Lord John Lee of Trafford became the first Isa millionaire in 2003 and he now has an Isa pot worth multiples of this. He has revealed his winning formula to becoming an Isa millionaire.

Smanantha Collett reveals her investing journey: Stocks and shares investing wasn't really a topic of conversation with my friends or my family, so I didn't tell anyone what I was doing. It's now been almost 25 years since I started and hand on heart, I've never noticed I've been investing. I'm now 49 and can say compound interest over time is a miracle.

Anyone who starts investing quickly learns the golden rule of building a successful, resilient portfolio: don't put all your eggs in one basket. At times of great uncertainty, the likes of which we are seeing now, it is even more crucial to have a diversified bundle of investments. That way, you are not overly exposed if one company, sector or region takes a big tumble. But while most investors know the value of diversification in protecting their wealth, many botch it in the execution, misguidedly believing it is simply a matter of buying a bit of everything. Badly performed diversification can quickly turn into its evil cousin, what experts playfully call 'diworsification' - a portfolio that unintentionally is riskier than it appears. So how can you avoid diworsification?

While purse strings remain tight for many across the country, some 3.5million have taken to investing in the past year in the UK alone, with a total of 11million having begun investing in Europe overall, according to research by BlackRock. Gen Z and Millennial investors account for just under a third, or 28 per cent, of UK investors.

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

Cash earned from selling old clothes could help young people get started with investing, according to Lloyds Bank. Research by the bank suggests that its customers aged between 18 and 25 who used Vinted make approximately £25 per month from selling on the platform. Lloyds has run the numbers on how much young people could make if they took some of their Vinted profits and invested them month by month.

Each month, This is Money puts a senior fund or investment manager to task with tough questions for our I'm a fund manager series to find out how they manage their own money. In this instalment, Greg Eckel, portfolio manager of Canadian General Investments shares his thoughts on Nvidia, Tesla, gold and Bitcoin.

Markets taking a tumble didn't do my Isa investments any favours but the crucial mistake I made was looking in the first place. Sharp falls worry investors, but corrections are natural. Markets don't rise in a straight line and big down days will always come along, so I should expect this to happen and be willing to ride it out. The important thing is not to make rash decisions - here are my tips to do so.

Retirement ages is a hot topic. When I talked about this here, the response was remarkably polarising. My suggestion was that working longer, beyond the retirement ages that we mostly aspire to, was not necessarily such a bad thing. And my Career Happiness can Inspire Longer Lives - or CHILL - idea can feed into cutting the amount you need for a comfortable retirement.

FreeTrade launched the flexible feature to allow investors to withdraw and replace money without impacting their annual Isa allowance, so long as it is put back in the same tax year. Flexibility is a useful tax-beating feature to have, allowing savers and investors to dip into funds and pay them back without losing allowance - and is more commonly found in cash Isas.

Despite rumours that Labour will stage a CGT raid, the Liberal Democrats are the only main party committed to hiking capital gains tax rates. But they also have a plan to radically overhaul the tax - and it could even save some long-term investors money. So, is this a better way to deal with profits on shares, funds, property and other assets? We look at the Lib Dem capital gains tax plan in detail.

Investors are nervously awaiting the Autumn Budget after Keir Starmer warned that 30 October is 'going to be painful', ramping up fears of a tax raid Investment experts say that for many small investors, the question is whether they should cash in some profits and pay a lower rate on them before the Chancellor potentially hikes capital gains tax.

Barely a week passes without mention of the powerfully appealing phrase 'early retirement' - on social media and news websites, and among bloggers and podcasters. Escaping the rat race has always held appeal but the allure appears to be growing and becoming more intense. I checked on Google Trends, just to check the rise is real. And yes, the number of searches for 'retire early' has risen three-fold in a decade. At the sharp extreme end of the 'retire early' movement is the FIRE brigade. Coined by bloggers, the acronym emerged in the aftermath of the 2008 banking crisis and captured the aspiration of many young workers who wanted Financial Independence and to Retire Early. They still do, the Google data tells us.

An increasing number of retail investors are moving away from social media 'finfluencers' as a source of investment advice, and instead heading back towards more traditional channels, data claims. So-called 'finfluencers', social media influencers who specialise in financial advice, have grown in popularity on platforms such as Tiktok, Instagram, Twitter and Youtube in recent years, having seen a boost during the Covid pandemic as more people looked to investing.

Global government bond markets are vast and affect everyone who pays tax, saves or invests. But it's often hard to tell what's going on when there's a surge in bond buying or a sell-off because the jargon used by industry insiders can be pretty impenetrable. We unscramble it here to help everyone else fathom what's going on.

You don't need to attempt the perfect strategy. But be mindful of the current market climate, how much you have to invest and for how long, and your attitude to risk. Financial markets have been volatile of late, which makes investing a large lump sum at once even more daunting than usual. But money experts say if you plan to stay invested for a long time it is better to get your money in the market immediately.

