Financial support makes it possible for the Brookings Institution to advance its mission. As a 501(c)3 tax-exempt nonprofit organization, Brookings relies on the support of generous donors who share our commitment to transparency, independence, and integrity. Since 1983, we have published information about our finances and a list of donors in our Annual Reports.

Funding Overview

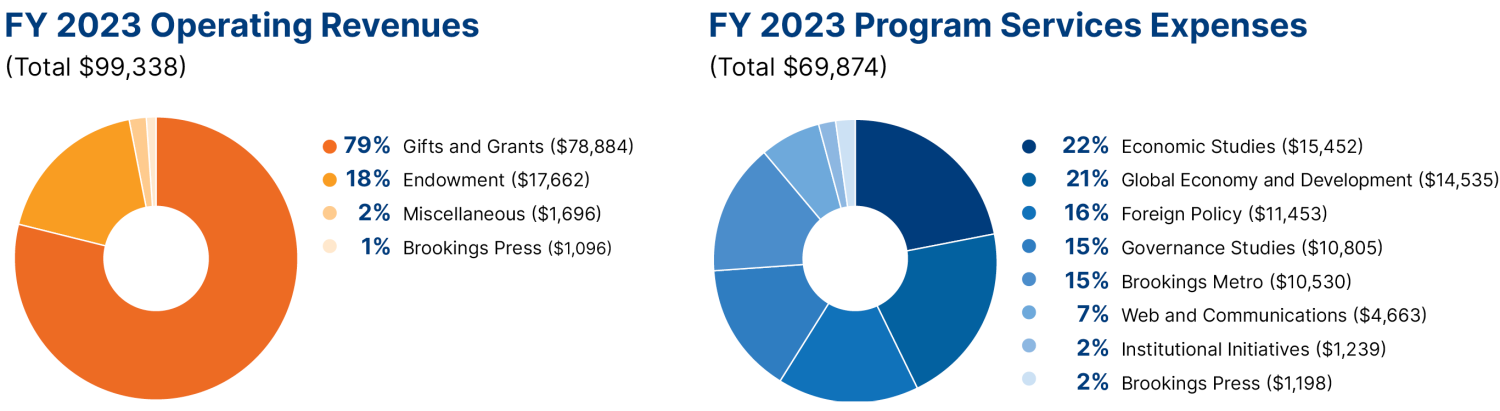

Brookings is funded through the support of a diverse array of philanthropic individuals, foundations, corporations, and governments. More than 80% of Brookings’s annual revenue comes from gifts and grants from our donors.

Snapshot of our Financial Position for the Fiscal Year ended June 30, 2023

(in thousands) | Preliminary and Unaudited

Notes: As a nonprofit and scientific organization, Brookings is exempt from federal income taxes under section 501(c)(3) of the Internal Revenue Code. The Institution also qualifies as a publicly supported organization under section 170(b)(1)(A)(vi) of the code. Brookings’s policy is to make an annual investment spending allocation for the support of operations. This amount is calculated based on 70% of the prior year’s spending adjusted for inflation and 30% of 5% of the market value of the investments as of December 31 of the prior fiscal year. Certain reclassifications of prior year balances have been made to conform to the current year presentation.

Independence and Integrity

In its engagement with funders, Brookings is guided by principles and policies of transparency, independence, and disclosure that safeguard the trust and credibility of the institutions scholarship and activities. Read our donor guidelines and independence and integrity policies for detailed information.

Foreign Funding

Humankind’s biggest challenges are not limited by borders. Threats to democracy, equality, peace, and climate resilience span communities and the world. To support its mission to provide independent research and ideas to help solve these challenges at the local, national, and global levels, Brookings accepts financial support from a diverse spectrum of funders, including individuals, organizations, and governments outside the United States. The Institution’s aggregate funding from foreign governments typically makes up less than 10 percent of Brookings overall financial support.

In addition to its overarching independence and integrity policies, Brookings has established principles pursuant to which it evaluates foreign funding. Prospective funding from outside the United States is subject to a review process to assess, among other things, the funders democratic status and track record of support for independent research, civil society, the rule of law, and respect for democracy and human rights. Foreign funders are required to acknowledge and agree to Brookings’s research independence principles, including its policy that bars the institution or its personnel from engaging in activities that would require registration under the Foreign Agents Registration Act.

For more information, read FAQs about Brookings Approach to Foreign Funding

Audited Financial Statements

View and/or download Brookings audited financial statements and IRS 990 Forms.

Audited Financial Statements

2023 Audited Financial Statements

2022 Audited Financial Statements

2021 Audited Financial Statements

2020 Audited Financial Statements

2019 Audited Financial Statements

2018 Audited Financial Statements

2017 Audited Financial Statements

2016 Audited Financial Statements

2015 Audited Financial Statements