EV sales EXCEED government targets for the first time - but it comes amidst claims manufacturers are rationing petrol car availability to avoid fines

- EV registrations in August exceed Zero Emission Vehicle mandate's 22% target

- Comes against accusations that car makers are limiting petrol deliveries to boost EV numbers and escape financial penalties

- Petrol sales last month fell by 10% - the equivalent of 5,000 fewer deliveries

Sales of electric cars have exceeded binding Government targets for the first time this year with 23 per cent of all new models entering the road in August powered solely by batteries, official figures have confirmed.

Registrations data published by the Society of Motor Manufacturers and Traders on Wednesday show that 84,575 new cars were sold last month - and of these 19,113 were EVs.

Green transport groups have dubbed it a milestone moment for the sector, as it is the first time since the introduction of the Zero Emission Vehicle (ZEV) mandate that monthly EV sales have surpassed the required target of achieving a minimum 22 per cent ZEV registrations.

However, the achievement has been tainted by reports that car manufacturers are using a variety of tactics - including actively rationing the availability and delivery of new petrol cars - to artificially inflate EV sales in a bid to avoid ZEV mandate fines.

New EV sales in August eclipsed the Government's ZEV mandate targets for the first time in a month since it was introduced. But the achievement has been tainted by accusations that manufacturers are limiting availability of petrol cars to artificially inflate EV sales shares

The trade body said on Thursday that the UK new car market 'remained stable in August' with registrations falling 1.3 per cent year-on-year.

This is the first decline in growth seen in the sector for over two years.

Continuing the recent trend, fleet purchases drove the market, accounting for six in 10 cars registered last month, or 51,329 units.

Whereas registrations by private buyers remained flat, growing marginally by 0.2 per cent to 32,110 vehicles and accounting for fewer than two in five (38 per cent) new models entering the road in August.

Sales of battery cars grew 10.8% last month and accounted for 22.6% of all registrations

Electric vehicle (BEV) registrations grew 10.8% last month, while sales of petrol cars declined 7.3% amidst claims that manufacturers have actively limited the availability of new combustion engine models to inflate their share of new EVs to meet government targets

But the headline statistic for the monthly car sales update was the rise in EV demand.

Sales of battery vehicles grew 10.8 per cent last month and accounted for 22.6 per cent of all registrations.

This is being flagged by green groups as a major turning point for the sector as it is the first time EV market share in a month has been higher than the 22 per cent requirement set out by the ZEV mandate since it was introduced back in January.

It is also the highest percentage share for EVs in a month since December 2022 when they made up 32.9 per cent of all new car sales.

The SMMT attributed the success to 'heavy discounting by manufacturers over the summer and a raft of new models attracting buyers'.

However, the figures come in the wake of accusations by industry members that car makers are holding back petrol and hybrid deliveries in an attempt to artificially inflate EV sales shares in order to meet the mandate's threshold for 2024 - and thus avoid big fines.

Robert Forrester, boss at one of Britain's biggest new car dealer networks Vertu Motors, says car makers are targeting the UK with EVs that many drivers do not want while at the same time withholding the availability of new petrol models

Boss of one of Britain's biggest car dealership chains this week claimed manufacturers have been 'rationing' petrol and hybrid cars to avoid falling foul of the government's rules.

Vertu Motors chief executive Robert Forrester said some car makers had imposed a 'restriction on supply' of combustion engine cars and were pushing EV models on dealer networks in an effort to meet the ZEV requirements.

'It's almost as if we can't supply the cars that people want, but we've got plenty of the cars that maybe they don't want,' he said this week.

'They [manufacturers] are trying to avoid the fines. So they're constraining the ability for us to supply petrol cars in order to try and keep to the government targets,' he added.

Richard Peberdy, UK Head of Automotive for KPMG, today added: 'New EV sales are growing at a pace that presently makes it unlikely that some car makers will be able to meet the target that requires 22 per cent of their 2024 new car registrations to be zero emission.

'This is leading them to consider how they respond, pondering the likes of discounting, restricting petrol vehicle sales to try and meet the mandated EV percentage of their total sales, and other technical measures regarding carrying the mandate target into the following year.'

The SMMT confirmed petrol registrations had fallen 10.1 per cent - almost 5,000 cars - last month, which has been the biggest contributor to the market going into decline for the first time in over two years.

Diesel sales fell 7.3 per cent in August, too, but represent a much smaller proportion of the market today.

The industry report shows plug-in hybrid (PHEV) registrations declined 12.3 per cent, with a 6.8 per cent share, but hybrid electric vehicle (HEV) uptake increased by 36.1 per cent, to make up 13.8 per cent of the market.

The trade body said on Thursday that the UK new car market 'remained stable in August' with registrations declining by 1.3 per cent year-on-year

Mike Hawes, SMMT chief executive, said while the success of EV registrations in August was welcomed, he added that it is also a 'low volume month' which can be 'subject to distortion'.

He believes September - with the arrival of the new 74 plate driving higher sales - will be a better reflection of EV uptake.

'The introduction of the new 74 plate, together with a raft of compelling offers and discounts from manufacturers, plus growing model choice, will help increase purchase consideration and be a true barometer for market demand,' he said.

