My wife and I are both 56 and in good health. Our house is worth around £250,000 and mortgage free. I was wondering if selling my kids 49% of the house would be a good way of ensuring they get something from the estate in the future.

In our wills we leave everything to each other if one of us dies and in the terrible scenario where we both died, we would leave everything to the children. As it stood before the Budget, they would have been able to have the house, our savings and pensions without losing any money to inheritance tax. Would our children now lose 40 per cent of our pensions to inheritance tax?

I would like to transfer ownership of my three-bedroom house, which is currently worth approximately £550,000 to my nephew and nieces (in equal proportions) to benefit from the seven year rule and avoid inheritance tax. I would need however to rent out three rooms and live in one room myself to afford the rent. Would this mean that I am still benefiting from the house such that it would still be a 'gift with reservation' for inheritance tax purposes?

Hargreaves Lansdown used official data plus its own Saving and Resilience Barometer to work out who counts as wealthy. We reveal what individuals with the top 10 per cent of assets in the country typically hold - and why they are most likely to enjoy such prosperity in their early 60s, just before retirement.

Seeking financial advice can be a daunting prospect. Many people are under the impression that financial advice is too expensive, or simply 'not for someone like me'. But you don't have to be a millionaire investor for financial advice and planning to be worth your time and money - and the lifetime value that you get can vastly outweigh the initial cost.

Over many years we have made equal regular gifts to our two daughters up to the inheritance tax annual exemption. But we are considering reducing our potential £45,000 inheritance tax bill by making additonal regular annual gifts from our joint current bank account. How would this work and is it based on joint income?

in January 2018, Philip Hammond asked the Office of Tax Simplification to carry out a review of inheritance tax - its verdict was damning. It painted a picture of a total mess of a tax, which despite only being paid by a small percentage of estates manages to create an administration nightmare for many more and where the merely rich pay a higher effective rate than the really rich.

A relative passed away last year and left me and my son their bungalow in a London suburb. I have inherited 75% and my son 25%. We don't want to be landlords so initially planned to sell the home - but I've recently read about how in-demand bungalows are and am wondering if we should wait for its value to increase. Is that a good idea, and if not, what should we do with the cash we get from selling it?

One option for those planning to leave sizeable wealth to their loved ones, is to create a family investment company to manage and pass on their wealth to the next generation. This is Money sheds the light on whether creating a family investment company might be the right move for you to protect your families' inheritance.

In a few months I'm due an inheritance of £200,000 from my dad's estate and I have no idea what to do with it. I have my home which is mortgage free, I have no workplace pension and I don't work, I'll need about £70,000 so that I can live and pay bills until I can have my state pension in six years' time. I don't want to put the money in anything risky. I would really appreciate your help.

I own my own property and live on my own. The property is worth around £325k. I am due to inherit around £250k from my father, and I currently have a pension pot at £113k in an accumulation fund and £186k in a drawdown fund. I am currently healthy so hopefully this won't be in the foreseeable future, however like to plan ahead. What is the best way to pass my wealth on to my daughter?

I have no dependents and have paid off my mortgage. I am now 65 and hope to retire next year when I will receive a full state pension as well as an NHS pension of around £4,000 per year. I currently have £180,000 in savings - mainly cash Isas and premium bonds. How can I get a monthly payout from this without eating too much into my savings pot, and what is the best way to make sure that my money is safe?

Barely a week passes without mention of the powerfully appealing phrase 'early retirement' - on social media and news websites, and among bloggers and podcasters. Escaping the rat race has always held appeal but the allure appears to be growing and becoming more intense. I checked on Google Trends, just to check the rise is real. And yes, the number of searches for 'retire early' has risen three-fold in a decade. At the sharp extreme end of the 'retire early' movement is the FIRE brigade. Coined by bloggers, the acronym emerged in the aftermath of the 2008 banking crisis and captured the aspiration of many young workers who wanted Financial Independence and to Retire Early. They still do, the Google data tells us.

I'm 77 and have a £70,000 a year final salary pension from an employer that I worked for 30 years but after retiring I also set up my own business which makes about £50,000 a year. I would like to start giving some money away, as I realise a large chunk of my estate will end up facing inheritance tax. I should have done more of this earlier - as time may not be on my side here - what can I do?

When will interest rates fall again? Forecasts on when base rate will be cut

When will interest rates fall again? Forecasts on when base rate will be cut

Can I max out Premium Bonds for my two children to boost own chances of winning?

Can I max out Premium Bonds for my two children to boost own chances of winning?

The one NS&I account you SHOULD cling onto: SYLVIA MORRIS

The one NS&I account you SHOULD cling onto: SYLVIA MORRIS

Final deadline to claim pension credit and still get Winter Fuel Payment is 21 December

Final deadline to claim pension credit and still get Winter Fuel Payment is 21 December

Charge anxiety overtakes range as biggest barrier to EV adoption

Charge anxiety overtakes range as biggest barrier to EV adoption

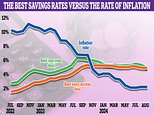

Best inflation-beating savings rates: Here's where to find the best deals

Best inflation-beating savings rates: Here's where to find the best deals

Should I overpay my £41k mortgage despite the early repayment charge? DAVID HOLLINGWORTH replies

Should I overpay my £41k mortgage despite the early repayment charge? DAVID HOLLINGWORTH replies

Waspi women will receive NO compensation, says Labour, as Steve Webb warns of 'worrying precedent'

Waspi women will receive NO compensation, says Labour, as Steve Webb warns of 'worrying precedent'

A nail bar conman has stolen £380 from my Revolut account while I was on holiday: SALLY SORTS IT

A nail bar conman has stolen £380 from my Revolut account while I was on holiday: SALLY SORTS IT

Did you miss out on the £100 Nationwide Fairer Share payment? Here's how to ensure you'd qualify next year

Did you miss out on the £100 Nationwide Fairer Share payment? Here's how to ensure you'd qualify next year

High Street sheds 225,000 jobs in just five years: Reeves urged to reform business rates to arrest decline

High Street sheds 225,000 jobs in just five years: Reeves urged to reform business rates to arrest decline

Is a pavement parking ban in Britain inbound? Just one in five oppose it...

Is a pavement parking ban in Britain inbound? Just one in five oppose it...

Bitcoin rockets past $107,000 a coin as Trump teases US crypto reserve

Bitcoin rockets past $107,000 a coin as Trump teases US crypto reserve

Terrifying truth about Temu toys: From toxic chemicals, illegal products and even flaws that could kill

Terrifying truth about Temu toys: From toxic chemicals, illegal products and even flaws that could kill

I'm 67 and have a 17-year shortfall in my state pension record - should I buy top-ups? STEVE WEBB replies

I'm 67 and have a 17-year shortfall in my state pension record - should I buy top-ups? STEVE WEBB replies

I'm the executive producer of TV show Chateau DIY... here's how you could buy a castle in France for the average price of semi in Britain

I'm the executive producer of TV show Chateau DIY... here's how you could buy a castle in France for the average price of semi in Britain

Are we getting a fair deal on energy bills and why have standing charges ballooned? This is Money podcast

Are we getting a fair deal on energy bills and why have standing charges ballooned? This is Money podcast

This is Money is part of the Daily Mail, Mail on Sunday & Metro media group

dmg media Contact us How to complain Advertise with us Contributors Terms Subscription Terms & Conditions Do not sell or share my personal information Privacy Settings Privacy policy & cookies