How Commerzbank is transforming financial advisory workflows with gen AI

Tolga Bastürk

Product Owner, Commerzbank

Anant Nawalgaria

Sr. Staff ML Engineer, Google

In today's fast-paced financial landscape, staying competitive requires embracing innovation and efficiency. Commerzbank, a leading German bank, recognized the potential to streamline its internal workflows, particularly within its financial advisory division for corporate clients.

Given regulatory requirements, sales advisors need to carefully document investment suggestions in detailed protocols. It’s a highly manual and time consuming task. This has led to significant productivity bottlenecks and reduces the time available for advising customers.

"Our Sales advisor team spends a considerable amount of time in documentation of advisory calls," said Ulrich Heitbaum, COO of Corporate Clients segment at Commerzbank. "By partnering with Google to build a sophisticated GenAI system to automate this process, we considerably boost productivity. One thought leads us: Only lean, smoothly functioning processes and reliable technology lead to an outstanding - excellent - service delivery to the customer."

Recognizing the potential for improvement, Commerzbank partnered with Google Cloud to develop an advanced gen AI-powered solution that automates this labor-intensive process. By leveraging Google Cloud's AI and machine learning capabilities, Commerzbank was able to automate this process and achieve significant gains in sales advisor productivity.

The Challenge: Time-Consuming Manual Processes

Financial advisors play a crucial role in providing personalized financial advice to clients. However, the process of reviewing client interactions and extracting and summarizing relevant domain and client-specific information was highly manual and inefficient. Sales advisors had to dedicate significant time to listening to call recordings, identifying key details, and manually entering data into various systems. This process not only consumed valuable time but also increased the risk of errors and inconsistencies.