'Encouraging a mass market shift to EVs remains a challenge, however, and urgent action must be taken to help buyers overcome affordability issues and concerns about chargepoint provision.'

Colin Walker, Head of green think tank Transport at the Energy and Climate Intelligence Unit, says the figures point to EV demand being in 'increasingly rude health', while Ralph Palmer from Transport & Environment waxed that it is a sign that the ZEV mandate is working and 'EV appeal is really charging up'.

What is the ZEV mandate?

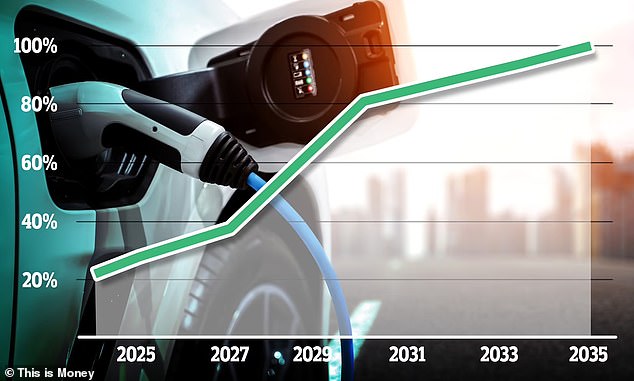

The ZEV mandate was made law in January, requiring mainstream manufacturers to increase their EV sales share to at least 22 per cent of all registrations in 2024.

The threshold increases each year up until the ban on sales of new petrol and diesel cars, which the DfT has confirmed to This is Money will officially be brought forward from 2035 to 2030.

Under the existing ZEV targets (which currently conform to a ban from 2035) will see car makers forced to up their EV sales share to 28 per cent next year and a third (33 per cent) in 2026.

Failure to achieve these binding targets will see manufacturers stung with fines of £15,000 per car (and £18,000 per van) below the thresholds.

The ZEV mandate requires mainstream car makers to increase their share of EV sales each year until the ban on new petrol and diesel models. The minimum requirement to avoid fines in 2024 is 22%, rising to 28% next year and 33% in 2026

Brands underperforming against the ZEV can side-step fines by either purchasing credits from other manufacturers - namely brands like Tesla and Polestar which sell only battery cars - or deferring allowances to the following year.

Unfortunately for car makers, its introduction has come at a time when EV sales have started to decelerate.

Concerns among drivers around the premium price of new models, range and charge anxiety, a floundering charging infrastructure and electric cars suffering huge levels of depreciation in recent years has created a roadblock for EV uptake, which manufacturers have struggled to overcome.

In the first six months of 2024, EVs made up just 16.6 per cent of all car sales - well below the 22 per cent required of manufacturers. This is only marginally ahead of the year previous when EVs accounted for 16.1 per cent of registrations by the mid-year point.

The trade body has also openly admitted that the EV market is being driven predominantly by fleets and the availability of low-tax salary sacrifice schemes through employees. In contrast, demand from private buyers is account for fewer than one in five EV registrations.

Some car makers, including BMW and Mercedes, are said to be exceeding the ZEV mandate's 2024 target. However, others are falling behind

Manufacturers using tactics - including 'rationing' petrol car deliveries - to artificially inflate EV share

While some car manufacturers, including BMW, Hyundai, Mercedes and Vauxhall, are ahead of this year's ZEV mandate threshold, others are falling behind.

This has resulted in some industry criticism of the scheme, which hasn't been introduced anywhere else across Europe.

Carlos Tavares, chief executive of Stellantis - the group that owns Vauxhall but also Citroen, Fiat, Peugeot and a number of other big automotive names - warned in April that the group was having to sell its EVs at heavily-discount prices in an effort to encourage sales to meet the ZEV requirements.

He said the mandate was 'terrible for the UK', adding: 'I'm not going to sell cars at a loss.'

In May, Ford suggested it could actively limit the availability of new petrol models in the UK to increase its share of EVs sales as part of efforts to dodge the significant fines levied.

Martin Sander, who at the time was general manager at Ford Europe's EV division (who has since moved to VW), said: 'We can't push EVs into the market against demand. We're not going to pay penalties. We are not going to sell EVs at huge losses just to buy compliance.

'The only alternative is to take our shipments of [combustion engine] vehicles to the UK down and sell these vehicles somewhere else.'

The ZEV Mandate effect: Guy Pigounakis, commercial director of MG UK, says the 'horrific fines' for not hitting Government EV sales targets are responsible for 'behaviour from manufacturers not seen in 40 years'

Last month, Guy Pigounakis, commercial director of MG UK, exclusively told This is Money that the industry is already witnessing an array of inventive strategies not seen in the sector for 40 years to meet the ZEV mandate thresholds for 2024.

This included limited new petrol car deliveries, pre-registering more vehicles and taking advantage of schemes such as Motability to inflate EV numbers.

On Wednesday, Volvo announced it had abandoned its plans to sell only electric cars by 2030.

The Swedish company said it had readjusted targets and is now aiming for 90 to 100 per cent of its global sales to be either pure electric or plug-in hybrid by the end of the decade.

Volvo, majority-owned by China's Geely, has attributed its change in policy to a 'slower than expected' rollout of charging infrastructure, the withdrawal of government incentives in some markets and 'additional uncertainties' created by recent tariffs on electric vehicles.