JUPITER UK INCOME: Fund in radical shift as it turns its focus on to the best of Britain

Investment fund Jupiter UK Income has had a serious makeover in the past seven months, with 40 per cent of its portfolio being changed.

Although it's far too early to assess the merits of the impact, the result is an investment vehicle that now lives up to its name, focused on extracting a mix of income and capital return from the UK stock market.

The overhaul was triggered by the appointment of new investment managers after Jupiter's 'star' stock picker Ben Whitmore decided to jump ship – UK Income was one of a number of funds that he ran.

The £1.3billion investment vehicle is now overseen by Adrian Gosden and Chris Morrison, who joined Jupiter from GAM Investments, bringing with them the fund GAM UK Equity Income which has since been relabelled Jupiter UK Multi Cap Income.

Gosden says Jupiter UK Income is now a 'core, proper UK equity income fund'. He adds: 'We've done a lot in a short space of time, and as a result we now own the portfolio – it's on us to deliver for our investors.'

The overhaul has resulted in the fund's chunky holdings of international shares (18 per cent) being heavily sold down.

All UK equity income funds can invest a fifth of their portfolio overseas, but the new managers want to focus on a UK stock market which they believe is seriously undervalued and has the potential to power ahead next year.

Among those international stocks jettisoned are Bayer, Harley Davidson, Intel, Nokia and Ralph Lauren.

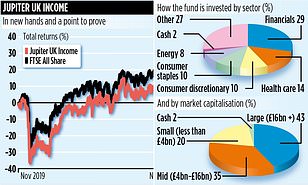

The result is a portfolio comprising 47 stocks and a fund with an attractive dividend yield of 4.5 per cent that has the prospect of growing above inflation. Income is paid to investors biannually.

The fund is heavily skewed to FTSE 100 companies (75 per cent) which differentiates it from UK Multi Cap Income.

It's also full of companies which will be familiar to UK income-oriented investors: GlaxoSmithKline, BP and tobacco stocks Imperial Brands and British American Tobacco.

Recent additions include real estate companies Segro (a specialist in industrial units), urban logistics-focused LondonMetric and student accommodation provider Empiric Student Property.

Gosden describes these as 'sheds and beds' investments, and believes they will do well as interest rates continue to fall in the UK.

Gosden accepts that the undervaluation of the UK stock market goes back to beyond the Brexit vote in 2016, but he believes there are three catalysts for change.

The first is the continued buying of UK-listed companies by international rivals and private equity – an indication, he says, that they believe they are purchasing seriously undervalued businesses that will rise in value.

Secondly, UK companies buying back shares means the supply of equities will continue to shrink – 7 per cent next year – which should help drive up share prices.

Finally, further rate cuts next year (Gosden believes there will be three more) should favour the UK stock market, which responds favourably to lower interest rates.

Over the past five years the fund has underperformed both its benchmark (the FTSE All-Share Index) and the average for its peer group. Respective returns are 23.3, 30.6 and 26 per cent. Ongoing charges total 0.94 per cent.

Fund ratings specialist FundCalibre includes Jupiter UK Multi Cap Income among its top UK equity income picks.

It also likes UK equity income funds run by Artemis, Rathbone and Schroders.

Highly rated UK equity income investment trusts include Murray Income and The City of London.

DIY INVESTING PLATFORMS

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you