The Technical Solution: A Deep Dive into Commerzbank's gen-AI system

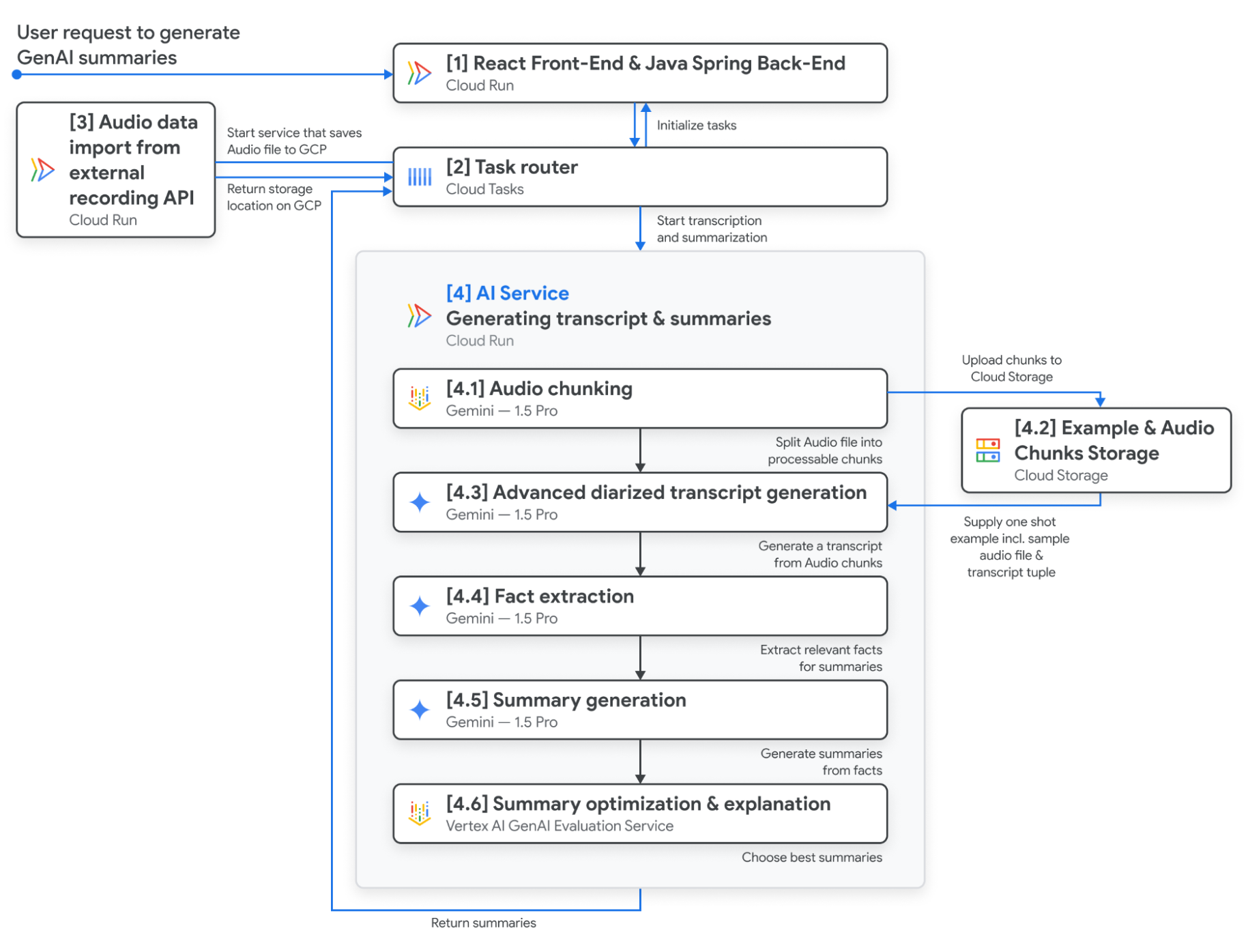

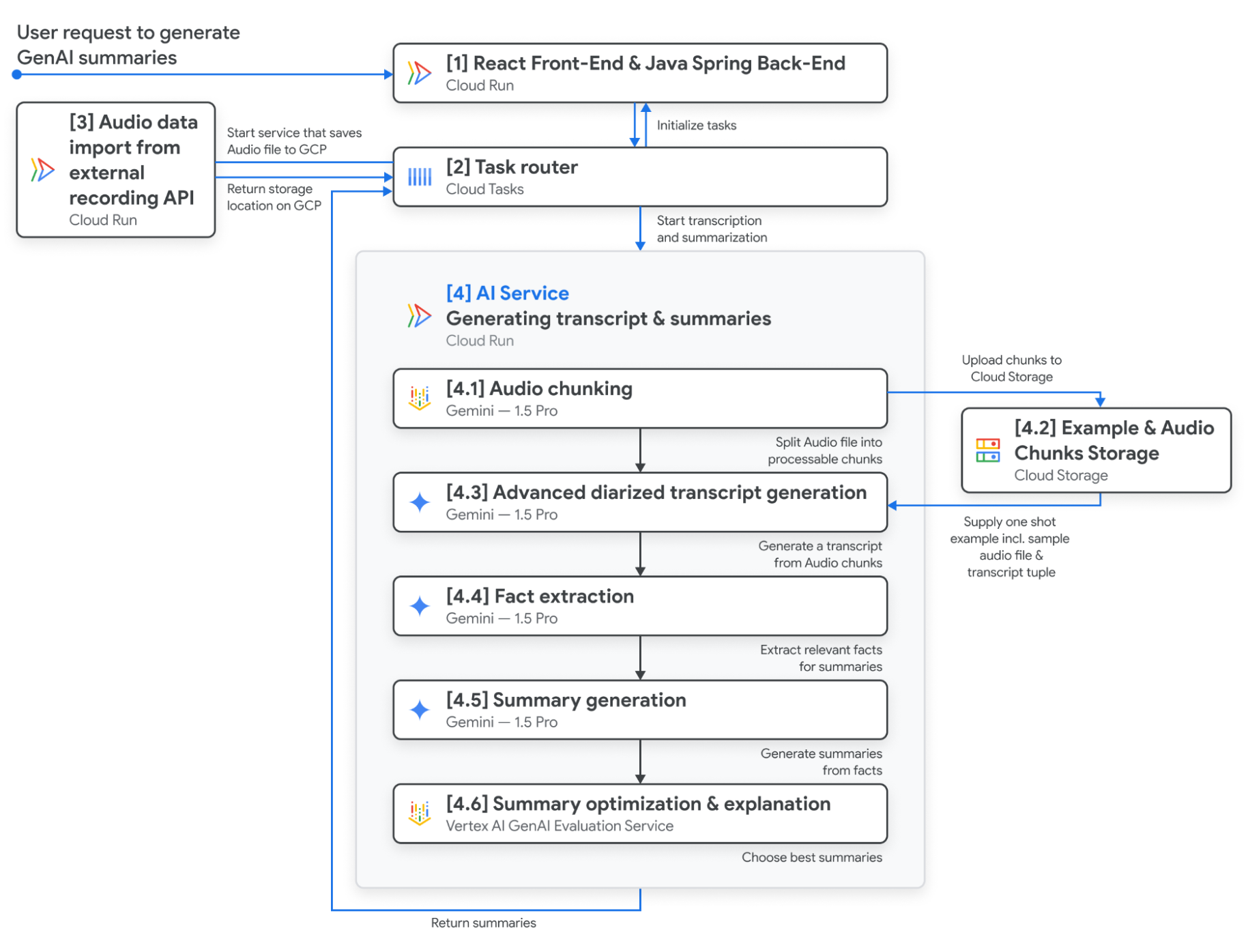

Commerzbank's solution for automating financial advisory workflows leverages a sophisticated multi-step gen-AI architecture built using Vertex AI and designed for quality, scalability and extensibility. Gemini 1.5 Pro's ability to understand multiple modalities and process long context information played a key role in building this system that would not have been possible with any other model. Here's a breakdown of the key steps involved:

An end-to-end architecture of the AI Advisor system

1. User interaction and data import (1, 2, 3):

The process begins with the sales advisor using a user-friendly frontend interface (1) to select the client calls they need to process. This interface communicates with a Java Spring backend (2) that manages the workflow. The backend then initiates the import of the selected audio recordings from Commerzbank's recording system (3) into Google Cloud Platform (GCP) storage buckets. This ensures the data is readily available for the AI processing pipeline.

