Blue Whale manager Stephen Yiu on the INVESTING SHOW: Why I ditched Facebook for better and more reliable growth opportunities

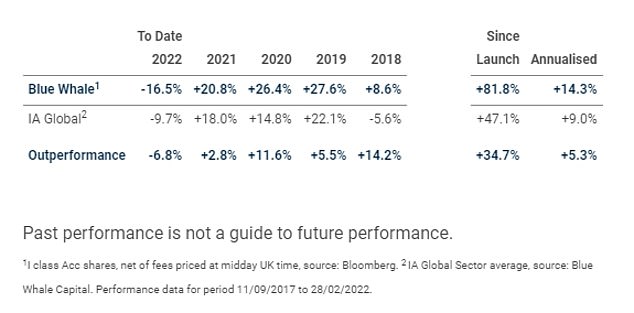

The Blue Whale Growth fund has proved a hit with investors since its launch almost five years ago, richly rewarding them with an 82 per cent return.

Backed by investing platform founder Peter Hargreaves, the fund managed by Stephen Yiu has targeted a relatively tight portfolio of 25 of what he sees as the world's best growth companies.

His stock picking has delivered an average 14.3 per cent annual return for investors since launch, compared to the IA Global sector average fund's 9 per cent.

But investing conditions have changed dramatically over the past six months, with inflation seemingly far more persistent and less transitory than central banks expected, leading to a shift in the interest rate environment and a sell-off for high-flying growth stocks.

The £960million fund, with a 0.87 per cent ongoing charges figure, has fallen 16.5 per cent over the year-to-date, compared to the sector average 9.7 per cent decline.

So does the market turmoil this year change things for Blue Whale and how did Stephen get ahead of the curve on two of those big names, selling out of both Meta, as Facebook is now known, and Paypal before both suffered hefty declines in their share prices?

On this episode of the Investing Show, Stephen returns to the studio to join This is Money's Simon Lambert to discuss whether his investment outlook has changed, how the recent shake-out has affected the Blue Whale portfolio and where he sees the best opportunities now.

He reflects on how the change in investor sentiment - set against a backdrop of high inflation, geopolitical tension and the war in Ukraine - could have an impact and whether investors need to sift out the reliable growth stocks from the more hopeful blue-sky shares.

Stephen reveals why he still holds top ten positions in Adobe, Microsoft and Nintendo and why he has also backed luxury goods leader Kering.

The Blue Whale Growth Fund has richly rewarded investors in the four-and-a-half years since its launch, but suffered this year in the market shake out.

THE INVESTING SHOW

-

What you need to know about investing in a VCT and the 30% tax break

What you need to know about investing in a VCT and the 30% tax break -

ChatGPT's threat to Google, Meta going wrong and a growth energy stock

ChatGPT's threat to Google, Meta going wrong and a growth energy stock -

Is commercial property now a great value opportunity?

Is commercial property now a great value opportunity? -

Impax Environmental Markets invests in companies that help the planet

Impax Environmental Markets invests in companies that help the planet -

Will investors get a boost if inflation drops?

Will investors get a boost if inflation drops? -

Temple Bar: The UK stock market is as interesting as in 2008

Temple Bar: The UK stock market is as interesting as in 2008 -

International Biotech's Ailsa Craig says shares are cheap

International Biotech's Ailsa Craig says shares are cheap -

What will Liz Truss mean for the stock market and investors?

What will Liz Truss mean for the stock market and investors? -

Will the rest of 2022 be better and can the UK outperform?

Will the rest of 2022 be better and can the UK outperform? -

Blue Whale's Stephen Yiu on ditching Facebook

Blue Whale's Stephen Yiu on ditching Facebook -

Has the shift from growth to value kicked in already?

Has the shift from growth to value kicked in already? -

BP and Shell shares pay big dividends but will they be held back?

BP and Shell shares pay big dividends but will they be held back? -

Gresham House's Ken Wotton on UK smaller companies

Gresham House's Ken Wotton on UK smaller companies -

The next wave of disruptive firms: BG US Growth's manager

The next wave of disruptive firms: BG US Growth's manager -

Where investors can profit in the dividend recovery

Where investors can profit in the dividend recovery -

Investing in the best of British smaller companies can pay off

Investing in the best of British smaller companies can pay off -

Are cheap bank shares a way to bag recovery profits?

Are cheap bank shares a way to bag recovery profits? -

'Crypto is the poster child of empty calorie speculation'

'Crypto is the poster child of empty calorie speculation' -

Will investors profit from a Roaring Twenties?

