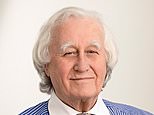

HAMISH MCRAE: Scrap National Insurance for the golden oldies

The Chancellor, Rachel Reeves, wants to get more of us into work.

That's understandable, for the more people in employment, the more people there are paying taxes – and making the Government's dreadful Budget arithmetic look a little less glum.

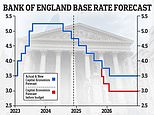

But how? Up to now, most of the debate about Reeves's Budget has been on the extent to which the rise in employers' National Insurance Contributions will have the opposite effect by discouraging hiring.

If there is a problem in the demand for labour, there has also been a slump on the supply side, as disability and sickness rates have remained much higher than they were before the pandemic.

But let's be charitable and look at one area where she could, if she were wise, find a way of boosting employment. It is older workers.

The pension age has now gone up to 66 for both men and women, but what matters most from a tax perspective is when people actually retire, rather than the date when they get their state pension.

On the rise: Up to now, most of the debate about the Budget has been on the extent to which the rise in employers' National Insurance Contributions

In recent years that has been creeping upwards. From the 1950s through to the middle 1990s it fell sharply. Back in 1950, the average age a man stopped working was over 67; for a women, just under 64.

By the 1990s, that was down to around 63 for a man and 61 for a woman. But this year the Office for National Statistics estimates that the average age for a man will be 65.7, and for a women 64.5.

Employment dipped during the pandemic, as a lot of people decided to retire earlier than they otherwise would, but now it is climbing again.

So if the Chancellor wants to keep older people in paid work, and paying tax, she will be pushing at an open door. So what should she do?

There is one simple lever she could pull. It would be to exempt employers from paying NICs for anyone beyond the state retirement age.

At the moment, employees aged 66 or over don't pay NICs. It would be a bit ridiculous for someone to be drawing their state pension on one hand, and then having to pay into it (without receiving any further benefits) on the other. But if employees don't pay, why should their employers?

There is a practical point here. Older workers are still paying full income tax. If employers find that older workers are significantly cheaper to hire than younger ones, they will try to find ways of encouraging them to stay in the workforce.

On a quick tally, if this change in NICs were to help push up the average age at retirement by more than a year, overall tax revenues would rise, not fall. It would more than pay for itself. The loss on National Insurance would be more than offset by the rise in income tax.

The story gets better. If companies are going to employ more people in their late 60s, they will also be incentivised to hold onto staff that are a bit younger. That's the late 50-year-olds and early 60-year-olds.

The Chancellor said in her Mansion House speech last week that she wanted to get inactive workers back into jobs. That's fine, but once someone has stopped work, it is tough to get them back. It's far better to keep them with a foothold in the market. It doesn't have to be full-time work; indeed many people at that stage of their careers don't want that.

But it has to be paid – there are lots of voluntary opportunities for older people and they make a huge contribution to society. But for a government desperate for tax revenue, it needs people to be earning.

There are lots of other issues here. There is the danger that people underestimate how much money they will need in retirement. There is the need for older workers to be flexible in their attitudes, and for younger ones to feel comfortable working alongside them.

Companies have to learn how to make the best use of older talent. It's a huge task and lots of people are working on it. But if Reeves really wants to boost work opportunities for older people – and help the national finances – this one is a winner.

Is she clever enough to see this? If not, it's one for the Tories to grab.

DIY INVESTING PLATFORMS

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you