What rising inflation means for you: CPI increases to a six-month high - what happens next?

- Inflation has risen higher than the national target, meaning consumers pay more

Inflation rose above the Bank of England's 2 per cent target in October, reaching a six-month high.

At its peak, inflation stood at 11.1 per cent. The latest ONS figures show that consumer prices index inflation climbed from 1.7 per cent in September to 2.3 per cent in October.

The headline figure had been steadily falling this year, before a surprise uptick in August. It has now risen below the central bank's target, despite forecasts that it might stay static or even fall further.

At the same time as a rise in the headline rate, there has been a slight rise in core inflation, from 3.2 per cent to 3.3 per cent.

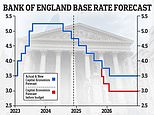

The rise in stubborn core inflation paired with easing wage rises suggest that there will be no further cuts to the Bank of England base rate in 2024.

What does the inflation fall mean for you, where does this leave the Bank of England on interest rate hikes, and could inflation tick higher again? We look at all this and more.

Weekly shop: High inflation has hit our household bills in recent years, from energy to food

What's the latest on inflation?

The bigger-than-expected rise in the headline inflation rate to 2.3 per cent coincided with another increase in core inflation, which has continued to run hot.

Core inflation - which excludes volatile items like food, energy & alcohol - now stands at 3.3 per cent in the 12 months to October 2024.

The largest upward contribution came from energy bills, with the Ofgem price cap rising to £1,717 on 1 October.

Rising inflation is bad news, as it means consumers paying more for goods and services.

The only reason inflation was not higher is because of cheaper oil, meaning the cost of manufacturing falls, and because of cheaper theatre and gig tickets.

Food inflation stands at 1.9 per cent, up from 1.8 per cent in September.

Meanwhile the cost of healthcare remains high at 5.6 per cent, an increase from 5.2 per cent.

Services inflation was 5.6 per cent in October, flat from September.

What does inflation falling mean for you?

Consumer prices inflation, known as CPI, measures the average change in the cost of consumer goods and services purchased in Britain, with the ONS monitoring a basket of goods representative of UK consumers.

Monthly change figures are given but the key measure that is watched is the annual rate of inflation. The Bank of England has a target to keep this at 2 per cent.

An inflation spike has hit over the last two years or so, with the CPI rate peaking in October 2022 at 11.1 per cent.

Rising inflation means the rate of increase in the cost of living is increasing.

Any decline in the inflation rate is to be celebrated though, as it increases the chance of wages, investment returns and savings interest matching or beating inflation - delivering a real increase in people's wealth.

> The best inflation-fighting savings deals

The main measure by which the Bank of England seeks to control inflation is interest rate rises. Higher inflation decreases the chance of base rate cuts and increases expectations of how high rates will go.

Expectations that the Bank would have to keep raising rates to combat inflation have sent mortgage rates spiralling costing mortgaged homeowners dear.

> How much would a mortgage cost you? Check the best rates

Could inflation rise again?

While the headline inflation figure rose, there is a chance it could rise again.

Luke Bartholomew, deputy chief economist at stockbroker Abrdn, said: 'Headline inflation is likely to drift further above target for the next few months, but it is the fundamental determinants of inflation that will determine the path of interest rates from here.'

Will the Bank of England cut rates again?

A rise inflation, particularly in services, decreases the chances that the central bank will carry out any interest rate cuts.

Julian Jessop, economics fellow at the Institute for Economic Affairs, said: 'The Bank expects the Budget measures to lift inflation above 2.5 per cent, taking it further away from the MPC’s 2 per cent target.

Grim faces: The Bank of England is very unlikely to cut rates again in its next meeting

'But this increase should only be temporary and may not materialise at all, particularly if the main impact of the Budget is actually to undermine confidence and growth.

'In any event, the current official interest rate of 4.75 per cent is still higher than it needs to be to continue bearing down on inflation, especially when the full effects of past monetary tightening have yet to feed through.'

But others disagree, and think the chance of a 2024 base rate cut is now remote.

Danni Hewson, AJ Bell head of financial analysis, said: 'At 2.3 per cent, inflation is only slightly above the Bank’s 2 per cent target but it does disrupt a three-month downward trend and market expectation of a further interest rate cut in December is now only 16 per cent, with almost half thinking that even February will be too early for the MPC to cut again.'

What does it mean for your savings?

Inflation means the value of interest earned on savings and investments falls in real terms.

However, if inflation deters the Bank from cutting its base rate, then there is a silver lining for savers as rates will remain at a higher level.

Ed Monk, associate director of Fidelity International, said: 'Higher inflation is a blow to savers and investors, too, who will see the real return they achieve fall.

'Savers have enjoyed an extended period where interest has exceeded price rises, and fund purchases by our clients demonstrate this appetite for cash and cash-like assets, with cash and short-maturity bond funds featuring highly in the list of best-sellers this year.

'Inflation-beating interest on cash will no doubt have likely tempted some investors to move money from investments into savings accounts. That appeal is eroded by higher inflation, even if cash interest is likely to exceed inflation for a while longer.'

> Check the best savings rates in This Is Money's independent tables

What does it mean for your mortgage?

Borrowers on tracker rates had bad news with November's inflation figure.

The rise in inflation means the chance of Bank base rate dropping, and therefore most tracker rates, is now more remote.

David Hollingworth, associate director at L&C Mortgages said: 'Although the rate lifting above target is not a shock, at 2.3 per cent it is a little higher than many had expected. That will pour more cold water on the prospects for another cut to base rate to come next month, which will be disappointing news for those on a variable or tracker rate mortgage.'

The news is not much better for those taking out new fixed rate mortgages.

Hollingworth said: 'Fixed rates have already been on the move and have climbed in recent weeks, often by 0.25 per cent of a percentage point or more. That has driven fixed mortgage rates upwards, and all the UK high street lender rates are now back above 4 per cent, with only Allied Irish Bank clinging onto anything below that.

'Those increases are due to the less optimistic forecast for interest rates and today’s figures will do nothing to change that.'

> Compare the best mortgage rates based on your home's value and loan size