(LEAD) (News Focus) Facing weak growth and debt woes, S. Korea begins cautious policy pivot

(ATTN: RECASTS headline, lead with more info; ADDS more comments, future paths throughout)

By Oh Seok-min

SEOUL, Oct. 11 (Yonhap) -- The Bank of Korea's (BOK) first monetary policy pivot in 38 months demonstrated its shift of attention to how to prop up sagging domestic demand and boost growth momentum as inflationary pressure has markedly eased.

But any further rate cuts are unlikely at least for three months to come amid lingering concerns over rising home prices and household debts, officials and experts said Friday.

The BOK lowered its benchmark interest rate by a quarter percentage point to 3.25 percent to end its tightening cycle that began in August 2021.

The BOK had delivered rate hikes through January 2023 and kept the rate at 3.5 percent, the highest level in about 16 years. The last time it reduced the rate was May 2020.

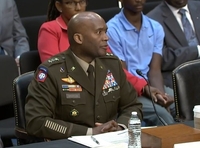

Bank of Korea Gov. Rhee Chang-yong bangs the gavel to open a Monetary Policy Committee meeting at the central bank in Seoul on Oct. 11, 2024. The meeting decided to cut the key rate by 25 basis points to 3.25 percent. (Pool photo) (Yonhap)

The rate cut decision came as consumer prices, a key gauge of inflation, rose 1.6 percent on-year in September, the lowest level since February 2021, when consumer prices grew 1.4 percent.

The BOK set mid-term inflation rate at 2 percent.

High borrowing costs for a long period of time have hindered private consumption and investment and negatively affected the economic recovery despite strong exports.

Citing weak domestic demand over high interest rates, the BOK in August lowered its forecast for the South Korean economic growth this year to 2.4 percent from its previous projection of 2.5 percent.

"Uncertainties surrounding the growth outlook have heightened compared to August due to the delayed recovery in domestic demand. The future path of economic growth is likely to be influenced by the pace of recovery in domestic demand, economic conditions in major countries, and trends in IT exports," the BOK said in a statement on the monetary policy decision.

Retail sales, a gauge of private spending, fell 1.3 percent on-year in August and facility investment tumbled 5.4 percent. Construction investment also dropped 9 percent on fewer new orders in the sector.

Under the circumstances, the office of President Yoon Suk Yeol unusually expressed disappointment over the BOK's rate freeze decision in August, and the ruling People Power Party has voiced hope for monetary easing.

"We don't need to maintain the tightening stance for too long at a time when inflation has eased, given the current economic situation," Gov. Rhee Chang-yong said in a press briefing following the rate-setting meeting.

"The growth of domestic demand came below the potential growth rate, and the overall growth rate also remains just a bit above the potential rate," he added.

The rate cut also came as the Federal Reserve lowered its benchmark interest rate by a half percentage point last month in an aggressive pivot aimed at bolstering the United States' labor market.

BOK Gov. Rhee Chang-yong said following the Fed's big cut that an environment was created where the BOK can fully focus on domestic factors when implementing monetary policy.

"While inflation is showing a clear trend of stabilization, household debt growth has begun to slow with tightened macroprudential policies by the government, and risks in the foreign exchange market have somewhat eased," according to the BOK statement.

But the BOK's monetary easing is expected to be very gradual, as five members of the board said maintaining the policy rate at the current level over the next three months is appropriate.

This year's last rate-setting meeting is scheduled to take place on November 28.

"We need time to assess the impact of this reduction on housing prices, household debts and other financial circumstances. We also need to check how the U.S. presidential election and geopolitical issues will affect the market," Rhee said.

The central bank chief acknowledged that Friday's decision can be viewed as "hawkish" as the BOK stressed the need to factor in financial stabilization.

The growth of household debts has slowed and the number of home transactions has reduced in recent weeks, though concerns linger over how to rein in rising housing prices that risk worsening debt problems.

Household loans extended by five major banks rose by 5.6 trillion won (US$4.15 billion) on-month to come to 730.97 trillion won as of end-September.

It marked the sixth straight month led by the mortgages increase, though the growth slowed down from a record on-month increase in August after lenders tightened household lending.

Surging household debt has been one of the major concerns for policymakers here as high indebtedness is feared to curb spending.

"The growth in household debts has slowed down further in October on the back of lending curbs, but the government will continue to be on high alertness as we still see a high increase rate and the recent slowdown could be at least in part caused by seasonal factors, such as the Chuseok holiday," an official of the financial authorities said.

The BOK said in a recent report that a rate cut by 25 basis points is projected to raise the national average home price by 0.43 percentage point in a year, and the figure will come to 0.83 percentage point for Seoul.

"Despite the slowing economy and cooling inflation, the BOK will not be able to reduce the rate further this year due to concerns about the housing market. It is also projected to stop short of cutting the rate by 0.25 percentage point twice in the first half of next year," Park Jung-woo, an economist of Nomura Securities Co., said.

Prof. Seok Byoung-hoon of Seoul's Ewha Womans University said lower borrowing costs are expected to help support private consumption and corporate investment, while warning of a surge in demand for loans in case banks somewhat ease lending regulations early next year.

[email protected]

(END)

-

(LEAD) Investigators seek to quiz Yoon over martial law on Christmas Day

(LEAD) Investigators seek to quiz Yoon over martial law on Christmas Day -

(2nd LD) Acting President Han vetoes six contentious bills passed by opposition

(2nd LD) Acting President Han vetoes six contentious bills passed by opposition -

Yoon's legal representative again denies insurrection charges

Yoon's legal representative again denies insurrection charges -

(LEAD) Gen. Brunson to take office as new USFK chief this week: Pentagon

(LEAD) Gen. Brunson to take office as new USFK chief this week: Pentagon -

(3rd LD) U.S. plans on high-level in-person engagement with Han's administration during last weeks of Biden gov't: Campbell

(3rd LD) U.S. plans on high-level in-person engagement with Han's administration during last weeks of Biden gov't: Campbell