender built for Guy Ritchie goes on sale

- Check out the new £1million Brabus Big Boy 1200 motorhome

-

Royal Mail edges closer to foreign takeover as Business...

Royal Mail edges closer to foreign takeover as Business...

-

Halifax launches a highly unusual fixed rate mortgage -...

Halifax launches a highly unusual fixed rate mortgage -...

-

Aston Martin raises £211m from investors after profit...

Aston Martin raises £211m from investors after profit...

-

Nationwide gains £2.3bn from Virgin Money takeover deal

Nationwide gains £2.3bn from Virgin Money takeover deal

-

Just Eat to delist in London after less than five years...

Just Eat to delist in London after less than five years...

-

BUSINESS LIVE: Nationwide bags £2.3bn from Virgin Money...

BUSINESS LIVE: Nationwide bags £2.3bn from Virgin Money...

-

Supermarket loyalty schemes DO offer real savings of up...

Supermarket loyalty schemes DO offer real savings of up...

-

Minister demands rapid rates reform: Reynolds urges...

Minister demands rapid rates reform: Reynolds urges...

-

Pets at Home shares plunge as retail sales remain subdued

Pets at Home shares plunge as retail sales remain subdued

-

EasyJet profits take off as airline cashes in on package...

EasyJet profits take off as airline cashes in on package...

-

Pennon swings to £19m loss after parasite-contaminated...

Pennon swings to £19m loss after parasite-contaminated...

-

Aviva in £3.3bn bid for Direct Line: Takeover battle...

Aviva in £3.3bn bid for Direct Line: Takeover battle...

-

Blanc scores a Direct hit: Aviva boss's swoop on rival...

Blanc scores a Direct hit: Aviva boss's swoop on rival...

-

Reeves Budget is a 'tax on the working person' and will...

Reeves Budget is a 'tax on the working person' and will...

-

Tackle business rates to prevent the death of the High...

Tackle business rates to prevent the death of the High...

-

MARKET REPORT: Nearly-new car dealer Motorpoint shrugs...

MARKET REPORT: Nearly-new car dealer Motorpoint shrugs...

-

Blow to City as Just Eat become latest firm to quit the...

Blow to City as Just Eat become latest firm to quit the...

-

Germany goes kaput: How Net Zero is killing Europe's most...

Germany goes kaput: How Net Zero is killing Europe's most...