Biotech shares are in the doldrums and that gives investors an opportunity: International Biotechnology Trust's Ailsa Craig on the INVESTING SHOW

Biotech enjoyed a boom in the early days of the pandemic as exciting vaccine research combined with its growth company elements to send stocks soaring.

But the sector has suffered over the past year and Ailsa Craig of International Biotechnology Trust says that ‘valuations have now come right back down to pre-pandemic levels.’

However, with growth stocks out of fashion but biotechnology firms continuing to forge ahead with their innovations, she believes investors are being presented with an opportunity in the sector.

International Biotechnology Trust is also unusual among more growth share-focussed investment trusts in paying a substantial dividend, with a current yield of 5.01 per cent.

Ailsa joins Simon Lambert and Richard Hunter on this episode of the Investing Show to discuss biotech investing and some of the firms at the cutting edge of medicine that International Biotechnology Trust invests in.

Ailsa says: ‘The biotech market has a cyclicality, it goes in favour and out of favour. Valuations are a pendulum, they swing far too expensive and then swing to incredibly cheap and there are over 150 biotech companies trading at less than cash at the moment.

‘There are huge opportunities and so it’s great for a buy side investor, such as myself, to go out there with cash to invest and pick up some of these exciting more early stage companies.’

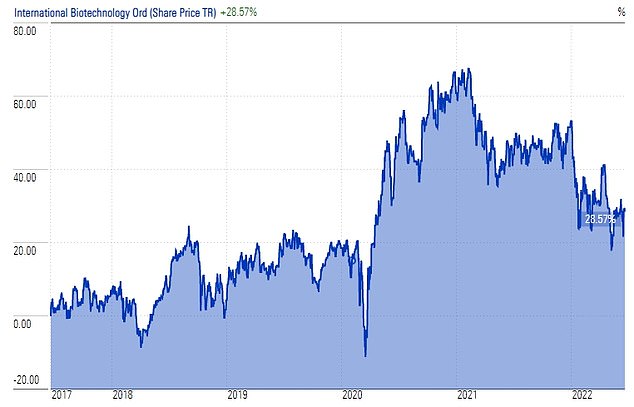

Biotech is an exciting sector to invest in but also a volatile one, as IBT's share price return shows (Source AIC)

Yet, while biotech is an exciting sector for investors, it is also a volatile one and they should beware allocating too much of their portfolio to it.

Ailsa argues that biotech is an area where armchair investors buying individual stocks can expose themselves to very high risks.

There are ways to mitigate the risk of biotech investing, Ailsa says, and that is something the trust aims to do with both its medical and professional expertise and portfolio positioning.

For example, when the early-stage side of biotech was flying very high, the trust shifted more of its investments into larger revenue growth and profitable biotech companies to lower the risk of being caught out by overheated valuations for some firms.

But over the past 12 months, it has reduced its weighting down from these larger companies and moved more into early stage companies where they see value.

Ailsa argues that the biotech industry is currently in the doldrums and the next stage of the cycle should involve things pick up and large pharma companies seek to buy out small innovative players, at which point valuations will start to pick up.

She also explains why medical innovation nowadays starts at the university spin-out level, a part of the trust run by the UK’s vaccine taskforce leader Kate Bingham – something which prevented it from investing in any Covid vaccine-linked firms.

That led to IBT's performance falling behind its peers during the early pandemic years, as they were able to invest in high-flying vaccine stocks.

FE Trustnet figures show the sector average trust was up 8.7 per cent 12 to 24 months ago vs International Biotechnology Trust's 1.6 per cent share price gain.

However, IBT has outperformed the sector and protected investors better over the past year, falling 11.6 per cent compared to a 18.2 per cent sector average decline.

Over three years, International Biotechnology Trust is up 8 per cent vs a sector average of 5.3 per cent and over five years it is up 28.6 per cent vs a sector average of 20.4 per cent.

The £257million trust currently trades on a 4.3 per cent discount to its net asset value and has ongoing charges of 1.2 per cent.

Most watched Money videos

- Tesla UK unveils look of sleek CyberCab in London's Westfield

- Jaguar targets new customers by ditching logo and going electric

- How Trump changes things for investors and ways to back AI

- Inside the Polestar 4, the UK's first car without a rear window

- French family car Renault launch new electric era Renault 4 E-Tech

- Actor Theo James appears in advert for the Range Rover Sport

- Rare 1992 Ford Escort RS Cosworth sets new world record auction price

- Hyundai Inster: Is it the cheap EV we've been waiting for?

- Ford Capri EV driven: We test 2024's most controversial car

- Couple turns Disney World cabin into perfect tiny home

- Custom Land Rover Defender built for Guy Ritchie goes on sale

- Check out the new £1million Brabus Big Boy 1200 motorhome

-

Are interest rate cuts about to stall and what does that...

Are interest rate cuts about to stall and what does that...

-

JEFF PRESTRIDGE: If World War Three really does break...

JEFF PRESTRIDGE: If World War Three really does break...

-

Bosses demand urgent business rates shake-up

Bosses demand urgent business rates shake-up

-

Nationwide bags £2bn on Virgin Money deal

Nationwide bags £2bn on Virgin Money deal

-

TONY HETHERINGTON: The truth comes out about Tui's...

TONY HETHERINGTON: The truth comes out about Tui's...

-

Car finance scandal plunging Close Brothers into turmoil

Car finance scandal plunging Close Brothers into turmoil

-

HAMISH MCRAE: Roaring Twenties may fizzle out for investors

HAMISH MCRAE: Roaring Twenties may fizzle out for investors

-

City grandee Victor Blank gave Rachel Reeves £175k donations

City grandee Victor Blank gave Rachel Reeves £175k donations

-

Cannon and Ball started as singers but switched to comedy...

Cannon and Ball started as singers but switched to comedy...

-

Ease the pain of 'farmer harmer' Starmer's brutal...

Ease the pain of 'farmer harmer' Starmer's brutal...

-

Sara Weller is Britain's bravest businesswoman

Sara Weller is Britain's bravest businesswoman

-

EDINBURGH INVESTMENT TRUST Impressive returns and a...

EDINBURGH INVESTMENT TRUST Impressive returns and a...

-

Asda hires former boss to revive its fortunes

Asda hires former boss to revive its fortunes

-

MIDAS SHARE TIPS: Fintel, the investor who really knows...

MIDAS SHARE TIPS: Fintel, the investor who really knows...

-

Women retire on £695 less a month than men

Women retire on £695 less a month than men

-

MIDAS SHARE TIPS UPDATE: Shares in our tip BP Marsh have...

MIDAS SHARE TIPS UPDATE: Shares in our tip BP Marsh have...

-

Killing Kittens founder seeks £500k for growth

Killing Kittens founder seeks £500k for growth

-

Treasury cuts stake in NatWest to less than 11%

Treasury cuts stake in NatWest to less than 11%