Will investors profit from a Roaring Twenties? -

How we invest in companies helping the planet: Jupiter Green

How we invest in companies helping the planet: Jupiter Green -

What's behind Baillie Gifford Managed Fund's winning mix?

What's behind Baillie Gifford Managed Fund's winning mix? -

Nick Train: 'There's plenty to be optimistic about'

Nick Train: 'There's plenty to be optimistic about' -

Can Scottish Mortgage keep climbing? Tom Slater interview

Can Scottish Mortgage keep climbing? Tom Slater interview -

'UK equities could be the perfect way to play a global reopening'

'UK equities could be the perfect way to play a global reopening' -

We've had the vaccine rally and US election, so what happens next?

We've had the vaccine rally and US election, so what happens next? -

Is Japan a golden opportunity in the coronavirus storm?

Is Japan a golden opportunity in the coronavirus storm? -

What next for shares after the post-crash bounce?

What next for shares after the post-crash bounce? -

What the fund that beat the crash is buying now

What the fund that beat the crash is buying now -

Where to look for shares that will benefit from a recovery?

Where to look for shares that will benefit from a recovery? -

What kind of rescue could trigger a bounce back?

What kind of rescue could trigger a bounce back? -

How to invest through a crisis like coronavirus

How to invest through a crisis like coronavirus -

How to invest for high income and avoid dividend traps

How to invest for high income and avoid dividend traps -

How to find shares with dividends that can grow: Troy Income & Growth...

How to find shares with dividends that can grow: Troy Income & Growth... -

Blue Whale: 'We want companies that grow whatever happens'

Blue Whale: 'We want companies that grow whatever happens' -

How biotech investors can profit from an ageing population

How biotech investors can profit from an ageing population -

Will the UK election result boost or sink the stock market?

Will the UK election result boost or sink the stock market? -

Scottish Mortgage's Tom Slater on how and why it invests

Scottish Mortgage's Tom Slater on how and why it invests -

'It's a vast area of change': We meet a food fund manager

'It's a vast area of change': We meet a food fund manager -

Are 'cheap' bank shares an opportunity to profit or a value trap?

Are 'cheap' bank shares an opportunity to profit or a value trap? -

How to invest in the new era of falling interest rates

How to invest in the new era of falling interest rates -

How to profit from green energy, reducing waste and boosting recycling

How to profit from green energy, reducing waste and boosting recycling -

How to get a near 6% yield by tapping into Asia's dividends

How to get a near 6% yield by tapping into Asia's dividends -

The UK is cheap and shares could bounce back: Fund managers' tips

The UK is cheap and shares could bounce back: Fund managers' tips -

How to find the best British companies and not worry about Brexit

How to find the best British companies and not worry about Brexit -

What next for Neil Woodford and his investors?

What next for Neil Woodford and his investors? -

Can US smaller companies can still offer rich pickings?

Can US smaller companies can still offer rich pickings? -

Can UK shares shake off the Brexit hangover?

Can UK shares shake off the Brexit hangover? -

Is commercial property an unloved investment ripe for returns?

Is commercial property an unloved investment ripe for returns? -

Buffettology manager's tips on picking shares to beat the market

Buffettology manager's tips on picking shares to beat the market -

Invest in the UK's best companies and beat Brexit: Free Spirit manager

Invest in the UK's best companies and beat Brexit: Free Spirit manager -

Are house prices due a fall or could there be a Brexit deal bounce?

Are house prices due a fall or could there be a Brexit deal bounce? -

Profit from smaller company shares but take less risk - Gresham House...

Profit from smaller company shares but take less risk - Gresham House... -

How to find the world's best dividend shares: Evenlode Global Income...

How to find the world's best dividend shares: Evenlode Global Income... -

The US is expensive and the UK is unloved, so it's time to be picky:...

The US is expensive and the UK is unloved, so it's time to be picky:... -

Ruffer made 23% when shares crashed in 2008, so where is it investing...

Ruffer made 23% when shares crashed in 2008, so where is it investing... -

The shares hit the hardest in the stock market slump (and those that...

The shares hit the hardest in the stock market slump (and those that... -

How to invest in improving our world: From a reverse vending machine...

How to invest in improving our world: From a reverse vending machine... -

Mark Mobius: 'Emerging and frontier markets are cheap'

Mark Mobius: 'Emerging and frontier markets are cheap' -

How to invest around the world the easy way - and try to dodge crashes

How to invest around the world the easy way - and try to dodge crashes -

How impact investing can profit from the companies that will shape our...

