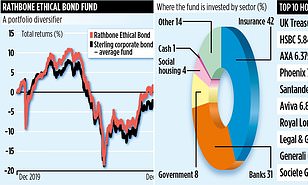

Revealed: Ten UK shares that hiked dividends by at least 50% in 2024

Spire Healthcare hiked shareholder payouts more than any FTSE 350 firm in 2024, as 10 companies bucked a trend of weaker dividends with hikes of more than 50 per cent.

The FTSE 250 private healthcare provider announced a total dividend of 2.1 pence per share for 2024, up a whopping 320 per cent on last year's effort of 0.5 pence a share.

Payouts from London-listed firms have weakened overall in 2024 as the all-important mining sector has been forced to slash dividends against weaker commodities demand amid softer economic growth.

Spire is one of ten UK-listed companies that increased their dividend payouts by more than half in 2024, fresh analysis from AJ Bell shows.

Dan Coatsworth, investment analyst at AJ Bell, said: 'Having suspended dividend payments during the pandemic, the company is now in the process of playing catch-up.

'The dividend growth effectively means the company is putting a rubber stamp on its outlook, implying everything is going well. Indeed, Spire said its large dividend hike reflects "confidence in the long-term prospects of the business".'

Payout: Ten UK firms upped their dividends by more than 50 per cent in 2024

During the pandemic, and the economic headwinds that have followed, many firms suspended their dividends as a result of the hardship they were facing following a downturn in business.

Coatsworth said some of the biggest increases declared in 2024 'should be seen in the context of rebuilding the payout back up to a sustainable level'.

Both EasyJet and TI Fluid Systems upped their dividends by 169 per cent, with EasyJet paying 12.1p per share, with analysts forecasting that this could increase to 14.7p in 2025 and 15.8p in 2026.

Meanwhile, GSK consumer spinoff Haleon increased its payout by 150 per cent and Park Plaza, and art'otel owner PPHE Hotels saw its dividend grow by 140 per cent.

The hotelier paid a 36p per share dividend, and could be set to increase this further to 46.1p in 2025, according to market forecasts.

Coatsworth said: 'Dividends are a key component of successful investing, whether taken as an income to support retirement or reinvested to compound future returns. A key advantage over cash is that companies often raise their dividends each year, whereas interest rates on savings in the bank tend to be fixed.'

While only these five firms more than doubled their payouts, a further five firms increased their dividends by more than half, with HSBC notably increasing its dividend by 91 per cent from 42.4p to 64.6p.

Coatsworth added: 'Many banks now pay higher dividends than before the pandemic, thanks to a steep increase in interest rates helping to boost their earnings.'

| Company | Dividend per share growth |

|---|---|

| Spire Healthcare | 320% |

| EasyJet | 169% |

| TI Fluid Systems | 169% |

| Haleon | 150% |

| PPHE Hotel | 140% |

| HSBC | 91% |

| Informa | 84% |

| Senior | 77% |

| C&C | 55% |

| Standard Chartered | 50% |

| FirstGroup | 45% |

| Mitie | 38% |

| Centrica | 33% |

| Energean | 33% |

| Lancashire Holdings | 33% |

| Associated British Foods | 33% |

| Me Group International | 32% |

| TBC Bank | 31% |

| Paragon Banking | 31% |

| Whitbread | 31% |

| Source: AJ Bell, Sharescope, Company announcements. Based on the most recent annual dividend declaration. Data from 1 Jan to 3 December 2024. Excludes special dividends. | |

These higher dividends are a result of these banks charging more for lending, helping to boost their profits and cash flow.

He said: 'It's worth noting that these figures are purely based on normal dividends. HSBC has also paid out a special dividend on top, funded by the sale of its banking operations in Canada.

Standard Chartered also made the list, increasing its dividend by 50 per cent, while Georgia-based TBC Bank and UK-firm Paragon Banking both upped their dividends by 31 per cent.

This dividend growth, calculated between January and 1 December, does not include special dividends paid by any of these companies. HSBC also paid out a special dividend after selling its Canadian banking operations.

DIY INVESTING PLATFORMS

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you