2. Audio chunking and storage (4.1, 4.2):

To handle potentially lengthy client calls, the imported audio recordings are divided into smaller, manageable segments (4.1). This "chunking" process allows the system to process even multi-hour calls efficiently. These audio chunks are then stored securely within GCP storage (4.2), ensuring data durability and accessibility for subsequent steps.

3. Advanced diarization and transcription (4.3):

This step is crucial for generating a high-quality, structured transcript that captures the nuances of the conversation. Gemini 1.5 Pro is employed to create a diarized transcript, meaning each speaker is identified and their contributions are accurately attributed. This process occurs sequentially, with each audio chunk processed in order. To maximize accuracy, the model receives the transcript generated up to that point, along with carefully engineered prompts and a few-shot example of audio-to-text transcription. This ensures the final transcript is not only accurate in terms of content but also includes correct speaker identification and especially numerical information, which is crucial in a financial context. Once the final transcript is generated, the individual audio chunks from step 4.2 are deleted to optimize storage.

4. Fact extraction (4.4):

With a comprehensive and long transcript in hand, Gemini 1.5 Pro long context is then used to analyze and extract relevant facts (4.4). This involves identifying key information related to the specific financial advisory document that needs to be completed. The model is prompted to recognize and extract crucial details such as client names, investment preferences, risk tolerance, and financial goals.

5. Summary generation (4.5):

This step focuses on generating concise and accurate summaries for each field within the financial advisory document. Leveraging the extracted facts from the previous step and employing Chain-of-Thought (CoT) prompting, Gemini 1.5 Pro creates multiple German-language summaries tailored to the specific domain and the requirements of each form field. This ensures the generated summaries are not only informative but also comply with Commerzbank's internal guidelines and regulatory requirements.

6. Summary optimization and explanation (4.6):

To ensure the highest quality output, the multiple summaries generated for each form field are evaluated and the best summary for each field is selected using the Vertex AI Gen AI Evaluation Service (4.6). Importantly, the service also provides a human-readable explanation for its selection, enabling sales advisors to understand the reasoning behind the AI's choices and maintain trust in the automated process.

This multi-stage architecture, combining the power of Gemini 1.5 Pro with Vertex AI's evaluation capabilities, enables Commerzbank to automate a complex and time-consuming process with high accuracy and efficiency. By streamlining these workflows, Commerzbank empowers its sales advisors to focus on higher-value tasks, ultimately improving client service and driving business growth.

The Benefits: Increased Efficiency and Productivity

The impact of this AI-powered automation has been significant. By automating the manual tasks associated with financial advisory documentation, Commerzbank has achieved substantial productivity gains. Sales advisors now have more time to focus on higher-value activities, such as building client relationships and providing personalized financial advice.

Key benefits of the solution include:

- Reduced processing time: The automated solution significantly reduces the time required to process client interactions by achieving what takes a client 60-plus minutes in just a few minutes with manual human overview. This greatly accelerates time to business.

- Increased productivity: By automating manual tasks, the solution empowers sales advisors to focus on more strategic activities, leading to increased productivity and improved client service.

Looking into the Future

Commerzbank's collaboration with Google Cloud exemplifies the transformative power of AI in the financial services industry. By embracing innovative technologies, Commerzbank is streamlining its operations, empowering its employees, and enhancing the client experience. “Therefore, we set up a Strategic Initiative Corporate Clients AI powered sales force - to make our sales focus on high value activities” Sebastian Kauck, CIO Corporate Clients at Commerzbank.

They plan to scale this solution to other use cases and enhance its functionality, providing new and additional value to their sales team. This AI-powered solution is just one example of how Commerzbank is leveraging technology to stay ahead of the curve and deliver exceptional financial services, in addition to many other cloud and GenAI use cases.

This partnership has not only delivered significant productivity gains but has also laid the foundation for future innovation. Commerzbank plans to expand the use of AI and automation across other areas of its business, further optimizing its operations and enhancing its offerings to clients.

This project was a joint collaboration between Anant Nawalgaria, Patrick Nestler, Florian Baumert and Markus Staab from Google and Tolga Bastürk, Otto Franke, Mirko Franke, Gregor Wilde, Janine Unger, Enis Muhaxhiri, Andre Stubig, Ayse-Maria Köken and Andreas Racke from Commerzbank.