How impact investing can profit from the companies that will shape our... -

Did England's World Cup run boost the economy?

Did England's World Cup run boost the economy? -

How to find the best companies - and make sure their shares are worth...

How to find the best companies - and make sure their shares are worth... -

What is happening to house prices and the property market?

What is happening to house prices and the property market? -

Three opportunities to profit for investors - from gold and oil shares...

Three opportunities to profit for investors - from gold and oil shares... -

What you need to know about global funds - and finding the world's...

What you need to know about global funds - and finding the world's... -

When is a good time to start investing - and how can you cut the...

When is a good time to start investing - and how can you cut the... -

What you need to know about crowdfunding, peer to peer, and Innovative...

What you need to know about crowdfunding, peer to peer, and Innovative... -

How to invest in retirement: The Investing Show Live

How to invest in retirement: The Investing Show Live -

Tips to invest your Isa - and what to think about if you're worried...

Tips to invest your Isa - and what to think about if you're worried... -

Why now is the time to invest in Vietnam

Why now is the time to invest in Vietnam -

Get a 4% dividend from the future of medicine: International...

Get a 4% dividend from the future of medicine: International... -

Asia's best companies can deliver for the next 20 years - we speak to...

Asia's best companies can deliver for the next 20 years - we speak to...

Most watched Money videos

- Jaguar targets new customers by ditching logo and going electric

- Tesla UK unveils look of sleek CyberCab in London's Westfield

- French family car Renault launch new electric era Renault 4 E-Tech

- Rare 1992 Ford Escort RS Cosworth sets new world record auction price

- How Trump changes things for investors and ways to back AI

- Couple turns Disney World cabin into perfect tiny home

- Inside the Polestar 4, the UK's first car without a rear window

- Actor Theo James appears in advert for the Range Rover Sport

- Ford Capri EV driven: We test 2024's most controversial car

- Custom Land Rover Defender built for Guy Ritchie goes on sale

- Hyundai Inster: Is it the cheap EV we've been waiting for?

- Check out the new £1million Brabus Big Boy 1200 motorhome

-

Halifax launches a highly unusual fixed rate mortgage -...

Halifax launches a highly unusual fixed rate mortgage -...

-

Aston Martin raises £211m from investors after profit...

Aston Martin raises £211m from investors after profit...

-

Nationwide gains £2.3bn from Virgin Money takeover deal

Nationwide gains £2.3bn from Virgin Money takeover deal

-

Just Eat to delist in London after less than five years...

Just Eat to delist in London after less than five years...

-

BUSINESS LIVE: Nationwide bags £2.3bn from Virgin Money...

BUSINESS LIVE: Nationwide bags £2.3bn from Virgin Money...

-

Supermarket loyalty schemes DO offer real savings of up...

Supermarket loyalty schemes DO offer real savings of up...

-

Pets at Home shares plunge as retail sales remain subdued

Pets at Home shares plunge as retail sales remain subdued

-

EasyJet profits take off as airline cashes in on package...

EasyJet profits take off as airline cashes in on package...

-

Aviva in £3.3bn bid for Direct Line: Takeover battle...

Aviva in £3.3bn bid for Direct Line: Takeover battle...

-

Germany goes kaput: How Net Zero is killing Europe's most...

Germany goes kaput: How Net Zero is killing Europe's most...

-

Pennon swings to £19m loss after parasite-contaminated...

Pennon swings to £19m loss after parasite-contaminated...

-

Blanc scores a Direct hit: Aviva boss's swoop on rival...

Blanc scores a Direct hit: Aviva boss's swoop on rival...

-

MARKET REPORT: Nearly-new car dealer Motorpoint shrugs...

MARKET REPORT: Nearly-new car dealer Motorpoint shrugs...

-

Reeves Budget is a 'tax on the working person' and will...

Reeves Budget is a 'tax on the working person' and will...

-

Tackle business rates to prevent the death of the High...

Tackle business rates to prevent the death of the High...

-

Blow to City as Just Eat become latest firm to quit the...

Blow to City as Just Eat become latest firm to quit the...

-

Minister demands rapid rates reform: Reynolds urges...

Minister demands rapid rates reform: Reynolds urges...

-

Royal Mail edges closer to foreign takeover as Business...

Royal Mail edges closer to foreign takeover as Business...