Anyone wanting to save a deposit to buy their first home should consider putting money into a Lifetime Isa - and earn a 25 per cent bonus on contributions. Alternatively, the Isa can be used to save for later life, as the cash can also be taken out at the age of 60, but if it is taken out before then for anything other than a first home purchase then a hefty 25 per cent penalty applies.

Once someone has decided to start investing some of their money in the tax-beating shelter of an Isa, what's the quickest and simplest way to do it? From why investing makes sense, to how to manage your risk, what DIY investing platform to use and some ideas for funds to pick that invest around the world, Simon Lambert explains what you need to know as briefly as possible.

Cashing out crypto gains? Beware the capital gains trap as the taxman cracks down on the bitcoin boom

Cashing out crypto gains? Beware the capital gains trap as the taxman cracks down on the bitcoin boom

I'm a fund manager

Greg Eckel of Canadian General Investments backs Nvidia but says bitcoin is 'a mystery' that he won't invest in

I'm a fund manager

Greg Eckel of Canadian General Investments backs Nvidia but says bitcoin is 'a mystery' that he won't invest in

Buy early and these shares can sprinkle some Christmas magic on your portfolio, says ANNE ASHWORTH

Buy early and these shares can sprinkle some Christmas magic on your portfolio, says ANNE ASHWORTH

I started investing £25 a month when I was on £21,000 a year - now I've got £200,000 and I'm on track for my Lamborghini dream

I started investing £25 a month when I was on £21,000 a year - now I've got £200,000 and I'm on track for my Lamborghini dream

Will I face a 67% IHT bill and what happens next to inflation?

Financial advisers reveal questions they're answering following the Budget

Will I face a 67% IHT bill and what happens next to inflation?

Financial advisers reveal questions they're answering following the Budget

I don't pretend to like anything - and I'm a quick taker of profits

Fund manager David Coombs' tips for ordinary investors on the INVESTING SHOW

I don't pretend to like anything - and I'm a quick taker of profits

Fund manager David Coombs' tips for ordinary investors on the INVESTING SHOW

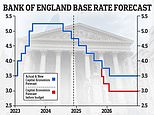

UK builders battered as borrowing costs rises

Investors trim bets on Bank of England interest rate cut

UK builders battered as borrowing costs rises

Investors trim bets on Bank of England interest rate cut

Private equity fire sale

With shares of many trusts trading at a huge discount, is now the time to pounce?

Private equity fire sale

With shares of many trusts trading at a huge discount, is now the time to pounce?

Broker tips M&S shares to hit their highest level since 2015 as analysts back high-flying retailer's food-only store expansion

Broker tips M&S shares to hit their highest level since 2015 as analysts back high-flying retailer's food-only store expansion

Your stock market needs YOU: US shares hit record highs - but should you buy these British bargains instead?

Your stock market needs YOU: US shares hit record highs - but should you buy these British bargains instead?

(Un)Super Size Me: Can YOU cash in on the pharma giants leading the weight loss boom?

(Un)Super Size Me: Can YOU cash in on the pharma giants leading the weight loss boom?

Dividends slump to three-year low as mining giants slash payouts: UK stock market sees income sink

Dividends slump to three-year low as mining giants slash payouts: UK stock market sees income sink

We were told we had long-forgotten shares... but tracing firm turned lost dividends from £1,171 to just £353.52

We were told we had long-forgotten shares... but tracing firm turned lost dividends from £1,171 to just £353.52

Young people and women lead a surge in investing

Gen Z and millennials now account for nearly a third of all investors

Young people and women lead a surge in investing

Gen Z and millennials now account for nearly a third of all investors

INVESTING SHOW

Why share prices and bonds look good right now - a chief investment officer explains

INVESTING SHOW

Why share prices and bonds look good right now - a chief investment officer explains

Primark vs Burberry!

The past year has seen luxury brands fall 8%, whereas high street stocks have risen 21%

Primark vs Burberry!

The past year has seen luxury brands fall 8%, whereas high street stocks have risen 21%

Sell on Vinted... and invest the profits! How young people could kick start a nest egg with their old clothes

Sell on Vinted... and invest the profits! How young people could kick start a nest egg with their old clothes

Can your children help cut your tax bill? HEATHER ROGERS explains

Can your children help cut your tax bill? HEATHER ROGERS explains

Do you need a financial adviser. a planner or a wealth manager?

We explain the difference - including the costs

Do you need a financial adviser. a planner or a wealth manager?

We explain the difference - including the costs

The Magnificent Seven's dominance is narrowing global ETFs, so are they still the low-risk investment people think?

The Magnificent Seven's dominance is narrowing global ETFs, so are they still the low-risk investment people think?

