Can fund managers bounce back from a bad run, or is your money better off in a passive fund?

- Investment performance of managed funds has fallen behind passive ones

Managed funds have seen a downturn of late, with many falling behind passive funds in terms of performance.

With passive funds proving a much cheaper option for investors, it is unsurprising that an increasing number are choosing to move their investments into passive trackers.

In 2024, total assets in US passive funds surpassed those in active funds for the first time, according to Morningstar.

The second quarter of the year saw passive funds continue to see net inflows in the UK, while active funds saw net outflows.

Passive funds now make up 30 per cent of the UK's fund space, with assets of more than £340billion.

However, with some active funds suffering, AJ Bell's Dan Coatsworth says there could also be an opportunity for investors to buy in ahead of an upturn in fortunes.

Division: Investors are increasingly shifting their money to passive funds due to the low fees

Coatsworth, an investment analyst at the DIY investing platform, said: 'Investing in funds can be a journey of highs and lows.

When a fund experiences a period of underperformance, it can prompt investors to wonder whether it offers up a buying opportunity with the hope of a rebound, or a signal to exit.'

How can you spot a buying opportunity?

Three is the magic number. On average, investors hold funds for just three years. But when it comes to judging the performance of an active manager it isn't enough to really assess the quality of the fund.

Back in 1997, the average holding period was eight years.

Coatsworth said: 'Previous research has shown that fund managers let go after three years of underperformance often delivered positive returns after that point – frequently surpassing those of their replacements. This suggests that a temporary downturn may not always indicate the end of a fund's run of good performance.

'While a three-year period has become an unofficial benchmark for assessing fund performance, it's crucial to recognise that fund managers are unlikely to outperform an index or peer group consistently.'

The key instead, Coatsworth says, is to focus on the philosophy and process behind a fund's investments, especially the consistency of these.

'If a fund manager deviates from their established approach, it may signal potential for future underperformance due to "style drift",' he said.

Fund performance could also be impacted changes to the number of stocks held or trades made, or by a fund manager being replaced.

Coatsworth said: 'While a fresh perspective can sometimes enhance performance, the departure of a seasoned manager may mean a substantial shift in strategy.'

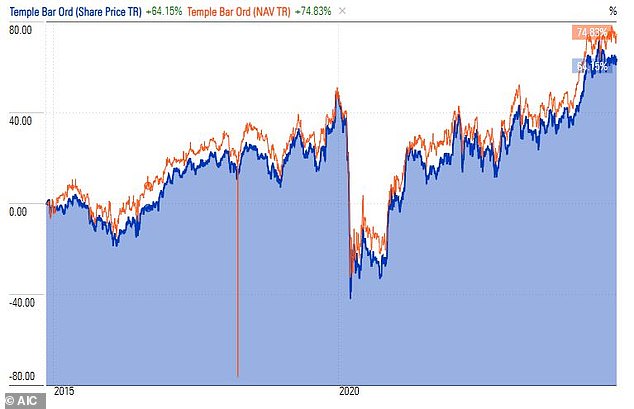

Temple Bar Investment Trust, for example, saw its performance tumble between 2018 and 2021, before a strong rebound in recent years.

Changing fortunes: After a period of underperformance, Temple Bar Investment Trust has seen an upswing

Which active funds are hoping to bounce back?

Slater Growth (ongoing charge: 1.54 per cent)

An example of the thesis that three years is too short to judge a fund, according to Coatsworth, is Slater Growth.

Slater Growth, despite having underperformed over the past three years, having fallen 27 per cent compared to the 5 per cent gain for the IA UK All Companies index, has delivered 516 per cent since 2005, more than double the 228 per cent increase in the IA UK All Companies Index over the same period.

Coatsworth said: 'The pedigree of the manager suggests the fund has good bounce back potential. Slater applies a proven investment process that starts with a screening of the UK universe across several criteria.'

He said: 'Slater puts recent underperformance down to a big de-rating in the small and mid-cap parts of the UK market plus rising interest rates, accentuated by fund outflows.'

Montanaro UK Smaller Companies (ongoing charge: 1.3 per cent)

Coatsworth also says beleaguered Montanaro is a buying opportunity, with the fund benefitting from the general outperformance of small caps against larger caps over the long term.

Coatsworth said: 'The dearth of publicly available research means there are plenty of opportunities for the Montanaro team to find undiscovered gems.

'The team looks for simple businesses in distinct niches, which makes them less vulnerable to the vagaries of the economic cycle, and they must be profitable.'

Montanaro also pays a quarterly dividend of one per cent of its net asset value, giving a 4 per cent yield each year.

'The fund was back on track in the first half of 2024, outperforming the index as it became apparent rates were set to fall, but the sluggish pace of cuts has held it back in the third quarter despite positive results from its portfolio companies,' Coatsworth said.

RIT Capital Partners (Ongoing charge: 0.77 per cent)

Similarly, RIT Capital has struggled over the past few years, losing 27 per cent.

However, Coatsworth says this that despite this downturn, the fund could now be back to strength.

'More recently, manager Maggie Fanari has been articulating her plan to revive the trust's fortunes to investors who've seen an uptick in portfolio performance, while buybacks continue apace and falling interest rates should offer a tailwind,' he said.

'As of 30 September 2024, NAV was £26.19 per share, up 1.5 per cent from the previous month, and meaning the fund had generated a positive NAV total return of 8.8 per cent year-to-date.'

DIY INVESTING PLATFORMS

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you