I'm 45 and was given shares as a child that are now worth £7,000

How on earth do I work out capital gains tax if I sell

I'm 45 and was given shares as a child that are now worth £7,000

How on earth do I work out capital gains tax if I sell

What is the VIX?

How you can profit from stock market volatility with Wall Street's 'fear index'

What is the VIX?

How you can profit from stock market volatility with Wall Street's 'fear index'

Gold hits a new high above $2,500

TANYA JEFFERIES on what's driving the price and how best to get exposure

Gold hits a new high above $2,500

TANYA JEFFERIES on what's driving the price and how best to get exposure

Missed out on the 'Magnificent Seven'?

How British firms are embracing artificial intelligence to drive growth - and how you can invest

Missed out on the 'Magnificent Seven'?

How British firms are embracing artificial intelligence to drive growth - and how you can invest

Investors have poured billions into money market funds - but they could be looking elsewhere as interest rates begin to fall

Investors have poured billions into money market funds - but they could be looking elsewhere as interest rates begin to fall

The Yen's revenge:

Why Japanese markets have been creating turmoil for YOUR investments

The Yen's revenge:

Why Japanese markets have been creating turmoil for YOUR investments

EXCLUSIVEStore First investment scandal victims targeted by scammers sending fake FSCS letters

EXCLUSIVEStore First investment scandal victims targeted by scammers sending fake FSCS letters

Stock markets have a habit of freaking out - but you shouldn't

SIMON LAMBERT on how investors can ride the waves through a storm

Stock markets have a habit of freaking out - but you shouldn't

SIMON LAMBERT on how investors can ride the waves through a storm

Work out how a lump sum or regular monthly savings would grow

Here's how you can profit from BITCOIN MANIA

Here's how you can profit from BITCOIN MANIA

How connectivity is shaping smart cities: The Internet of Things and its real-world impact right now

Sponsored

How connectivity is shaping smart cities: The Internet of Things and its real-world impact right now

Sponsored

The 'new' classic Jaguar that's the antithesis of its electric rebrand: TWR Supercat is a reborn XJS for the 21st century

The 'new' classic Jaguar that's the antithesis of its electric rebrand: TWR Supercat is a reborn XJS for the 21st century

EXCLUSIVESurge in shops and offices converted to homes as landlords tap in to sky-high property demand

EXCLUSIVESurge in shops and offices converted to homes as landlords tap in to sky-high property demand

Heat pump grants offered to more homes - as Government also relaxes noise rules on green devices

Heat pump grants offered to more homes - as Government also relaxes noise rules on green devices

Jaguar is not looking back on its radical rebrand... quite literally: British car maker teases concept EV with NO REAR WINDOW

Jaguar is not looking back on its radical rebrand... quite literally: British car maker teases concept EV with NO REAR WINDOW

My coffee machine refund went to an empty Love2Shop voucher I'd binned: CRANE ON THE CASE

My coffee machine refund went to an empty Love2Shop voucher I'd binned: CRANE ON THE CASE

Applying for power of attorney? Avoid these 12 mistakes which could see you rejected

Applying for power of attorney? Avoid these 12 mistakes which could see you rejected

Our landlord increased the rent twice in the last year adding £450 a month - can we do anything?

Our landlord increased the rent twice in the last year adding £450 a month - can we do anything?

Betrayal of buyer beware - but the cost of the alleged car finance scam could be bad for Britain: ALEX BRUMMER

Betrayal of buyer beware - but the cost of the alleged car finance scam could be bad for Britain: ALEX BRUMMER

Could YOUR pension fund a 35-year retirement? More are living to 100, here's how to go the distance

Could YOUR pension fund a 35-year retirement? More are living to 100, here's how to go the distance

How HALF of a pension could be gobbled up by Labour's inheritance tax snatch: JEFF PRESTRIDGE

How HALF of a pension could be gobbled up by Labour's inheritance tax snatch: JEFF PRESTRIDGE

When will interest rates fall again? Forecasts on when base rate will be cut

When will interest rates fall again? Forecasts on when base rate will be cut

Can't find a bank that offers joint savings accounts? Try these paying up to 4.65% says SYLVIA MORRIS

Can't find a bank that offers joint savings accounts? Try these paying up to 4.65% says SYLVIA MORRIS

EXCLUSIVEOur top 10 winter driving tips - including how to react if you skid on snow or ice

EXCLUSIVEOur top 10 winter driving tips - including how to react if you skid on snow or ice

Council bills could hit £3,000. Here's how to slash that and even get money back with SIX smart tricks

Council bills could hit £3,000. Here's how to slash that and even get money back with SIX smart tricks

Why have crypto prices soared in the past week? This is Money podcast

Why have crypto prices soared in the past week? This is Money podcast

This is Money is part of the Daily Mail, Mail on Sunday & Metro media group

dmg media Contact us How to complain Advertise with us Contributors Terms Subscription Terms & Conditions Do not sell or share my personal information Privacy Settings Privacy policy & cookies